941 Pr Form

What is the 941 PR?

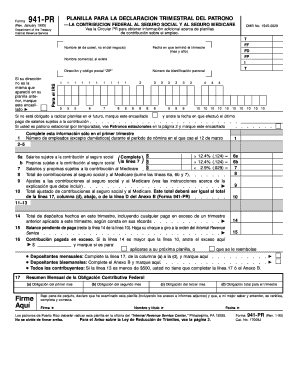

The 941 PR form is a tax document used by employers in Puerto Rico to report income taxes withheld from employees' wages, as well as the employer's share of social security and Medicare taxes. This form is essential for compliance with federal tax regulations and ensures that the tax obligations of both the employer and employees are accurately reported to the Internal Revenue Service (IRS). The 941 PR is filed quarterly, allowing for timely updates on tax liabilities and payments made throughout the year.

Steps to complete the 941 PR

Completing the 941 PR form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including total wages paid, tips reported, and any adjustments for prior quarters. Next, fill out the form by entering the total number of employees, the amount of wages subject to withholding, and the total taxes withheld. It is important to double-check all figures for accuracy. After completing the form, sign and date it before submission. Finally, ensure that the form is filed by the appropriate deadline to avoid penalties.

Legal use of the 941 PR

The 941 PR form is legally binding when completed and submitted according to IRS guidelines. To ensure its legality, the form must be signed by an authorized representative of the business. Additionally, using a secure electronic signature solution, like airSlate SignNow, can enhance the legal standing of the document. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial for the eSignature to be recognized legally.

Filing Deadlines / Important Dates

Filing deadlines for the 941 PR form are typically set for the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

It is essential for employers to adhere to these deadlines to avoid late fees and penalties.

Who Issues the Form

The 941 PR form is issued by the Internal Revenue Service (IRS), which oversees tax collection and compliance in the United States. Employers in Puerto Rico are required to use this specific form to report their tax obligations accurately. The IRS provides guidelines and instructions for completing the form, ensuring that employers have the necessary information to fulfill their tax responsibilities.

Required Documents

To accurately complete the 941 PR form, employers need to gather several key documents. These include:

- Payroll records showing total wages paid to employees

- Records of tips reported by employees

- Documentation of any adjustments for prior quarters

- Employer identification number (EIN)

Having these documents readily available will help streamline the completion of the form and ensure accurate reporting.

Quick guide on how to complete 941 pr

Complete 941 Pr effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It presents an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage 941 Pr on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign 941 Pr effortlessly

- Obtain 941 Pr and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important parts of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign 941 Pr and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941 pr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 941 pr and how does airSlate SignNow facilitate its management?

941 pr refers to the IRS Form 941, which is essential for businesses to report payroll taxes. airSlate SignNow simplifies the process by allowing you to easily sign and send these documents electronically, ensuring compliance and efficiency in your payroll management.

-

What pricing options does airSlate SignNow offer for businesses looking to manage 941 pr?

airSlate SignNow provides various pricing plans tailored for different business needs. Whether you are a small business or a large enterprise, there is a cost-effective solution to help you manage your 941 pr efficiently, with features designed to enhance document workflows.

-

What features does airSlate SignNow provide for handling 941 pr documents?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for 941 pr documents. These tools make it easy to manage your payroll documents with accuracy while ensuring they are signed in a timely manner.

-

How can airSlate SignNow benefit my business when dealing with 941 pr?

Using airSlate SignNow for your 941 pr documents allows for faster processing and reduced paperwork. By digitizing your document management, you save time, minimize errors, and ensure that all tax filings are completed accurately and on schedule.

-

Is it easy to integrate airSlate SignNow with other software used for 941 pr?

Yes, airSlate SignNow integrates seamlessly with various accounting and HR software, making it ideal for managing 941 pr and other related documents. This integration streamlines your workflow and reduces the need for repetitive data entry, enhancing overall productivity.

-

Can I access airSlate SignNow from multiple devices for managing 941 pr documents?

Absolutely! airSlate SignNow is cloud-based, allowing you to access your 941 pr documents from any device, whether it's a computer, tablet, or smartphone. This flexibility ensures that you can manage your payroll documents anytime, anywhere.

-

What security measures does airSlate SignNow employ for 941 pr data?

airSlate SignNow takes security seriously, implementing robust encryption and compliance with industry standards to protect your 941 pr data. You can trust that your sensitive payroll information is safe from unauthorized access and bsignNowes.

Get more for 941 Pr

Find out other 941 Pr

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement