WH 1612 the South Carolina Department of Revenue Sctax Form

What is the WH 1612 The South Carolina Department Of Revenue Sctax

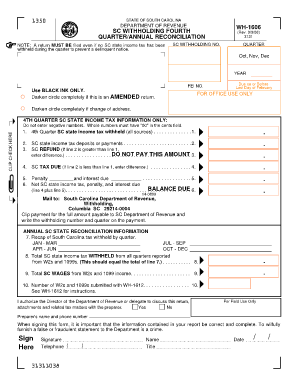

The WH 1612 form is a tax document issued by the South Carolina Department of Revenue. It is primarily used for reporting and remitting state income tax withheld from employees’ wages. This form is essential for employers who must comply with state tax regulations and ensure accurate reporting of withheld amounts. Understanding the purpose and requirements of the WH 1612 is crucial for maintaining compliance and avoiding potential penalties.

How to use the WH 1612 The South Carolina Department Of Revenue Sctax

To effectively use the WH 1612 form, employers must complete it accurately and submit it according to the guidelines set by the South Carolina Department of Revenue. This involves filling out the necessary information, including employer details, employee information, and the total amount of tax withheld. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to complete the WH 1612 The South Carolina Department Of Revenue Sctax

Completing the WH 1612 form involves several key steps:

- Gather all required information, including employer and employee details.

- Calculate the total state income tax withheld for the reporting period.

- Fill out the WH 1612 form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail, as per the guidelines.

Legal use of the WH 1612 The South Carolina Department Of Revenue Sctax

The WH 1612 form is legally binding when filled out and submitted according to the regulations established by the South Carolina Department of Revenue. Electronic submissions are recognized as valid under the ESIGN Act, provided that the necessary electronic signature requirements are met. Employers must ensure compliance with all relevant laws to avoid penalties related to incorrect or late submissions.

Key elements of the WH 1612 The South Carolina Department Of Revenue Sctax

Key elements of the WH 1612 form include:

- Employer identification information, such as name and tax ID number.

- Employee details, including names and Social Security numbers.

- The total amount of state income tax withheld during the reporting period.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the WH 1612 form to avoid penalties. Typically, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. It is essential to stay informed about these dates to ensure timely submissions and compliance with state tax regulations.

Quick guide on how to complete wh 1612 the south carolina department of revenue sctax

Complete WH 1612 The South Carolina Department Of Revenue Sctax effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents quickly and without hold-ups. Handle WH 1612 The South Carolina Department Of Revenue Sctax on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign WH 1612 The South Carolina Department Of Revenue Sctax with ease

- Locate WH 1612 The South Carolina Department Of Revenue Sctax and then select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or black out sensitive information using features provided by airSlate SignNow specifically for that purpose.

- Produce your eSignature using the Sign tool, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign WH 1612 The South Carolina Department Of Revenue Sctax and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 1612 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is WH 1612 The South Carolina Department Of Revenue Sctax?

WH 1612 The South Carolina Department Of Revenue Sctax is a tax form used to report and remit withholding tax payments for employees in South Carolina. It is critical for businesses to accurately complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with WH 1612 The South Carolina Department Of Revenue Sctax?

airSlate SignNow helps businesses streamline the process of completing and eSigning WH 1612 The South Carolina Department Of Revenue Sctax. With our platform, you can easily fill out forms, obtain signatures, and securely manage tax documents online.

-

What are the pricing options for using airSlate SignNow for WH 1612 The South Carolina Department Of Revenue Sctax?

We offer various pricing plans tailored to meet the needs of businesses of all sizes looking to manage WH 1612 The South Carolina Department Of Revenue Sctax forms. Our plans are cost-effective, enabling you to choose one that best aligns with your budget and usage requirements.

-

What features does airSlate SignNow provide for handling WH 1612 The South Carolina Department Of Revenue Sctax?

airSlate SignNow includes features like customizable templates, document sharing, and secure eSigning to simplify handling WH 1612 The South Carolina Department Of Revenue Sctax. These functionalities enhance your efficiency and ensure accuracy in tax submissions.

-

Can I integrate airSlate SignNow with my existing payroll software for WH 1612 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow integrates seamlessly with a variety of payroll and accounting software. This integration allows for easy management of WH 1612 The South Carolina Department Of Revenue Sctax, simplifying the process of tax reporting.

-

What are the benefits of using airSlate SignNow for WH 1612 The South Carolina Department Of Revenue Sctax?

Using airSlate SignNow for WH 1612 The South Carolina Department Of Revenue Sctax offers numerous benefits, including reduced paperwork, increased compliance accuracy, and faster processing times. Our solution enables your business to focus more on growth while ensuring tax forms are managed efficiently.

-

Is airSlate SignNow secure for handling sensitive information related to WH 1612 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow employs robust security measures to protect sensitive information related to WH 1612 The South Carolina Department Of Revenue Sctax. Our platform complies with industry standards to ensure that your documents and data remain safe and confidential.

Get more for WH 1612 The South Carolina Department Of Revenue Sctax

Find out other WH 1612 The South Carolina Department Of Revenue Sctax

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself