Form 945

What is the Form 945

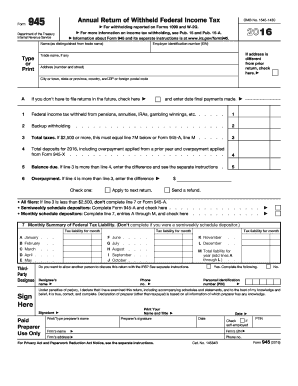

The 2016 Form 945 is a tax form used by businesses to report annual withholding on non-payroll payments, including pensions, annuities, and certain gambling winnings. This form is essential for employers who need to report and remit the federal income tax withheld from these payments. Understanding the purpose of Form 945 helps ensure compliance with IRS regulations and contributes to accurate tax reporting.

How to use the Form 945

To effectively use the 2016 Form 945, businesses must first gather all relevant information regarding the payments made throughout the year. This includes details about the recipients, the amounts paid, and the total federal income tax withheld. Once the necessary data is collected, the form can be filled out accurately, ensuring that all fields are completed as required. After completing the form, it must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 945

Completing the 2016 Form 945 involves several key steps:

- Gather all payment records and withholding information for the year.

- Fill in the business name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the total payments made and the total federal income tax withheld in the appropriate sections.

- Sign and date the form, certifying that the information provided is accurate.

- Submit the completed form to the IRS by the deadline, either electronically or by mail.

Legal use of the Form 945

The legal use of the 2016 Form 945 is governed by IRS regulations that require accurate reporting of withheld taxes. Businesses must ensure compliance with these regulations to avoid potential legal issues, including penalties for underreporting or failing to file. The form serves as a crucial document for the IRS to track tax liabilities associated with non-payroll payments, reinforcing the importance of maintaining accurate records and timely submissions.

Filing Deadlines / Important Dates

For the 2016 Form 945, the filing deadline is typically January 31 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential for businesses to be aware of these dates to ensure timely filing and avoid any late fees or penalties. Keeping a calendar of important tax dates can help in managing these deadlines effectively.

Form Submission Methods (Online / Mail / In-Person)

The 2016 Form 945 can be submitted to the IRS through various methods. Businesses may choose to file electronically using approved e-filing software, which can streamline the process and provide immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address based on the business location. In-person submissions are generally not available for this form, making electronic or mail options the most practical choices for compliance.

Quick guide on how to complete form 945 401234476

Effortlessly complete Form 945 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 945 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Form 945 with ease

- Obtain Form 945 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click the Done button to save your edits.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 945 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945 401234476

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 form 945, and why is it important?

The 2016 form 945 is an annual return used by employers to report Income Tax withheld from nonpayroll payments. Understanding this form is crucial for businesses to ensure they comply with IRS regulations and avoid penalties. Proper management of the 2016 form 945 can streamline your payment reporting processes.

-

How can airSlate SignNow help with the 2016 form 945?

airSlate SignNow simplifies the signing and submission process for the 2016 form 945 through a user-friendly eSignature platform. Businesses can easily gather signatures from necessary parties, ensuring timely filings. This reduces paperwork and enhances compliance with IRS requirements.

-

Is airSlate SignNow affordable for small businesses needing to file the 2016 form 945?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. With competitive pricing, you can efficiently manage your 2016 form 945 submissions without breaking the bank. Our goal is to provide accessible solutions for all sizes of businesses.

-

What features does airSlate SignNow provide to assist with document management for the 2016 form 945?

airSlate SignNow includes features like template creation, cloud storage, and real-time tracking to manage documents related to the 2016 form 945. These tools allow users to streamline their document workflows, ensuring efficient and organized handling of forms. Enhanced security measures also protect sensitive information.

-

Can I integrate airSlate SignNow with my existing accounting software for handling the 2016 form 945?

Absolutely! airSlate SignNow supports various integrations with popular accounting software, making it easy to manage your 2016 form 945 alongside your other financial documents. This interconnectivity enhances your workflow and reduces the need for duplicative data entry.

-

How does airSlate SignNow enhance the security of my 2016 form 945 submissions?

airSlate SignNow places a strong emphasis on security, utilizing encryption and secure storage to protect your 2016 form 945 submissions. You can have peace of mind knowing that your sensitive data is safeguarded from unauthorized access. Compliance with industry standards ensures your documents are handled with integrity.

-

What are the benefits of using airSlate SignNow for electronic signatures on the 2016 form 945?

Using airSlate SignNow for electronic signatures on the 2016 form 945 offers expedited processes and reduced error rates. With digital signatures, you can finalize documents quickly and securely, leading to increased efficiency within your business operations. It's a modern solution for traditional paperwork.

Get more for Form 945

Find out other Form 945

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure