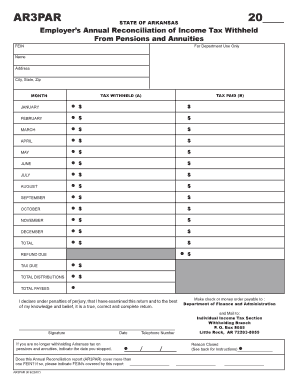

Ar3par Form

What is the ar3par?

The ar3par form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of the ar3par is essential for ensuring compliance with tax regulations and for accurate reporting of income and expenses.

How to use the ar3par

Using the ar3par form involves several key steps. First, gather all necessary financial documents, such as income statements and expense reports. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS. Utilizing digital tools like airSlate SignNow can streamline this process, allowing for easy eSigning and submission.

Steps to complete the ar3par

Completing the ar3par form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Access the ar3par form through the appropriate channels.

- Fill in personal and financial information as required.

- Review the form for accuracy and completeness.

- Sign the document electronically or manually.

- Submit the form according to IRS guidelines.

Legal use of the ar3par

The ar3par form must be used in compliance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with these regulations can result in penalties, making it critical for users to understand the legal implications of their submissions.

Required Documents

To complete the ar3par form, certain documents are typically required. These may include:

- Income statements from employers or clients.

- Expense receipts related to business operations.

- Previous tax returns for reference.

- Any additional documentation specified by the IRS for the current tax year.

Filing Deadlines / Important Dates

Filing deadlines for the ar3par form can vary based on the type of taxpayer and the specific tax year. Generally, the form must be submitted by the established deadlines to avoid penalties. It is important to stay informed about these dates to ensure timely compliance with IRS regulations.

Quick guide on how to complete ar3par

Access Ar3par effortlessly on any device

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and keep it securely stored online. airSlate SignNow provides all the essential tools to create, edit, and electronically sign your documents rapidly without delays. Manage Ar3par on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Ar3par with ease

- Find Ar3par and click on Get Form to initiate.

- Utilize the tools we make available to fill out your form.

- Emphasize important sections of the documents or redact confidential information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring document searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device you prefer. Edit and electronically sign Ar3par and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar3par

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar3par and how does it benefit businesses?

ar3par is an innovative eSigning solution that streamlines the document signing process. By using ar3par, businesses can enhance efficiency, reduce paperwork, and ensure faster approvals. This solution is tailored to meet the demands of modern organizations looking to optimize their workflows.

-

How much does ar3par cost?

The pricing for ar3par varies based on the plan you choose. airSlate SignNow offers flexible pricing options that cater to businesses of all sizes. You can review the pricing tiers on our website to find the perfect plan that fits your budget and needs.

-

What features does ar3par offer?

ar3par includes a suite of features that simplify the eSigning process, such as customizable templates, document tracking, and secure cloud storage. These features make it easy for users to manage their eSignature workflows while ensuring compliance and security. With ar3par, businesses can achieve seamless collaboration.

-

Is ar3par suitable for small businesses?

Absolutely! ar3par is designed with small businesses in mind. It provides a cost-effective and user-friendly solution that allows small companies to adopt eSigning technology without large investments, helping them compete more effectively in their markets.

-

Can ar3par integrate with other software applications?

Yes, ar3par seamlessly integrates with a wide range of software applications including CRM systems, project management tools, and cloud storage services. This capability ensures that you can easily incorporate ar3par into your existing workflows, enhancing productivity and efficiency.

-

What security measures does ar3par implement?

ar3par prioritizes security by employing advanced encryption protocols and secure access controls to ensure your documents remain safe. All signed documents are stored securely and comply with legal regulations. With ar3par, you can trust that your sensitive information is well protected.

-

How easy is it to use ar3par?

Using ar3par is incredibly easy, even for those with minimal tech experience. Its intuitive interface allows users to send, sign, and manage documents effortlessly. This simplicity means that businesses can quickly adopt ar3par without extensive training or onboarding processes.

Get more for Ar3par

- Cerere despagubire uniqa form

- Affidavit of corroborating witness form

- Pickup form

- Parc centre car park nottingham form

- Grade 2 and 3 math worksheet number patterns addition and subtractiomn math form

- Form mt 203 distributor of tobacco products tax return revised 824

- Tr 579 wt 739158725 form

- Know your rights on not for profit property tax exemptions form

Find out other Ar3par

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure