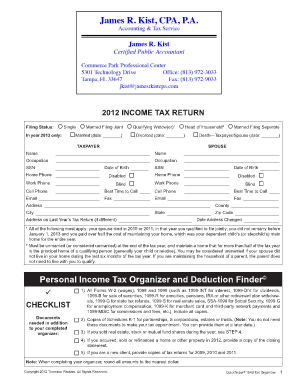

Personal Income Tax Organizer and Deduction Finder Form

What is the Personal Income Tax Organizer And Deduction Finder Form

The Personal Income Tax Organizer And Deduction Finder Form is a comprehensive document designed to assist taxpayers in organizing their financial information for tax preparation. This form helps individuals systematically gather necessary data, such as income sources, expenses, and potential deductions. By using this form, taxpayers can ensure they do not overlook any deductions that may reduce their taxable income, ultimately leading to potential savings on their tax bills.

Steps to complete the Personal Income Tax Organizer And Deduction Finder Form

Completing the Personal Income Tax Organizer And Deduction Finder Form involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Fill in personal information, such as your name, address, and Social Security number.

- Document all income sources, ensuring accuracy in reporting amounts.

- List all eligible deductions, including medical expenses, charitable contributions, and mortgage interest.

- Review the completed form for accuracy and completeness before submission.

How to use the Personal Income Tax Organizer And Deduction Finder Form

To effectively use the Personal Income Tax Organizer And Deduction Finder Form, start by identifying the sections relevant to your financial situation. Each section is designed to prompt you to think about various income sources and deductions. Take your time to fill out each section thoroughly, as this will help you maximize your tax benefits. Once completed, you can use the information gathered to prepare your tax return or provide it to your tax professional for assistance.

Legal use of the Personal Income Tax Organizer And Deduction Finder Form

The Personal Income Tax Organizer And Deduction Finder Form is legally valid when filled out correctly and used in accordance with IRS guidelines. It serves as a personal record that can help substantiate claims made on your tax return. While the form itself does not need to be submitted to the IRS, the information contained within it must be accurate and truthful to avoid penalties for misreporting income or deductions.

Key elements of the Personal Income Tax Organizer And Deduction Finder Form

Several key elements are essential to the Personal Income Tax Organizer And Deduction Finder Form:

- Personal Information: This includes your name, address, and Social Security number.

- Income Sources: Document all sources of income, including wages, dividends, and rental income.

- Deductions: Identify potential deductions, such as medical expenses, education costs, and business expenses.

- Signatures: Ensure the form is signed and dated to validate the information provided.

Examples of using the Personal Income Tax Organizer And Deduction Finder Form

There are various scenarios where the Personal Income Tax Organizer And Deduction Finder Form can be beneficial:

- A self-employed individual can use the form to track business expenses and maximize deductions.

- A family can document medical expenses to ensure they claim all eligible healthcare deductions.

- Students can gather information on tuition and related expenses to take advantage of education-related tax credits.

Quick guide on how to complete personal income tax organizer and deduction finder form

Complete Personal Income Tax Organizer And Deduction Finder Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Personal Income Tax Organizer And Deduction Finder Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Personal Income Tax Organizer And Deduction Finder Form without hassle

- Locate Personal Income Tax Organizer And Deduction Finder Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Income Tax Organizer And Deduction Finder Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal income tax organizer and deduction finder form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Personal Income Tax Organizer And Deduction Finder Form?

The Personal Income Tax Organizer And Deduction Finder Form is a tool designed to help individuals compile necessary financial information and identify potential deductions for their personal income tax filings. This form streamlines the process, ensuring that users don’t miss out on valuable deductions. It is user-friendly and aids in organizing all required documents in one place.

-

How does the Personal Income Tax Organizer And Deduction Finder Form benefit me?

Using the Personal Income Tax Organizer And Deduction Finder Form simplifies the tax preparation process by making it easier to track income and deductions. It helps users ensure they gather all necessary documentation, leading to a potentially higher tax refund. Additionally, it reduces the time and stress involved in preparing your taxes.

-

Is there a cost associated with the Personal Income Tax Organizer And Deduction Finder Form?

The Personal Income Tax Organizer And Deduction Finder Form is offered at a competitive price that reflects its value. For exact pricing details, it is recommended to check our website or contact our sales team. Investing in this form can save you signNow time and resources during tax season.

-

Can I integrate the Personal Income Tax Organizer And Deduction Finder Form with other tools?

Yes, the Personal Income Tax Organizer And Deduction Finder Form can be seamlessly integrated with various accounting and tax software solutions. This makes it easy to transfer data and maintain accurate records. Check our integrations page for specific tools that are supported.

-

How does the Personal Income Tax Organizer And Deduction Finder Form improve accuracy in tax filing?

The Personal Income Tax Organizer And Deduction Finder Form helps enhance accuracy by guiding users through the documentation process, reducing the chances of omissions or errors. By providing a structured format, it ensures that all possible deductions are considered. Accurate documentation ultimately leads to fewer audit risks and smoother filings.

-

Is the Personal Income Tax Organizer And Deduction Finder Form suitable for freelancers and self-employed individuals?

Absolutely! The Personal Income Tax Organizer And Deduction Finder Form is specifically beneficial for freelancers and self-employed individuals who need to track various income sources and expenses. It helps these users identify deductions unique to their situation, maximizing potential tax savings. This form is adaptable to different income types, making it invaluable for independent workers.

-

How can I access the Personal Income Tax Organizer And Deduction Finder Form?

The Personal Income Tax Organizer And Deduction Finder Form can be accessed directly through our website. Users can either fill it out online or download it for offline use. Instructions for completing the form are provided to ensure a seamless experience.

Get more for Personal Income Tax Organizer And Deduction Finder Form

- Identifying functions worksheet pdf form

- The fundamental counting principle worksheet answer key pdf form

- Kuta software infinite algebra 2 properties of parabolas answers with work form

- Form coa

- Pep annex 4 orh form children tooth surface copy edited 22 aug who

- Nudesc form

- Guest approval form for high school dances myflorence

- Az dps leosa instructor application azdps form

Find out other Personal Income Tax Organizer And Deduction Finder Form

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure