Fillable Multi Jurisdictional Tax Form

What is the fillable multi jurisdictional tax form

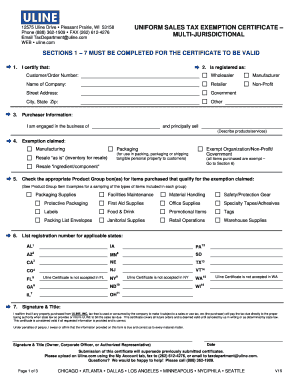

The fillable multi jurisdictional tax form is a standardized document designed to simplify the process of filing taxes across various jurisdictions. This form allows individuals and businesses to report income, deductions, and credits in a manner that complies with the diverse tax regulations of different states or localities. By using a fillable format, users can complete the form electronically, ensuring accuracy and efficiency in data entry. This form is particularly beneficial for taxpayers who operate in multiple states or have income sources from different jurisdictions, as it consolidates the necessary information into one comprehensive document.

How to use the fillable multi jurisdictional tax form

Using the fillable multi jurisdictional tax form involves several straightforward steps. First, access the form through a reliable electronic platform that supports digital completion. Once you have the form, gather all necessary financial documents, including income statements and previous tax returns. Begin filling out the form by entering your personal information, followed by income details, deductions, and credits applicable to your situation. Ensure that you review the form for accuracy before finalizing it. Once completed, you can eSign the document, providing a legally binding signature, and submit it according to the specific requirements of the jurisdictions involved.

Steps to complete the fillable multi jurisdictional tax form

Completing the fillable multi jurisdictional tax form involves a series of organized steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and previous tax returns.

- Access the fillable form through a trusted electronic platform.

- Enter your personal information accurately, including your name, address, and Social Security number.

- Input your income details, ensuring to include all sources of income from different jurisdictions.

- List any deductions and credits that apply to your situation, referencing the appropriate guidelines.

- Review the completed form for any errors or omissions.

- eSign the document to provide a legally binding signature.

- Submit the form according to the filing requirements of each jurisdiction.

Legal use of the fillable multi jurisdictional tax form

The legal use of the fillable multi jurisdictional tax form hinges on compliance with federal and state tax laws. For the form to be considered valid, it must be filled out accurately and submitted within the designated deadlines. Additionally, the use of electronic signatures is recognized under the ESIGN Act and UETA, provided that the signing process adheres to specific security measures. This legal framework ensures that the completed form holds the same weight as a traditional paper document when filed with tax authorities.

Filing deadlines / important dates

Filing deadlines for the fillable multi jurisdictional tax form vary depending on the jurisdictions involved. Generally, federal tax returns are due on April 15 each year, but state deadlines may differ. It is crucial for taxpayers to be aware of these dates to avoid penalties. Some states may offer extensions, while others adhere strictly to the standard deadlines. Keeping a calendar of important dates can help ensure timely submission of the form across all jurisdictions.

Required documents

To accurately complete the fillable multi jurisdictional tax form, several documents are typically required:

- Income statements (e.g., W-2, 1099 forms)

- Previous year’s tax return

- Documentation for deductions (e.g., mortgage interest statements, medical expenses)

- Records of any credits claimed in prior years

- Identification documents (e.g., Social Security card, driver’s license)

Quick guide on how to complete fillable multi jurisdictional tax form

Complete Fillable Multi Jurisdictional Tax Form easily on any device

Digital document management has become favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can locate the appropriate form and securely maintain it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Fillable Multi Jurisdictional Tax Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and eSign Fillable Multi Jurisdictional Tax Form effortlessly

- Locate Fillable Multi Jurisdictional Tax Form and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your needs in document management in just a few clicks from a device of your preference. Edit and eSign Fillable Multi Jurisdictional Tax Form and guarantee effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable multi jurisdictional tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable multi jurisdictional tax form?

A fillable multi jurisdictional tax form is a digital document designed to accommodate tax regulations across various jurisdictions. It allows users to enter their information directly into the fields, ensuring compliance with different tax laws. This feature simplifies the tax filing process and reduces errors, making it easier to manage multi jurisdictional tax obligations.

-

How can airSlate SignNow help with filling out a multi jurisdictional tax form?

airSlate SignNow provides an intuitive platform for creating and managing fillable multi jurisdictional tax forms. Users can easily customize forms and incorporate electronic signatures for efficient submission. Additionally, our solution enhances collaboration by allowing multiple stakeholders to complete their sections of the tax form seamlessly.

-

What are the pricing options for using airSlate SignNow for tax forms?

Pricing for airSlate SignNow is flexible and scalable, catering to businesses of all sizes. We offer different subscription plans that include features for managing fillable multi jurisdictional tax forms, such as unlimited document signing and secure storage. Check our pricing page for detailed information and choose the plan that fits your business needs.

-

Are fillable multi jurisdictional tax forms secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption to protect your fillable multi jurisdictional tax forms during transmission and storage. Additionally, we comply with industry standards, ensuring that sensitive tax information remains confidential and secure.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow offers seamless integrations with popular tax software to streamline your workflow. This capability enables users to efficiently create, manage, and eSign fillable multi jurisdictional tax forms directly from their existing systems. Check the integrations page for a list of compatible applications.

-

What are the benefits of using airSlate SignNow for multi jurisdictional tax forms?

The primary benefits of using airSlate SignNow for fillable multi jurisdictional tax forms include increased efficiency and reduced processing time. Our platform allows for quick form customization, electronic signatures, and real-time collaboration. This ultimately leads to timely and accurate tax submissions, freeing up valuable resources for your business.

-

Is it easy to create fillable forms with airSlate SignNow?

Yes, creating fillable multi jurisdictional tax forms with airSlate SignNow is simple and user-friendly. With our drag-and-drop interface, you can add fields, customize layouts, and create forms tailored to your specific requirements. You don't need technical expertise; anyone can easily design forms in just a few clicks.

Get more for Fillable Multi Jurisdictional Tax Form

- Snap interim report form

- Light duty work restrictions form

- Medication administration skills checklist form

- Fillable ub 04 form red 37269302

- Vaccine consent and administration record bluestone physician form

- All world cards leak download form

- Unconditional waiver of lien form

- Nra house officer grant reimbursement claim form

Find out other Fillable Multi Jurisdictional Tax Form

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile