Business Income Expenses Worksheet Accounting Tax 2019-2026

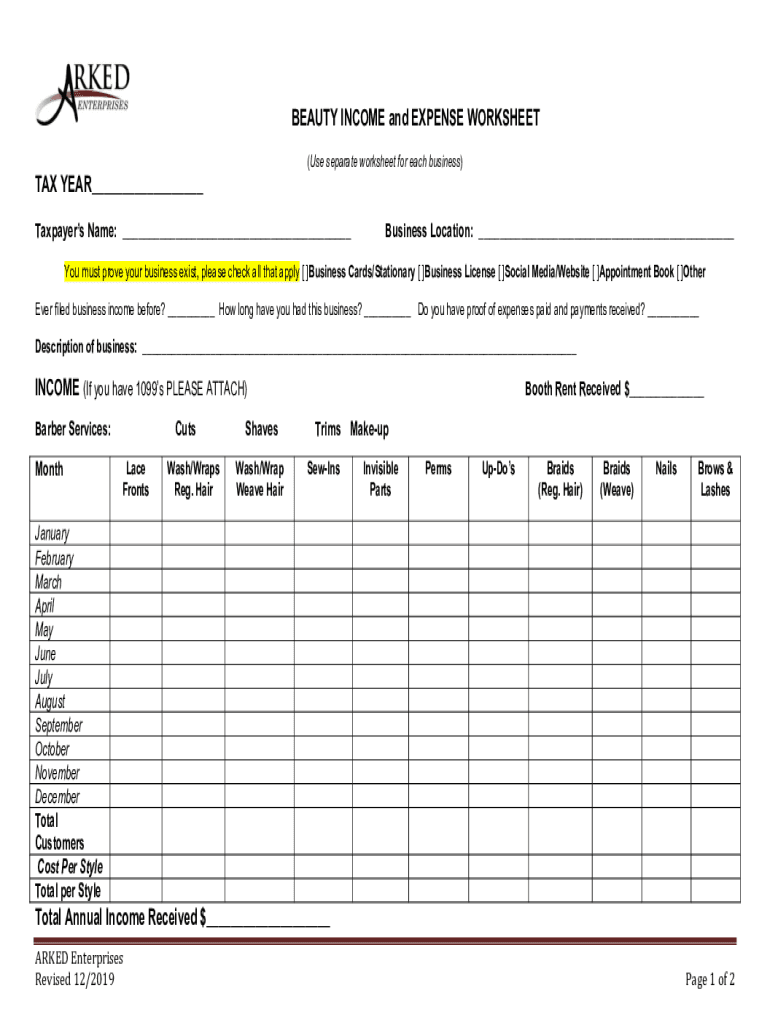

What is the hair stylist tax deduction worksheet?

The hair stylist tax deduction worksheet is a crucial document for professionals in the beauty industry. It helps stylists track and categorize their business expenses, ensuring they maximize their tax deductions. This worksheet typically includes sections for income, supplies, equipment, and other relevant expenses. By accurately completing this worksheet, hairstylists can prepare for tax season and potentially reduce their taxable income, leading to lower tax liabilities.

Steps to complete the hair stylist tax deduction worksheet

Completing the hair stylist tax deduction worksheet involves several key steps:

- Gather financial records: Collect all receipts, invoices, and bank statements related to your business expenses.

- List your income: Document all income earned from your hairstyling services during the tax year.

- Itemize your expenses: Break down your expenses into categories such as supplies, equipment, and marketing. Be thorough to ensure you capture all possible deductions.

- Calculate totals: Sum up your income and expenses to determine your net profit or loss.

- Review IRS guidelines: Familiarize yourself with IRS rules regarding tax deductions for hairstylists to ensure compliance.

Legal use of the hair stylist tax deduction worksheet

The hair stylist tax deduction worksheet is legally recognized as a tool for documenting business expenses. To ensure its legal validity, it must be filled out accurately and honestly. This document can serve as evidence in case of an audit by the IRS. Properly maintained records, along with the completed worksheet, can substantiate your claims for deductions, providing a clear picture of your business finances.

IRS guidelines for hairstylists

IRS guidelines provide essential information for hairstylists regarding what expenses are deductible. Common deductible expenses include:

- Cost of supplies, such as shampoos, conditioners, and styling products

- Equipment purchases, including scissors, hair dryers, and styling chairs

- Professional development costs, such as training and certification fees

- Marketing expenses, including business cards and online advertising

Understanding these guidelines helps hairstylists navigate their tax obligations and maximize their deductions.

Required documents for tax filing

When preparing to file taxes, hairstylists need to gather several key documents:

- Completed hair stylist tax deduction worksheet

- Receipts for all business-related expenses

- Income statements, such as 1099 forms or bank statements

- Previous year’s tax return for reference

Having these documents organized and ready can streamline the filing process and ensure accuracy.

Form submission methods

Hairstylists can submit their tax forms through various methods:

- Online: Many opt to file electronically using tax software, which often integrates with the hair stylist tax deduction worksheet.

- Mail: Physical copies of tax forms can be mailed to the appropriate IRS address.

- In-person: Some may choose to file in person at local IRS offices or through a tax professional.

Each method has its own advantages, and hairstylists should choose the one that best fits their needs.

Quick guide on how to complete business income expenses worksheet accounting tax

Prepare Business Income Expenses Worksheet Accounting Tax effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the proper template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Business Income Expenses Worksheet Accounting Tax on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Business Income Expenses Worksheet Accounting Tax without hassle

- Obtain Business Income Expenses Worksheet Accounting Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure private information with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Adjust and electronically sign Business Income Expenses Worksheet Accounting Tax and ensure exemplary communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business income expenses worksheet accounting tax

Create this form in 5 minutes!

How to create an eSignature for the business income expenses worksheet accounting tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hair stylist tax deduction worksheet PDF and how can I use it?

The hair stylist tax deduction worksheet PDF is a document designed to help hair stylists track and categorize their business-related expenses. Utilizing this worksheet can simplify the process of preparing for tax season, ensuring you don’t miss out on deductions that could lower your taxable income.

-

Is the hair stylist tax deduction worksheet PDF available for free?

Yes, many resources provide free templates for the hair stylist tax deduction worksheet PDF. However, premium versions may offer additional features and tips that enhance the user experience and ensure accurate calculations for your tax deductions.

-

How does the hair stylist tax deduction worksheet PDF help with expense tracking?

The hair stylist tax deduction worksheet PDF allows you to systematically list your expenses, which could include supplies, equipment, and salon fees. By organizing your expenses, you can streamline the filing process and ensure you capture all eligible deductions.

-

Can I integrate the hair stylist tax deduction worksheet PDF with my accounting software?

Yes, some versions of the hair stylist tax deduction worksheet PDF can be imported into popular accounting software, making it easier to manage your finances. This integration helps you maintain accurate records and simplifies the overall financial management for your salon business.

-

What features should I look for in a hair stylist tax deduction worksheet PDF?

When selecting a hair stylist tax deduction worksheet PDF, look for features such as pre-categorized expense sections, an easy-to-use layout, and clear instructions for completion. These features will assist you in reducing errors and maximizing your deductions.

-

How do I get started with the hair stylist tax deduction worksheet PDF?

To get started with the hair stylist tax deduction worksheet PDF, simply download a template that fits your needs. Fill in your business expenses as they occur throughout the year to ensure comprehensive tracking come tax season.

-

Are there any benefits to using a hair stylist tax deduction worksheet PDF over traditional methods?

Using a hair stylist tax deduction worksheet PDF offers several benefits over traditional paper methods, including improved organization and easy access to digital files. This can help save time during tax preparation and reduce the chances of overlooking important deductions.

Get more for Business Income Expenses Worksheet Accounting Tax

Find out other Business Income Expenses Worksheet Accounting Tax

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist