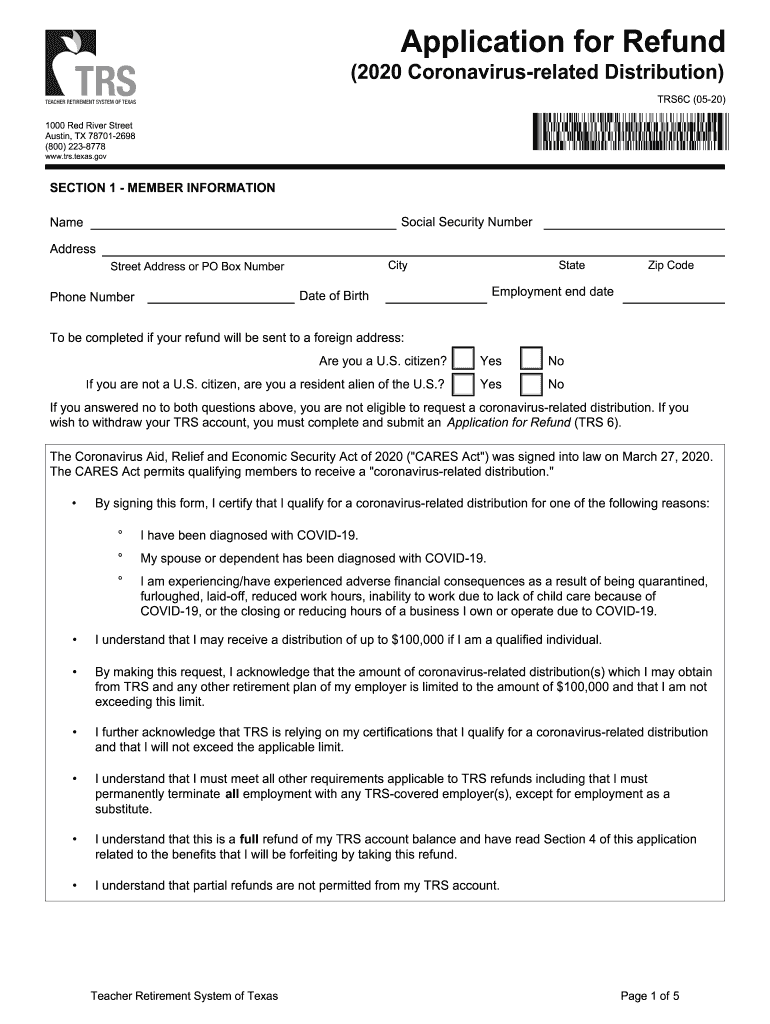

Form TRS6C Application for Refund Coronavirus Related Distribution Form TRS6C Application for Refund Coronavirus Related Distrib

Understanding the Certificate Check Process

The certificate check process is essential for verifying the authenticity of documents, especially when dealing with sensitive information such as financial statements or legal agreements. This procedure ensures that the documentation is legitimate and meets the required standards for acceptance by various institutions, including banks and government agencies. By utilizing a reliable electronic signature solution like signNow, users can streamline this verification process, enhancing both efficiency and security.

Steps to Complete the Certificate Check

Completing a certificate check involves several key steps:

- Gather Documentation: Collect all necessary documents that require verification.

- Access the Certificate Check Tool: Use an electronic signature platform that offers a certificate check feature.

- Upload Documents: Upload the documents you wish to verify into the system.

- Initiate the Check: Follow the prompts to start the verification process, ensuring all information is accurate.

- Review Results: Once the check is complete, review the results to confirm the authenticity of the documents.

Legal Use of Certificate Checks

Certificate checks are legally recognized in the United States, provided they comply with relevant regulations such as the ESIGN Act and UETA. These laws establish the validity of electronic signatures and records in transactions. By using a trusted electronic signature solution, users can ensure that their certificate checks are both legally binding and secure, protecting against fraud and unauthorized alterations.

Required Documents for Certificate Checks

To conduct a certificate check, certain documents may be required, depending on the nature of the verification. Commonly needed documents include:

- Identification documents (e.g., driver's license, passport)

- Financial records (e.g., bank statements, tax returns)

- Legal documents (e.g., contracts, agreements)

Having these documents ready can facilitate a smoother and more efficient certificate check process.

Eligibility Criteria for Certificate Checks

Eligibility for conducting a certificate check typically includes being a party involved in the transaction or having a legitimate interest in the verification of the documents. This may include individuals, businesses, or legal representatives. It is important to ensure that all parties involved have consented to the check to comply with privacy regulations.

Examples of Certificate Check Applications

Certificate checks are commonly applied in various scenarios, including:

- Verifying the authenticity of educational credentials for employment purposes.

- Confirming financial documents for loan applications.

- Authenticating legal agreements before signing.

These examples illustrate the importance of certificate checks in maintaining trust and integrity in both personal and professional transactions.

Quick guide on how to complete form trs6c application for refund coronavirus related distribution form trs6c application for refund coronavirus related

Effortlessly prepare Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to edit and electronically sign Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib with ease

- Locate Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form trs6c application for refund coronavirus related distribution form trs6c application for refund coronavirus related

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate check in airSlate SignNow?

A certificate check in airSlate SignNow ensures that all electronically signed documents are validated and backed by a secure certificate. This feature enhances the authenticity of your signatures, providing a reliable way to confirm document integrity and signer identity.

-

How does airSlate SignNow’s certificate check feature benefit my business?

The certificate check feature in airSlate SignNow helps businesses maintain compliance with industry regulations by ensuring every document is securely signed. This not only boosts trust among clients but also streamlines your workflow by providing verifiable evidence of signature authenticity.

-

Is the certificate check feature included in the pricing plans?

Yes, the certificate check feature is included in all airSlate SignNow pricing plans, giving users access to essential document security without extra costs. You can choose the plan that best fits your needs and still enjoy the benefits of a reliable certificate check to validate your eSigned documents.

-

How does airSlate SignNow integrate with other software for certificate checks?

airSlate SignNow seamlessly integrates with various CRM and business applications, allowing users to utilize the certificate check feature across different platforms. This interoperability ensures that you can maintain consistency in document management while enhancing the efficiency of your workflows.

-

Can I customize certificate check settings in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the settings related to the certificate check feature according to your organization's compliance requirements. This flexibility ensures you retain control over how documents are validated and securely signed.

-

What types of documents can I use with the certificate check feature?

The certificate check feature is compatible with various types of documents in airSlate SignNow, including contracts, agreements, and forms. You can confidently use this feature to secure any document that requires an electronic signature and validation.

-

How does certificate check enhance document security in airSlate SignNow?

The certificate check enhances document security by providing a cryptographic stamp that verifies the source and contents of the signed document. This advanced security measure ensures that any alterations post-signature can be easily detected, thus safeguarding your sensitive data.

Get more for Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib

- Report of marriage form download

- Summer and winter gizmo answer key form

- Blank checks template for kids form

- Tree planting project proposal doc form

- Ab009 san francisco building codes form

- Mileage reimbursement form pdf tashman

- Amvets membership card form

- Phillips academy summer session transcript request form

Find out other Form TRS6C Application For Refund Coronavirus related Distribution Form TRS6C Application For Refund Coronavirus related Distrib

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed