Nyc 4sez Form

What is the Nyc 4sez Form

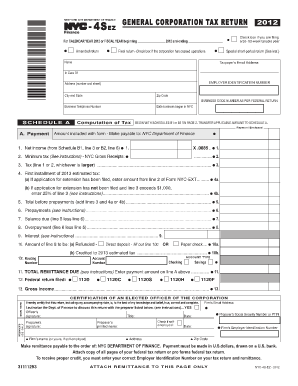

The Nyc 4sez Form, also known as the 100094205 form, is a document used primarily in New York City for specific administrative purposes. It is often required for various regulatory and compliance needs, including tax-related matters. This form serves as a declaration or application for certain benefits or services, ensuring that the information provided is accurate and compliant with local regulations.

How to use the Nyc 4sez Form

Using the Nyc 4sez Form involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from official city resources. Next, fill out the required fields accurately, providing all necessary information as requested. After completing the form, it is essential to review it for any errors before submission. Depending on the requirements, you may need to submit the form online, by mail, or in person.

Steps to complete the Nyc 4sez Form

Completing the Nyc 4sez Form requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Nyc 4sez Form from an official source.

- Read the instructions thoroughly to understand the information required.

- Fill in your personal details, ensuring all information is accurate.

- Attach any necessary supporting documents as specified in the form.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Legal use of the Nyc 4sez Form

The Nyc 4sez Form is legally binding when completed and submitted according to the applicable regulations. It is important to ensure that the information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Compliance with local laws and regulations is essential for the validity of the form, making it crucial to understand the legal implications of the information submitted.

Who Issues the Form

The Nyc 4sez Form is typically issued by a relevant city department or agency responsible for the specific administrative function it serves. This may include departments related to taxation, public services, or regulatory compliance. It is advisable to consult official city resources to identify the exact issuing authority for the form and any specific instructions they may provide.

Form Submission Methods

The Nyc 4sez Form can be submitted through various methods, depending on the requirements set forth by the issuing agency. Common submission methods include:

- Online submission through the official city portal.

- Mailing the completed form to the designated address.

- In-person submission at specified city offices.

Choosing the correct submission method is crucial to ensure timely processing and compliance with regulations.

Quick guide on how to complete nyc 4sez form 100094205

Effortlessly Prepare Nyc 4sez Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate template and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hesitation. Handle Nyc 4sez Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and electronically sign Nyc 4sez Form with ease

- Obtain Nyc 4sez Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether it be via email, SMS, or invitation link, or download it directly to your PC.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Nyc 4sez Form to guarantee exceptional communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 4sez form 100094205

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nyc 4sez Form and how can it help me?

The Nyc 4sez Form is an essential document used for filing taxes in New York City. By utilizing airSlate SignNow, you can easily fill out, sign, and send your Nyc 4sez Form securely, simplifying the tax process and ensuring compliance with local regulations.

-

How does airSlate SignNow streamline the Nyc 4sez Form process?

airSlate SignNow simplifies the Nyc 4sez Form process by providing an intuitive platform for completing and eSigning documents online. You can access templates, collaborate with others, and ensure all necessary fields are completed, resulting in a faster submission and fewer mistakes.

-

Is there a fee associated with using airSlate SignNow for the Nyc 4sez Form?

Yes, airSlate SignNow offers several pricing plans that provide great value for users needing to complete the Nyc 4sez Form. You can choose a plan that fits your budget and usage needs, with options ranging from individual to business accounts.

-

Can I integrate airSlate SignNow with other software for the Nyc 4sez Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more, allowing for easy management and sharing of your Nyc 4sez Form and other essential documents. This ensures a smooth workflow and better productivity.

-

What features does airSlate SignNow offer for completing the Nyc 4sez Form?

airSlate SignNow provides features such as templates, customizable fields, automatic reminders, and secure cloud storage specifically for the Nyc 4sez Form. These tools enable users to efficiently handle and track their documents, ensuring timely completion and submission.

-

Is airSlate SignNow legally binding for the Nyc 4sez Form?

Yes, documents signed through airSlate SignNow, including the Nyc 4sez Form, are legally binding. The platform complies with electronic signature laws like eIDAS and ESIGN, providing assurance that your signed forms are valid and recognized by authorities.

-

How secure is my information when using airSlate SignNow for the Nyc 4sez Form?

When using airSlate SignNow for the Nyc 4sez Form, your data is protected with advanced security measures, including encryption and secure servers. This ensures that your sensitive information remains confidential and is only accessible to authorized users.

Get more for Nyc 4sez Form

Find out other Nyc 4sez Form

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter