Ins 04 Gst Form

What is the Ins 04 Gst

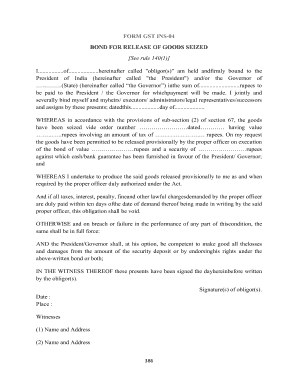

The Ins 04 Gst is a specific form used for reporting and managing certain tax-related information. It is essential for individuals and businesses to understand its purpose and implications. This form is primarily utilized to ensure compliance with tax regulations and to facilitate accurate reporting to the Internal Revenue Service (IRS). Understanding the Ins 04 Gst is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Ins 04 Gst

Using the Ins 04 Gst involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal details and any relevant financial data. Next, carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy of the completed form for your records. Utilizing electronic tools can streamline this process, making it easier to fill out and sign the document securely.

Steps to complete the Ins 04 Gst

Completing the Ins 04 Gst requires careful attention to detail. Here are the steps to follow:

- Gather required documents, such as identification and financial records.

- Access the Ins 04 Gst form through a reliable platform.

- Fill in personal information, including name, address, and Social Security number.

- Provide any necessary financial details as prompted on the form.

- Review the completed form for accuracy and completeness.

- Sign the form electronically to ensure it is legally binding.

- Submit the form according to the specified submission methods.

Legal use of the Ins 04 Gst

The legal use of the Ins 04 Gst is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in compliance with eSignature laws and other relevant regulations. Utilizing a trusted electronic signature solution can enhance the legal standing of the document. Additionally, maintaining compliance with privacy regulations and ensuring secure handling of personal information is crucial for the legal use of the Ins 04 Gst.

Filing Deadlines / Important Dates

Filing deadlines for the Ins 04 Gst are critical to avoid penalties and ensure compliance. It is important to be aware of the specific dates associated with the form's submission. Generally, deadlines may vary based on individual circumstances, such as the type of taxpayer or the nature of the information being reported. Keeping track of these important dates helps ensure timely filing and adherence to regulatory requirements.

Required Documents

When completing the Ins 04 Gst, certain documents are necessary to provide accurate information. Required documents may include:

- Proof of identity, such as a driver's license or Social Security card.

- Financial statements or records related to the information being reported.

- Any previous tax returns that may be relevant to the current filing.

Having these documents ready can facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete ins 04 gst

Complete Ins 04 Gst effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Ins 04 Gst on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Ins 04 Gst effortlessly

- Find Ins 04 Gst and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ins 04 Gst and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ins 04 gst

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form gst ins 04 used for?

The form gst ins 04 is a vital document for businesses in India, enabling them to declare input tax credit for goods and services. This form ensures compliance with GST regulations and helps businesses maintain accurate tax records. Properly utilizing form gst ins 04 can signNowly improve your financial reporting.

-

How can airSlate SignNow help with the form gst ins 04?

airSlate SignNow streamlines the signing and submission process for the form gst ins 04, making it easy to gather necessary signatures electronically. With our platform, you can create, share, and track your documents efficiently. This means faster completion and enhanced organization for your GST compliance tasks.

-

What features does airSlate SignNow offer for handling the form gst ins 04?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure cloud storage specifically for the form gst ins 04. These tools enable users to create forms quickly and manage their documents with ease. Additionally, automated reminders can help ensure timely submissions.

-

Is airSlate SignNow cost-effective for processing the form gst ins 04?

Yes, airSlate SignNow offers a cost-effective solution for businesses processing the form gst ins 04. With flexible pricing plans tailored to different needs, users can choose a plan that suits their budget while accessing premium features. This makes compliance with GST regulations affordable for everyone.

-

Can I integrate airSlate SignNow with my existing software for the form gst ins 04?

Absolutely! airSlate SignNow allows seamless integrations with popular business applications to facilitate processing the form gst ins 04. Whether you use CRM tools or accounting software, our platform can easily connect with your existing systems, enhancing workflow efficiency.

-

How does electronic signature work for the form gst ins 04 on airSlate SignNow?

The electronic signature feature on airSlate SignNow allows you to sign the form gst ins 04 securely online. This not only saves time but also ensures that your document remains legally binding under various regulations. Plus, you can track when signatures are applied, adding a layer of accountability.

-

What are the benefits of using airSlate SignNow for the form gst ins 04?

Using airSlate SignNow for the form gst ins 04 offers numerous benefits, including faster processing times and improved accuracy in documentation. Additionally, it enhances collaboration among team members and clients by allowing real-time updates and approvals. This level of efficiency is crucial for managing your GST responsibilities.

Get more for Ins 04 Gst

Find out other Ins 04 Gst

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe