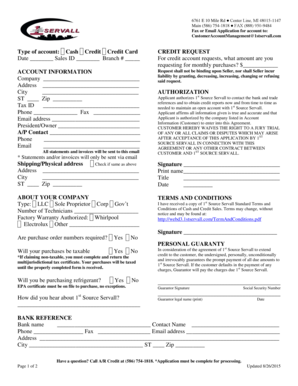

Credit Application 1st Source Servall Form

What is the 1st Source Credit Card?

The 1st Source credit card is a financial product offered by 1st Source Bank, designed to provide users with a convenient way to manage their expenses. This credit card typically features benefits such as rewards programs, low-interest rates, and flexible payment options. It is ideal for individuals looking to build credit or manage their finances effectively. Understanding the details of this card can help users make informed decisions about their financial needs.

Key Elements of the 1st Source Credit Card

When considering the 1st Source credit card, it is essential to be aware of its key elements. These may include:

- Interest Rates: The card may offer competitive interest rates, which can vary based on creditworthiness.

- Rewards Program: Users can earn points or cash back on eligible purchases, enhancing the value of their spending.

- Fees: Understanding any annual fees, late payment fees, or foreign transaction fees is crucial for managing costs.

- Credit Limit: The card typically comes with a predetermined credit limit, which can impact spending ability.

Steps to Complete the 1st Source Credit Card Application

Completing the application for the 1st Source credit card involves several straightforward steps:

- Gather Documentation: Collect necessary documents such as identification, proof of income, and Social Security number.

- Fill Out the Application: Complete the application form with accurate personal and financial information.

- Review Terms: Carefully read the terms and conditions, including interest rates and fees.

- Submit the Application: Send the completed application through the designated method, whether online or in-person.

Legal Use of the 1st Source Credit Card

Using the 1st Source credit card legally involves adhering to the terms set by the issuing bank. This includes making timely payments, staying within the credit limit, and using the card for legitimate purchases. Understanding the legal implications of credit card use can help users avoid penalties and maintain a positive credit history.

Eligibility Criteria for the 1st Source Credit Card

To qualify for the 1st Source credit card, applicants typically need to meet specific eligibility criteria. These may include:

- Age Requirement: Applicants must be at least eighteen years old.

- Residency: Proof of U.S. residency may be required.

- Credit History: A satisfactory credit score is often necessary for approval.

- Income Verification: Applicants may need to demonstrate a stable source of income.

Application Process & Approval Time for the 1st Source Credit Card

The application process for the 1st Source credit card is typically efficient. After submitting the application, applicants can expect to receive a decision within a few business days. Factors influencing approval time may include the completeness of the application and the applicant's credit profile. Once approved, cardholders will receive their credit card by mail, allowing them to start using it promptly.

Quick guide on how to complete 1st source credit card

Effortlessly Prepare 1st source credit card on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to generate, edit, and eSign your documents promptly without any delays. Manage 1st source credit card on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign 1st source bank credit card with Ease

- Locate 1st source credit card and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 1st source bank credit card and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1st source credit card

Create this form in 5 minutes!

How to create an eSignature for the 1st source bank credit card

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 1st source bank credit card

-

What is a 1st source credit card and how does it work with airSlate SignNow?

A 1st source credit card is a payment card that allows businesses to make transactions efficiently. When used with airSlate SignNow, it simplifies the payment process for eSigning documents, ensuring secure and quick payments while maintaining document integrity.

-

What are the pricing plans for using airSlate SignNow with a 1st source credit card?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. When paying with a 1st source credit card, users can take advantage of special discounts and loyalty programs, making eSigning documents even more affordable.

-

What features does airSlate SignNow offer for businesses using a 1st source credit card?

Users can utilize features such as document templates, automated workflows, and real-time tracking when paying with a 1st source credit card. These tools help streamline the eSignature process and enhance collaboration within teams.

-

How can I benefit from using airSlate SignNow and a 1st source credit card together?

Combining airSlate SignNow with a 1st source credit card provides a seamless way to manage document signing and payments. This integration helps businesses save time and reduce errors, making the eSigning process more efficient.

-

Are there any integrations available for airSlate SignNow when using a 1st source credit card?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications when using a 1st source credit card. This allows for improved workflow automation, data synchronization, and enhanced productivity across platforms.

-

Is it secure to use a 1st source credit card with airSlate SignNow?

Absolutely! airSlate SignNow employs strong encryption and security measures to protect all transactions, including those made with a 1st source credit card. Your sensitive information will be safeguarded while you eSign documents.

-

Can I manage multiple users with airSlate SignNow while using a 1st source credit card?

Yes, airSlate SignNow allows businesses to manage multiple users efficiently, even when integrating a 1st source credit card for payments. This feature enhances collaboration and ensures that all team members can access necessary documents easily.

Get more for 1st source credit card

- Sentry v260 manual form

- Health form packet albertus magnus

- Osceola county vehicle for hire permit application acton osceola form

- Consent to transfer form

- Calhoun county business license form

- Case 580k service manual pdf form

- Family based arrangement form

- 23 printable volleyball score app forms and templates fillable

Find out other 1st source bank credit card

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online