Ri 1040es Form

What is the Ri 1040es Form

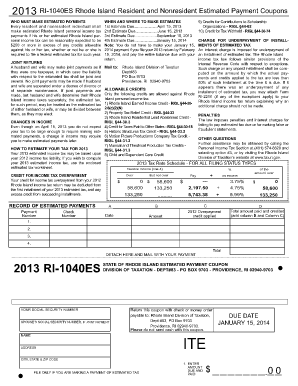

The Ri 1040es Form is a state-specific tax form used by residents of Rhode Island to make estimated income tax payments. This form is essential for individuals who expect to owe tax of one thousand dollars or more when filing their annual tax return. By submitting the Ri 1040es Form, taxpayers can avoid underpayment penalties and ensure they meet their tax obligations throughout the year.

How to use the Ri 1040es Form

Using the Ri 1040es Form involves a straightforward process. Taxpayers must first determine their estimated tax liability for the year. This estimation is based on expected income, deductions, and credits. Once the estimated amount is calculated, individuals can fill out the form and submit it according to the specified payment schedule. Payments can be made quarterly, aligning with the deadlines established by the Rhode Island Division of Taxation.

Steps to complete the Ri 1040es Form

Completing the Ri 1040es Form requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on your expected income for the year.

- Fill out the Ri 1040es Form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the form along with your estimated payment by the due date.

Legal use of the Ri 1040es Form

The Ri 1040es Form is legally binding when filled out and submitted according to Rhode Island tax laws. It is important for taxpayers to understand that accurate reporting of income and timely payments are crucial to avoid penalties. The form must be submitted electronically or via mail, and it is advisable to keep a copy for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Ri 1040es Form are critical for compliance. Taxpayers should be aware of the quarterly due dates, which typically fall on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Staying informed about these dates helps prevent late fees and interest charges.

Who Issues the Form

The Ri 1040es Form is issued by the Rhode Island Division of Taxation. This state agency is responsible for the administration of tax laws and ensures that residents comply with state tax obligations. Taxpayers can find the form and additional resources on the official Rhode Island Division of Taxation website.

Quick guide on how to complete ri 1040es form

Effortlessly prepare Ri 1040es Form on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Handle Ri 1040es Form on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The easiest way to modify and electronically sign Ri 1040es Form with ease

- Find Ri 1040es Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device. Modify and electronically sign Ri 1040es Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1040es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ri 1040es Form?

The Ri 1040es Form is an estimated tax payment form required by the state of Rhode Island. It enables individuals and businesses to make quarterly tax payments on income that is not subject to withholding. Using airSlate SignNow, you can easily eSign and submit your Ri 1040es Form online, streamlining your tax processes.

-

How can airSlate SignNow help with the Ri 1040es Form?

airSlate SignNow simplifies the process of completing and eSigning the Ri 1040es Form. Our platform provides a user-friendly interface that allows you to fill out your form, add necessary signatures, and send it securely without any hassle. This saves you time and ensures compliance with Rhode Island tax regulations.

-

Is airSlate SignNow cost-effective for handling tax forms like the Ri 1040es Form?

Yes, airSlate SignNow offers a cost-effective solution for managing forms such as the Ri 1040es Form. With transparent pricing plans, you can choose an option that fits your budget while accessing essential features that enhance your document workflow. Avoid expensive paper-based processes and invest in our digital solution instead.

-

Can airSlate SignNow integrate with accounting software for the Ri 1040es Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage the Ri 1040es Form alongside your financial processes. This integration allows for efficient data transfer and ensures that all necessary tax information is readily available at your fingertips.

-

What are the benefits of using airSlate SignNow for the Ri 1040es Form?

Utilizing airSlate SignNow for your Ri 1040es Form provides numerous benefits, including enhanced security, reduced processing time, and improved accuracy. The platform allows you to eSign documents from anywhere, ensuring you never miss a deadline. Plus, our robust tracking features keep you informed about the status of your documents.

-

Is it easy to get started with airSlate SignNow for the Ri 1040es Form?

Yes, getting started with airSlate SignNow for the Ri 1040es Form is quick and easy. Simply sign up for an account, upload your tax form, and begin the eSigning process. With an intuitive interface, you'll be able to navigate the platform effectively without any technical expertise.

-

Are there any mobile options for managing the Ri 1040es Form with airSlate SignNow?

Yes, airSlate SignNow provides mobile options for managing your Ri 1040es Form. Our mobile app allows you to eSign, send, and track documents directly from your smartphone or tablet. This flexibility ensures that you can complete your tax obligations on the go, making the process even more convenient.

Get more for Ri 1040es Form

- Dummit and foote solutions chapter 4 form

- Letter of direction template rbc form

- Ri 7004 instructions form

- Hud 504 form

- Dowling college transcript request form

- Lib colorado teacher of the year award liberty middle school liberty cherrycreekschools form

- Tax preparation arkansas attorney general form

- Resale certificate resale certificate form

Find out other Ri 1040es Form

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement