Tax Preparation Arkansas Attorney General Form

What is the Tax Preparation Arkansas Attorney General

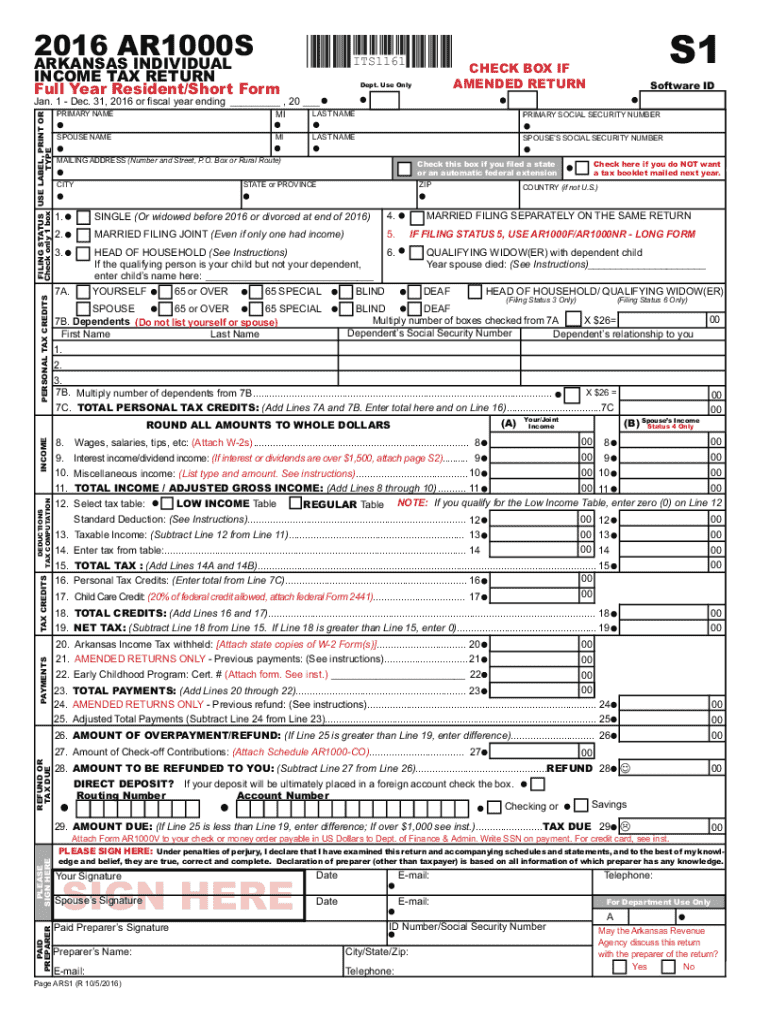

The Tax Preparation Arkansas Attorney General refers to the guidelines and resources provided by the Arkansas Attorney General’s office to assist taxpayers in understanding their rights and responsibilities related to tax preparation. This includes information on how to properly prepare taxes, the legal implications of tax filing, and the support available for taxpayers facing issues with tax compliance. The Attorney General's office plays a crucial role in ensuring that taxpayers are informed about state tax laws and protections against fraudulent practices.

Steps to complete the Tax Preparation Arkansas Attorney General

Completing the Tax Preparation Arkansas Attorney General involves several key steps to ensure compliance with state laws. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, review the specific tax guidelines provided by the Arkansas Attorney General’s office, which outline the legal requirements for filing. After preparing your tax forms, double-check for accuracy to avoid any mistakes. Finally, submit your completed tax forms either online, by mail, or in person, depending on your preference and the options available.

Required Documents

When preparing your taxes in accordance with the Tax Preparation Arkansas Attorney General, certain documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits you intend to claim

- Previous year’s tax return for reference

- Identification documents, such as a driver’s license or Social Security number

Having these documents organized and accessible will streamline the tax preparation process and help ensure compliance with state regulations.

Legal use of the Tax Preparation Arkansas Attorney General

The legal use of the Tax Preparation Arkansas Attorney General encompasses understanding taxpayer rights and responsibilities as outlined by state law. Taxpayers are entitled to fair treatment and protection against fraudulent practices. The Attorney General’s office provides resources that clarify legal obligations, enabling taxpayers to navigate the complexities of tax preparation while adhering to Arkansas tax laws. This legal framework is designed to protect taxpayers and promote transparency in the tax preparation process.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with the Tax Preparation Arkansas Attorney General. Typically, the deadline for filing state taxes is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is also important to be aware of any specific deadlines for extensions or additional filings. Marking these dates on your calendar can help prevent late submissions and potential penalties.

Digital vs. Paper Version

When preparing taxes under the Tax Preparation Arkansas Attorney General, taxpayers have the option to submit their forms digitally or via paper. The digital version often allows for quicker processing and may reduce the likelihood of errors. Conversely, some individuals may prefer the traditional paper method for its tangible nature. Understanding the benefits and drawbacks of each method can assist taxpayers in choosing the best option for their circumstances.

Quick guide on how to complete tax preparation arkansas attorney general

Complete Tax Preparation Arkansas Attorney General effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing users to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Tax Preparation Arkansas Attorney General on any platform through airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Tax Preparation Arkansas Attorney General with ease

- Locate Tax Preparation Arkansas Attorney General and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Preparation Arkansas Attorney General to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax preparation arkansas attorney general

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Tax Preparation Arkansas Attorney General?

The Tax Preparation Arkansas Attorney General oversees tax-related legal matters in the state, ensuring compliance with tax laws and regulations. They provide guidance on tax preparation processes and can assist in resolving disputes related to tax filings. Understanding their role can help you navigate tax preparation more effectively.

-

How can airSlate SignNow assist with Tax Preparation Arkansas Attorney General requirements?

airSlate SignNow offers a streamlined solution for eSigning and sending documents required for tax preparation. By using our platform, you can ensure that all necessary documents are signed and submitted in compliance with the guidelines set by the Tax Preparation Arkansas Attorney General. This helps reduce errors and speeds up the filing process.

-

What are the pricing options for airSlate SignNow related to tax preparation?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses involved in tax preparation. Our plans are designed to be cost-effective, ensuring that you can access essential features without breaking the bank. For specific pricing related to Tax Preparation Arkansas Attorney General compliance, please visit our pricing page.

-

What features does airSlate SignNow offer for tax preparation?

Our platform includes features such as document templates, secure eSigning, and automated workflows that are essential for efficient tax preparation. These features help you manage your documents effectively while ensuring compliance with the Tax Preparation Arkansas Attorney General's requirements. Additionally, our user-friendly interface makes it easy for anyone to use.

-

How does airSlate SignNow ensure document security for tax preparation?

Security is a top priority at airSlate SignNow, especially for sensitive tax documents. We utilize advanced encryption and secure cloud storage to protect your information, ensuring compliance with the standards set by the Tax Preparation Arkansas Attorney General. You can trust that your documents are safe and secure while using our platform.

-

Can airSlate SignNow integrate with other tax preparation software?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software to enhance your workflow. This integration allows you to manage your documents and eSignatures in one place, making it easier to comply with the Tax Preparation Arkansas Attorney General's requirements. Check our integrations page for a list of compatible software.

-

What are the benefits of using airSlate SignNow for tax preparation?

Using airSlate SignNow for tax preparation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with the Tax Preparation Arkansas Attorney General's guidelines. Our platform simplifies the signing process, allowing you to focus on what matters most—getting your taxes done accurately and on time.

Get more for Tax Preparation Arkansas Attorney General

- Foreclosure 497329927 form

- Forma pauperis form 497329928

- Character form

- Character license form

- Character reference form

- 497329932 keyword campaignid 9761395179 adgroupid 105629864288 form

- Representation agreement between agent and professional rodeo cowboy regarding procurement by agent of endorsements and paid form

- Proof of no income letter form

Find out other Tax Preparation Arkansas Attorney General

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement