Alabama Form 40es

What is the Alabama Form 40es

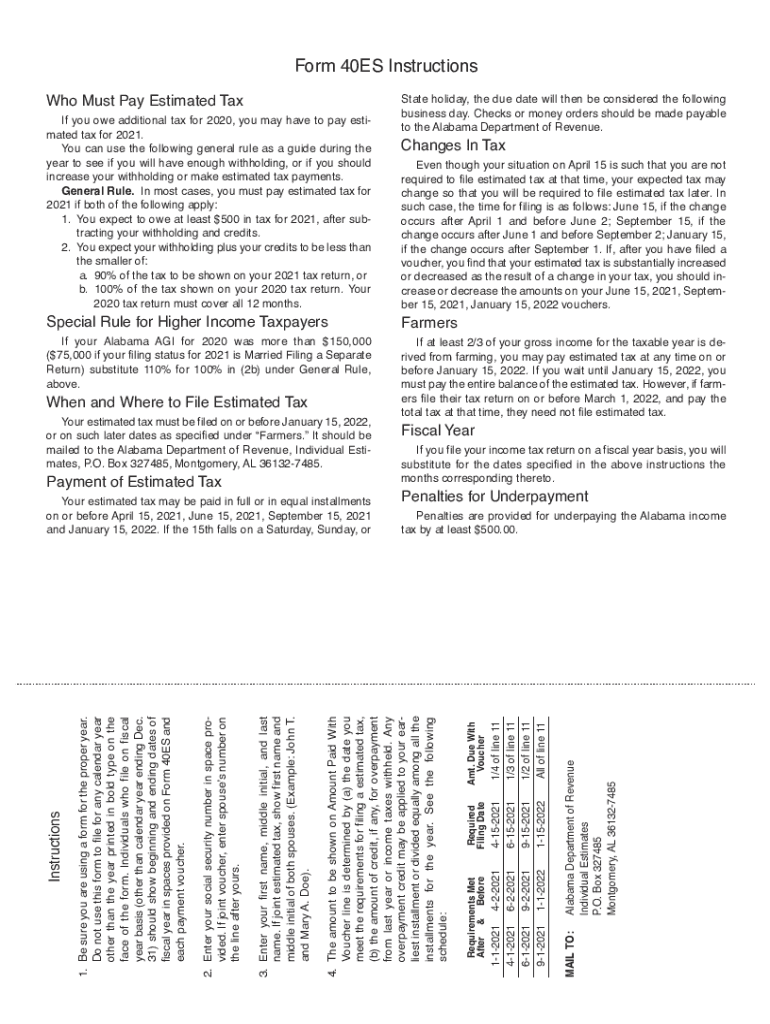

The Alabama Form 40es is an estimated tax payment form used by individuals and businesses to report and pay estimated income taxes to the state of Alabama. This form is particularly important for taxpayers who expect to owe tax of $500 or more when filing their annual tax return. By submitting Form 40es, taxpayers can avoid penalties and interest charges that may arise from underpayment of taxes throughout the year.

How to use the Alabama Form 40es

Using the Alabama Form 40es involves calculating your estimated tax liability for the year and submitting payments based on that estimate. Taxpayers should consider their expected income, deductions, and credits to determine the appropriate amount. The form allows for quarterly payments, which can help manage cash flow and meet tax obligations without a large lump-sum payment at year-end.

Steps to complete the Alabama Form 40es

Completing the Alabama Form 40es requires several steps:

- Gather financial information, including expected income, deductions, and credits.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the form with your personal details and calculated amounts.

- Review the completed form for accuracy before submission.

- Submit the form along with your payment by the due dates.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Alabama Form 40es to avoid penalties. Typically, estimated tax payments are due on the 15th of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions.

Form Submission Methods

The Alabama Form 40es can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Alabama Department of Revenue's website.

- Mailing a paper copy of the form to the appropriate state office.

- In-person delivery at designated state tax offices.

Legal use of the Alabama Form 40es

The Alabama Form 40es is legally binding when completed accurately and submitted on time. Compliance with state tax laws ensures that taxpayers fulfill their obligations, thereby avoiding potential legal issues. Using electronic tools to fill out and sign the form can enhance security and ensure compliance with eSignature regulations.

Key elements of the Alabama Form 40es

Key elements of the Alabama Form 40es include:

- Taxpayer identification information, including name and Social Security number.

- Estimated income and deductions for the tax year.

- Calculation of total estimated tax liability.

- Payment amounts for each quarter.

Quick guide on how to complete alabama form 40es

Prepare Alabama Form 40es effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and efficiently. Manage Alabama Form 40es on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Alabama Form 40es with ease

- Locate Alabama Form 40es and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Alabama Form 40es and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama form 40es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama estimated tax form 40ES for 2021?

The Alabama estimated tax form 40ES for 2021 is a document that allows taxpayers in Alabama to estimate and pay their state income tax throughout the year. This form is essential for individuals who expect to owe tax of $500 or more when filing their return. Completing this form helps avoid any penalties or interest due to underpayment.

-

How do I complete the Alabama estimated tax form 40ES for 2021?

To complete the Alabama estimated tax form 40ES for 2021, start by gathering your income information, including wages and other taxable income sources. Then, calculate your expected tax liability for the year and divide it by four to determine your quarterly payments. You can use airSlate SignNow to eSign and submit your form conveniently.

-

What are the deadlines for the Alabama estimated tax form 40ES for 2021?

The deadlines for submitting the Alabama estimated tax form 40ES for 2021 are typically the 15th of April, June, September, and January of the following year. Meeting these deadlines ensures you make timely payments and avoid late fees. Using airSlate SignNow can help you manage and submit these forms on time.

-

Are there penalties for not filing the Alabama estimated tax form 40ES for 2021?

Yes, failing to file the Alabama estimated tax form 40ES for 2021 or underpaying your taxes may result in penalties. The state may impose interest and fees on the unpaid tax balance. It’s advisable to accurately estimate your tax obligation and file the form to avoid these additional costs.

-

Can I eSign the Alabama estimated tax form 40ES for 2021?

Absolutely! With airSlate SignNow, you can easily eSign the Alabama estimated tax form 40ES for 2021, ensuring a secure and straightforward submission process. Electronic signing streamlines the task, making it simple to handle your tax forms without the hassle of printing and mailing them.

-

What features does airSlate SignNow offer for managing the Alabama estimated tax form 40ES for 2021?

airSlate SignNow offers several features to manage your Alabama estimated tax form 40ES for 2021, including easy document uploading, eSigning, and secure storage. The platform allows you to track your forms and ensure they are completed and submitted on time. It provides a cost-effective solution for handling your tax documents efficiently.

-

Is there customer support available for users of the Alabama estimated tax form 40ES for 2021?

Yes, airSlate SignNow provides excellent customer support for users handling the Alabama estimated tax form 40ES for 2021. Their support team is available to assist you with any questions or issues you may encounter while using the platform. This ensures a smooth experience in managing your tax documents.

Get more for Alabama Form 40es

- Tender form for the service of name of school

- Request an appeal or hearinglowell ma form

- Local beer ampamp american restaurantcobblestones of lowell form

- Dmv form 301

- Form dmv 301 certification of attendance

- Application for tinted window exemption dmv ny gov form

- Mutual support group meeting attendance form

- 1380 energy lane suite 202st paul mn 55108pho form

Find out other Alabama Form 40es

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy