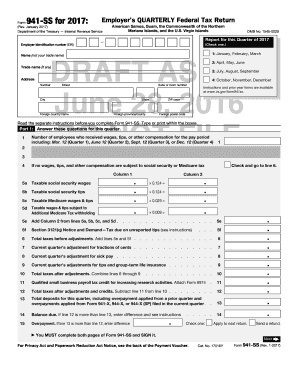

941ss Form

What is the 941ss

The 941ss form is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers who are filing for an employer identification number (EIN) and need to report their payroll tax liabilities. It serves as a crucial tool for businesses to ensure compliance with federal tax regulations and accurately report their tax obligations.

How to use the 941ss

To use the 941ss form effectively, employers must first gather all necessary payroll information, including total wages paid, the amount of federal income tax withheld, and the corresponding Social Security and Medicare taxes. After completing the form, employers can submit it electronically or by mail, depending on their preference and the guidelines set by the IRS. Utilizing a reliable eSignature solution can facilitate the signing and submission process, ensuring that the form is filed accurately and on time.

Steps to complete the 941ss

Completing the 941ss form involves several key steps:

- Gather all relevant payroll data for the reporting period.

- Fill out the form with accurate information regarding wages, taxes withheld, and other required details.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, ensuring compliance with eSignature laws.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Legal use of the 941ss

The 941ss form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, employers must comply with the requirements for electronic signatures, which include using a certified eSignature platform that meets the standards set by the ESIGN Act and UETA. This compliance ensures that the submitted form is recognized as a legitimate document for tax purposes.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the 941ss form to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Who Issues the Form

The 941ss form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Employers can access the form through the IRS website or through authorized tax preparation software. It is essential for employers to use the most current version of the form to ensure compliance with the latest tax regulations.

Quick guide on how to complete 941ss

Prepare 941ss easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without any delays. Manage 941ss on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and eSign 941ss effortlessly

- Find 941ss and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 941ss and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941ss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 941ss in relation to airSlate SignNow?

941ss refers to the standard IRS form used for reporting income taxes withholdings. airSlate SignNow can help businesses streamline the process of filling out and eSigning 941ss forms, making tax compliance easier and more efficient.

-

How can airSlate SignNow benefit my business when handling 941ss forms?

Using airSlate SignNow for 941ss forms simplifies document management by allowing you to send, eSign, and securely store these crucial tax documents. This reduces paperwork clutter and enhances compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing 941ss forms?

airSlate SignNow offers a user-friendly interface for creating, sending, and tracking 941ss forms. Key features include customizable templates, automated reminders for signatures, and a secure cloud storage solution to keep your documents organized.

-

Is there a cost to use airSlate SignNow for 941ss documentation?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. You can choose a plan that includes services for handling 941ss documents, ensuring you get the right features for your budget.

-

Can airSlate SignNow integrate with other software for 941ss preparation?

Absolutely, airSlate SignNow provides integrations with various accounting and payroll software that can assist in the preparation of 941ss forms. These integrations streamline workflows, making the entire process more efficient for businesses.

-

How secure is the information shared through airSlate SignNow for 941ss forms?

Security is a top priority at airSlate SignNow. When you use the platform for 941ss forms, your data is protected with industry-standard encryption and complies with regulatory requirements, ensuring your sensitive tax information is secure.

-

Can I track the status of my 941ss forms sent through airSlate SignNow?

Yes, airSlate SignNow provides a tracking feature that allows you to monitor the status of your 941ss forms in real-time. You will be notified when a document is viewed, signed, or completed, keeping you informed throughout the process.

Get more for 941ss

Find out other 941ss

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now

- Help Me With Sign California Letter of Intent

- Can I Sign California Letter of Intent