Company Liability Form

Understanding Company Liability

Company liability refers to the legal obligations that a business entity has towards its stakeholders, including creditors, employees, and customers. When a company is incorporated, it typically enjoys limited liability, meaning that the personal assets of its owners are protected from business debts and liabilities. This protection is a fundamental aspect of incorporated entities, such as corporations and limited liability companies (LLCs). Understanding the nuances of company liability is crucial for business owners to ensure compliance with legal standards and to safeguard their personal interests.

Steps to Complete Company Liability Documentation

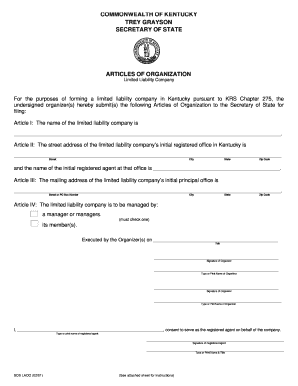

Completing the necessary documentation for establishing company liability involves several key steps. First, select the appropriate business structure, such as an LLC or corporation, as this choice will dictate the liability protections available. Next, prepare and file the Articles of Incorporation or Articles of Organization with the relevant state authority. This document outlines essential details about the company, including its name, purpose, and structure. After filing, it is important to create an operating agreement that defines the roles and responsibilities of the owners and how the company will be managed. Finally, ensure compliance with any state-specific regulations that may apply to your business type.

Legal Use of Company Liability

The legal use of company liability is critical for protecting personal assets and ensuring compliance with state laws. Incorporating a business provides a legal shield that separates personal and business liabilities. This means that, in most cases, creditors cannot pursue personal assets to satisfy business debts. However, it is essential to maintain proper corporate formalities, such as holding regular meetings and keeping accurate records, to uphold this protection. Failure to adhere to these practices may result in 'piercing the corporate veil,' where courts allow creditors to access personal assets.

Required Documents for Company Liability

To establish company liability, several documents are typically required. The primary document is the Articles of Incorporation or Articles of Organization, which must be filed with the state. Additionally, an operating agreement is recommended, especially for LLCs, as it outlines the internal management structure and operational procedures. Other necessary documents may include a federal Employer Identification Number (EIN) application, state tax registration forms, and any licenses or permits required for specific business activities. Keeping these documents organized is essential for maintaining compliance and protecting your company’s limited liability status.

State-Specific Rules for Company Liability

Each state has its own regulations regarding company liability, which can significantly impact how businesses operate. These rules often dictate the formation process, required documentation, and ongoing compliance obligations. For example, some states may require specific disclosures in the Articles of Incorporation, while others may have unique tax implications for different business structures. It is crucial for business owners to familiarize themselves with their state’s requirements to ensure full compliance and to take advantage of any protections offered under state law.

Examples of Using Company Liability

Understanding practical examples of company liability can help clarify its importance. For instance, if a corporation faces a lawsuit, only the assets owned by the corporation are at risk, protecting the personal assets of its shareholders. In contrast, if a sole proprietorship faces similar legal issues, the owner's personal assets may be vulnerable. Another example is in the context of business debts; an LLC can limit the personal financial risk of its members, ensuring that personal savings and property remain protected from business creditors. These scenarios highlight the critical role that company liability plays in business operations.

Quick guide on how to complete company liability

Prepare Company Liability effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files promptly without complications. Handle Company Liability on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Company Liability seamlessly

- Find Company Liability and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Select your preferred method of providing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and eSign Company Liability and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the company liability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for companies incorporated?

airSlate SignNow provides a range of features tailored for companies incorporated, including secure document signing, templates for contracts and agreements, and real-time tracking of signatures. This empowers businesses to streamline their document workflows efficiently. Moreover, the platform ensures compliance with legal standards necessary for any company incorporated.

-

How can airSlate SignNow help my company incorporated reduce costs?

By using airSlate SignNow, a company incorporated can dramatically reduce operational costs associated with traditional document signing methods. Our platform eliminates printing, mailing, and storage expenses, making it a cost-effective solution. Additionally, the efficiency gained leads to faster transactions, positively impacting the bottom line.

-

Is airSlate SignNow suitable for large companies incorporated?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including large companies incorporated. Our scalable solutions allow for multiple users and workflows, ensuring that all your document needs are met seamlessly. This makes it easy for larger organizations to manage their electronic signatures and documents efficiently.

-

What integrations does airSlate SignNow offer for companies incorporated?

airSlate SignNow seamlessly integrates with popular tools such as Salesforce, Google Drive, and Microsoft Office. This flexibility means that a company incorporated can connect their existing systems and enhance their document management processes. Our API also allows for custom integrations tailored to specific business needs.

-

How secure is airSlate SignNow for a company incorporated?

Security is a priority for airSlate SignNow, especially for companies incorporated handling sensitive documents. We utilize industry-leading encryption protocols and comply with various regulatory standards to protect your data. This ensures that all documents signed through our platform remain confidential and secure.

-

What pricing plans are available for companies incorporated using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to suit the needs of any company incorporated. You can choose from monthly or annual subscriptions, with options that include basic to premium features. This allows you to select a plan that fits your business size and document signing requirements.

-

Can airSlate SignNow help a company incorporated with compliance issues?

Yes, airSlate SignNow is equipped to assist a company incorporated with compliance by providing features that ensure legal adherence. The platform offers audit trails and timestamps for every document signed, which helps maintain compliance records. This makes it easier for businesses to meet regulations and legal standards.

Get more for Company Liability

Find out other Company Liability

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe