It31 Form

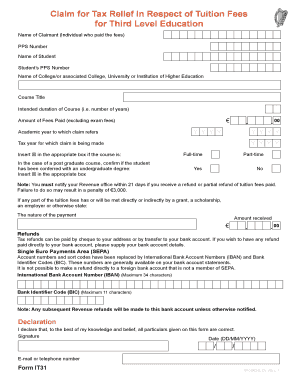

What is the It31 Form

The It31 form is a specific document used in the United States for tax purposes, particularly related to income reporting and deductions. This form is essential for individuals and businesses to accurately report their financial activities to the Internal Revenue Service (IRS). Understanding the purpose of the It31 form helps ensure compliance with tax regulations and avoids potential penalties.

Steps to Complete the It31 Form

Completing the It31 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and receipts for deductions. Next, follow these steps:

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income as outlined in the form’s sections.

- Detail any deductions you are eligible for, providing necessary documentation.

- Review the completed form for accuracy before submission.

Taking the time to carefully complete each section will help facilitate a smooth filing process.

Legal Use of the It31 Form

The It31 form is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is crucial to understand that electronic signatures are recognized as valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that the signing process meets specific requirements. Using a reliable eSigning solution, like airSlate SignNow, ensures that your digital signature is secure and compliant with legal standards.

Form Submission Methods

There are various methods to submit the It31 form, allowing flexibility based on your preferences. You can choose to file online through the IRS website or authorized e-filing services, which often provide instant confirmation of receipt. Alternatively, you may submit the form via traditional mail. If you opt for mail, ensure that you send it to the correct IRS address and consider using a trackable mailing option for peace of mind.

Filing Deadlines / Important Dates

Filing deadlines for the It31 form are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to the filing schedule, as well as any extensions that may be available.

Key Elements of the It31 Form

The It31 form contains several key elements that are essential for accurate reporting. These include:

- Personal identification information

- Income details from various sources

- Deductions and credits applicable to your tax situation

- Signature and date to validate the submission

Understanding these elements will help ensure that you provide all necessary information and comply with IRS requirements.

Quick guide on how to complete it31 form

Complete It31 Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage It31 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign It31 Form with minimal effort

- Obtain It31 Form and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Edit and eSign It31 Form and ensure solid communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it31 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it31 form and why is it important for businesses?

The it31 form is a tax document used by businesses to report specific income and expenses to the IRS. Understanding how to accurately complete and submit the it31 form is crucial for compliance and to avoid potential penalties. airSlate SignNow simplifies this process, enabling you to eSign and manage important documents quickly and securely.

-

How can airSlate SignNow assist me in filling out the it31 form?

airSlate SignNow offers an intuitive platform that allows you to upload, edit, and eSign your it31 form with ease. With user-friendly tools and templates, you can fill out the form accurately, ensuring all necessary information is included. This streamlined process saves time and reduces the risk of errors.

-

Is there a pricing plan that includes assistance with the it31 form?

Yes, airSlate SignNow provides a range of pricing plans tailored to fit different business needs. Each plan includes full access to document management features, allowing you to set up workflows for forms like the it31 form at competitive rates. Check our pricing page for more details on the best plan for your requirements.

-

Can I integrate airSlate SignNow with other software for managing the it31 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including accounting and tax preparation tools. This means you can efficiently manage your it31 form alongside your business operations. Our integration capabilities enhance your workflow by linking documents directly to your existing systems.

-

What features does airSlate SignNow offer for managing documents like the it31 form?

airSlate SignNow provides robust features such as document templates, real-time collaboration, and secure eSignature capabilities for managing your it31 form. These features ensure that your documentation process is not only efficient but also compliant with legal standards. Plus, you can track document activity for added peace of mind.

-

Can airSlate SignNow help with compliance related to the it31 form?

Yes, airSlate SignNow is designed to help you maintain compliance when handling the it31 form and other important documents. By utilizing our secure eSignature and document management features, you can ensure that all signatures are legally binding and that your records are well organized for any potential audits.

-

What are the advantages of using airSlate SignNow for the it31 form compared to traditional methods?

Using airSlate SignNow for the it31 form offers numerous advantages over traditional paper methods. It enhances efficiency by allowing you to complete, eSign, and store documents electronically. Additionally, you reduce the risk of lost paperwork and improve the speed of your business transactions.

Get more for It31 Form

Find out other It31 Form

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word