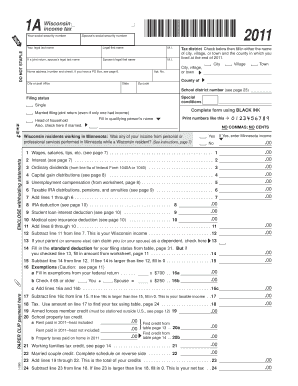

Wisconsin Tax Form 1a Fillable

What makes the wisconsin tax form 1a fillable legally binding?

As the society takes a step away from office working conditions, the execution of paperwork increasingly occurs electronically. The wisconsin tax form 1a fillable isn’t an exception. Working with it utilizing electronic tools differs from doing this in the physical world.

An eDocument can be viewed as legally binding given that specific needs are met. They are especially crucial when it comes to stipulations and signatures related to them. Entering your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it accomplished. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your wisconsin tax form 1a fillable when filling out it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and safe. In addition, it gives a lot of possibilities for smooth completion security wise. Let's rapidly go through them so that you can stay assured that your wisconsin tax form 1a fillable remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: adds an extra layer of protection and validates other parties identities through additional means, like an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data safely to the servers.

Completing the wisconsin tax form 1a fillable with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete wisconsin tax form 1a fillable

Effortlessly prepare Wisconsin Tax Form 1a Fillable on any device

The management of online documents has gained popularity among businesses and individuals. It presents an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can easily locate the appropriate form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Wisconsin Tax Form 1a Fillable across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Wisconsin Tax Form 1a Fillable with ease

- Obtain Wisconsin Tax Form 1a Fillable and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important paragraphs of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Tax Form 1a Fillable to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin tax form 1a fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin tax form 1A fillable?

The Wisconsin tax form 1A fillable is a digital version of the state's income tax form designed for individuals. It allows taxpayers to easily enter their information and calculations, making the tax-filing process more efficient. The fillable format is particularly user-friendly, ensuring accuracy and reducing errors during submission.

-

How do I obtain the Wisconsin tax form 1A fillable?

You can easily access the Wisconsin tax form 1A fillable online through official state government websites or trusted tax software providers. The form is typically available in PDF format that can be filled out electronically or printed for manual submission. airSlate SignNow can also assist in completing and eSigning this form seamlessly.

-

Is there a cost associated with using the Wisconsin tax form 1A fillable?

There is no cost to download the Wisconsin tax form 1A fillable itself, but using platforms like airSlate SignNow may involve subscription fees for additional features. Signing up for airSlate SignNow offers an affordable solution for businesses and individuals who frequently handle tax documents. This service simplifies the eSigning process, saving you time and effort.

-

Can I eSign the Wisconsin tax form 1A fillable using airSlate SignNow?

Yes, you can eSign the Wisconsin tax form 1A fillable using airSlate SignNow. The platform offers a secure and straightforward method for signing documents electronically. With its user-friendly interface, you can quickly add your signature and send it directly to recipients, accelerating the filing process.

-

What features does airSlate SignNow offer for filling out tax forms?

airSlate SignNow provides several features tailored for filling out tax forms, including templates, document sharing, and advanced eSignature options. Users can complete the Wisconsin tax form 1A fillable directly on the platform, ensuring seamless collaboration and document management. These features help ensure that your forms are professionally completed and signed.

-

Is the Wisconsin tax form 1A fillable user-friendly for beginners?

Absolutely! The Wisconsin tax form 1A fillable is designed to be user-friendly, catering to both experienced and novice users. With straightforward instructions and an easy-to-navigate interface on platforms like airSlate SignNow, anyone can fill out and submit their tax forms without hassle.

-

What benefits does airSlate SignNow provide for businesses processing tax forms?

airSlate SignNow offers numerous benefits for businesses processing tax forms, including enhanced security and compliance features, automated workflows, and the ability to manage multiple documents at once. By using the Wisconsin tax form 1A fillable on this platform, businesses can ensure a smooth preparation and submission process while saving both time and resources.

Get more for Wisconsin Tax Form 1a Fillable

- Report card template form

- Living will form ohio 100076130

- Sales tax exempt certificate form

- Manufacturing data report example form

- Form est additional charge for underpayment of

- M15np additional charge for underpayment of estimated tax form

- M1pr property tax refund return form

- Get get mn form mwr reciprocity exemptionaffidavit of

Find out other Wisconsin Tax Form 1a Fillable

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online