Cosmetology Tax Worksheet 2015

What is the cosmetology tax worksheet?

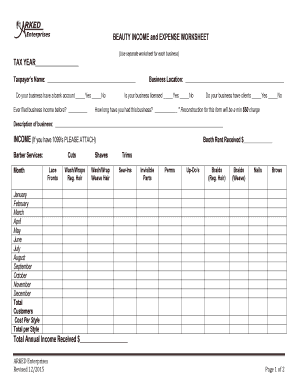

The cosmetology tax worksheet is a specialized form designed for professionals in the cosmetology industry to accurately report their income and expenses for tax purposes. This worksheet helps individuals such as hairstylists, estheticians, and nail technicians organize their financial information, ensuring compliance with IRS regulations. It typically includes sections for detailing income earned, business expenses, and deductions that can be claimed, making it a crucial tool for effective tax filing.

How to use the cosmetology tax worksheet

Using the cosmetology tax worksheet involves several steps to ensure accurate reporting. First, gather all relevant financial documents, including income statements and receipts for business expenses. Next, fill out the worksheet by entering your total income from cosmetology services and listing all deductible expenses, such as supplies, equipment, and continuing education costs. Finally, review the completed worksheet for accuracy before submitting it with your tax return.

Steps to complete the cosmetology tax worksheet

Completing the cosmetology tax worksheet requires careful attention to detail. Follow these steps:

- Collect all income records, including pay stubs and client payments.

- Document all business-related expenses, categorizing them appropriately.

- Fill in the worksheet, ensuring each section is completed accurately.

- Calculate total income and total expenses to determine your net income.

- Double-check all entries for errors before submission.

Legal use of the cosmetology tax worksheet

The legal use of the cosmetology tax worksheet is essential for ensuring compliance with tax laws. This worksheet must be filled out truthfully and accurately to avoid penalties. It serves as a formal document that can be requested by the IRS during audits. By using this worksheet correctly, cosmetology professionals can substantiate their income and expenses, which is vital for maintaining good standing with tax authorities.

Filing deadlines / important dates

Filing deadlines for the cosmetology tax worksheet align with the general tax filing schedule in the United States. Typically, individual tax returns are due on April fifteenth each year. However, if additional time is needed, a six-month extension can be requested, allowing for a deadline of October fifteenth. It is crucial to mark these dates on your calendar to ensure timely submission and avoid late fees or penalties.

Required documents

To complete the cosmetology tax worksheet, several documents are necessary. These include:

- Income statements from clients or employers.

- Receipts for all business-related expenses.

- Previous tax returns for reference.

- Any additional documentation that supports deductions claimed.

Who issues the form

The cosmetology tax worksheet is typically issued by the IRS or can be created based on IRS guidelines. While there may not be a specific form number associated with it, the worksheet adheres to the general standards set forth for tax reporting in the cosmetology industry. Tax professionals and accountants may also provide customized versions of the worksheet tailored to specific business needs.

Quick guide on how to complete cosmetology tax worksheet

Handle Cosmetology Tax Worksheet effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to find the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Cosmetology Tax Worksheet on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to adjust and electronically sign Cosmetology Tax Worksheet seamlessly

- Find Cosmetology Tax Worksheet and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Cosmetology Tax Worksheet to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cosmetology tax worksheet

Create this form in 5 minutes!

How to create an eSignature for the cosmetology tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cosmetology tax worksheet?

A cosmetology tax worksheet is a specialized document designed to help beauty professionals track their income, expenses, and deductions for tax purposes. This worksheet simplifies the tax filing process, ensuring you don't miss vital deductions that can save you money. Utilizing a cosmetology tax worksheet can streamline your financial management.

-

How can airSlate SignNow assist with my cosmetology tax worksheet?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning your cosmetology tax worksheet. By leveraging our digital tools, you can quickly fill out your worksheet, collaborate with your accountant, and ensure all documents are securely signed and stored. This solution saves time and improves organization.

-

Is there a cost associated with using airSlate SignNow for my cosmetology tax worksheet?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of businesses of all sizes. By investing in our service, you gain access to powerful features that facilitate the completion of your cosmetology tax worksheet efficiently. Check our pricing page for detailed information on packages and features.

-

What features does airSlate SignNow offer for managing my cosmetology tax worksheet?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time collaboration tools, making it perfect for managing your cosmetology tax worksheet. You can edit, update, and share your worksheets with ease, ensuring all stakeholders have access to the latest information. Additionally, our eSigning feature allows for quick approval and processing.

-

Can I integrate airSlate SignNow with other accounting software to manage my cosmetology tax worksheet?

Absolutely! airSlate SignNow supports integrations with popular accounting software, allowing you to connect your workflow to manage your cosmetology tax worksheet effectively. This integration enables seamless data transfer between platforms, reducing manual entry and minimizing errors, which saves you time during tax season.

-

How secure is my cosmetology tax worksheet when using airSlate SignNow?

Security is our priority at airSlate SignNow. Our platform provides advanced encryption and robust security measures to protect your cosmetology tax worksheet and any signed documents. You can rest assured that your sensitive financial information is safeguarded against unauthorized access and data bsignNowes.

-

Can airSlate SignNow help me understand tax deductions related to my cosmetology business?

Yes, airSlate SignNow can facilitate the process of identifying and tracking tax deductions through your cosmetology tax worksheet. By organizing your expenses and income, you can easily determine which items qualify as deductions, potentially reducing your taxable income. This can ultimately lead to signNow savings for your cosmetology business.

Get more for Cosmetology Tax Worksheet

Find out other Cosmetology Tax Worksheet

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document