New York State E File Signature Authorization for Tax Year for Forms it 204 and it 204 LL 2024

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

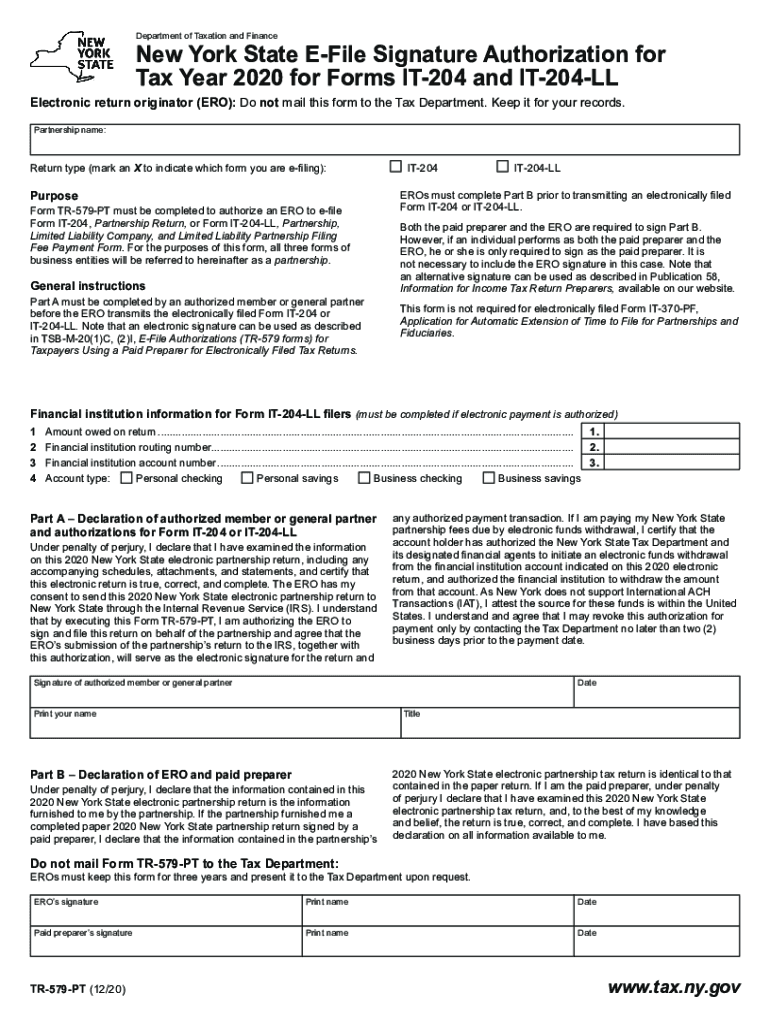

The New York State E File Signature Authorization for Tax Year for Forms IT-204 and IT-204 LL is a crucial document that enables taxpayers to authorize electronic filing of their partnership or limited liability company (LLC) tax returns. This authorization allows tax professionals to submit these forms on behalf of the taxpayer, ensuring compliance with state tax regulations. By completing this form, taxpayers can streamline their filing process, making it more efficient and secure.

How to use the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

To effectively use the New York State E File Signature Authorization, taxpayers must first complete the form accurately. This involves providing essential information such as the taxpayer's name, identification number, and details of the tax professional authorized to file on their behalf. Once completed, the form must be signed by the taxpayer, granting permission for electronic submission. The signed authorization can then be submitted along with the tax returns, ensuring that the e-filing process is valid and recognized by the state.

Steps to complete the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Completing the New York State E File Signature Authorization involves several key steps:

- Obtain the form from the New York State Department of Taxation and Finance website or your tax professional.

- Fill in your personal information accurately, including your name and identification number.

- Provide the name and information of the tax professional who will file on your behalf.

- Review the completed form for accuracy and completeness.

- Sign and date the form to authorize e-filing.

- Submit the signed form along with your IT-204 or IT-204 LL tax return.

Legal use of the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

The legal use of the New York State E File Signature Authorization is governed by state tax laws. By signing this form, taxpayers grant their consent for electronic filing, which is legally binding. It is essential that all information provided is accurate and truthful, as any discrepancies may lead to penalties or delays in processing. Taxpayers should retain a copy of the signed authorization for their records, as it serves as proof of consent for e-filing.

Required Documents

To complete the New York State E File Signature Authorization, taxpayers will need the following documents:

- The completed E File Signature Authorization form.

- Your IT-204 or IT-204 LL tax return.

- Identification documents, such as a Social Security number or Employer Identification Number (EIN).

- Any relevant financial documents that support your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the New York State E File Signature Authorization coincide with the due dates for the IT-204 and IT-204 LL forms. Typically, these forms are due on the fifteenth day of the third month following the end of the tax year. For example, if your tax year ends on December thirty-first, your filing deadline would be March fifteenth of the following year. It is crucial to submit the authorization and tax returns by this date to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year for forms it 204 and it 204 ll 557857891

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year for forms it 204 and it 204 ll 557857891

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

The New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL is a document that allows taxpayers to electronically sign and submit their tax forms. This authorization simplifies the filing process, ensuring compliance with state regulations while providing a secure method for submitting sensitive information.

-

How does airSlate SignNow facilitate the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

airSlate SignNow streamlines the process of obtaining the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL by providing an intuitive platform for eSigning documents. Users can easily send, sign, and manage their tax forms electronically, reducing the time and effort required for traditional paper submissions.

-

What are the pricing options for using airSlate SignNow for the New York State E File Signature Authorization?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when handling the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. Plans are designed to be cost-effective, ensuring that businesses of all sizes can access the tools necessary for efficient document management and eSigning.

-

What features does airSlate SignNow provide for the New York State E File Signature Authorization?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. These features enhance user experience and ensure that all documents are handled securely and efficiently.

-

What are the benefits of using airSlate SignNow for tax form submissions?

Using airSlate SignNow for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows users to complete their tax submissions quickly and accurately, minimizing the risk of errors and delays.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software, making it easier to manage the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. This integration allows users to streamline their workflow and ensure that all necessary documents are readily available for eSigning.

-

Is airSlate SignNow compliant with New York State regulations for eSigning?

Absolutely, airSlate SignNow is fully compliant with New York State regulations regarding electronic signatures, including those for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. This compliance ensures that users can trust the platform for secure and legally binding eSignatures.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- Transfer of security deposit to new tenant letter form

- Doj firearms qualification applicant form

- Downloadable pdf printable forklift license template form

- Kasambahay payslip form

- Conventry provider administrative review form

- Playground inspection checklist form

- Properties of water worksheet form

- Ncc application form

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself