Form 6251 Instructions

What is the Form 6251?

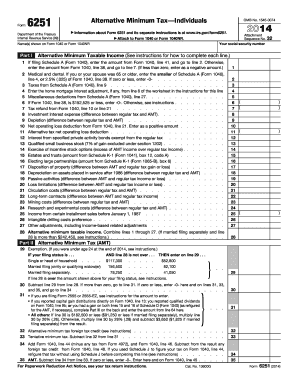

The Form 6251, also known as the Alternative Minimum Tax (AMT) Calculation, is a tax form used by individuals to determine if they owe the Alternative Minimum Tax. This form is essential for taxpayers who may have deductions or credits that could trigger AMT liability. The IRS requires this form to ensure that individuals pay a minimum amount of tax, regardless of the deductions they claim. Understanding the purpose of Form 6251 is crucial for accurate tax reporting and compliance.

Steps to Complete the Form 6251

Completing Form 6251 involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the steps to follow:

- Gather all necessary financial documents, including your income statements and any relevant deductions.

- Begin by filling out your total income on the form, including wages, interest, and dividends.

- Calculate and enter your adjustments, which may include tax-exempt interest and certain deductions.

- Complete the AMT exemption calculation to determine your taxable income under the AMT rules.

- Finally, compute your AMT liability and compare it with your regular tax liability to determine if you owe additional tax.

How to Obtain the Form 6251

Form 6251 can be obtained directly from the IRS website or through tax preparation software. Here are the methods to access the form:

- Visit the IRS website and navigate to the forms section to download a PDF version of Form 6251.

- Use tax software that includes Form 6251 as part of its package, ensuring you have the most up-to-date version.

- Request a physical copy by calling the IRS or visiting a local IRS office.

IRS Guidelines for Form 6251

The IRS provides specific guidelines for completing and filing Form 6251. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Review the instructions provided with the form carefully before starting your calculations.

- Ensure that all income and deductions reported are accurate and supported by documentation.

- File the form along with your regular tax return by the due date to avoid late penalties.

Legal Use of Form 6251

Form 6251 is legally binding when completed accurately and submitted in accordance with IRS regulations. To ensure its legal validity:

- Use a trusted electronic signature solution to sign the form if submitting electronically.

- Keep copies of all documentation related to the form for your records, as they may be required for future audits.

- Be aware of any changes in tax law that may affect the form's requirements or your eligibility.

Filing Deadlines for Form 6251

Filing deadlines for Form 6251 align with the standard tax return deadlines. It is essential to be aware of these dates to ensure timely submission:

- The typical deadline for individual tax returns, including Form 6251, is April 15 of each year.

- If you file for an extension, you may have until October 15 to submit your return and Form 6251, but any taxes owed must still be paid by April 15 to avoid penalties.

Quick guide on how to complete form 6251 instructions

Effortlessly Prepare Form 6251 Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 6251 Instructions on any device using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to edit and electronically sign Form 6251 Instructions effortlessly

- Find Form 6251 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any chosen device. Edit and electronically sign Form 6251 Instructions and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6251 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow 6251?

The pricing for airSlate SignNow 6251 is designed to accommodate businesses of all sizes. We offer flexible pricing plans that provide excellent value for eSigning and document management capabilities. Each plan includes essential features, ensuring you only pay for what you need.

-

What features does airSlate SignNow 6251 offer?

airSlate SignNow 6251 includes a variety of features such as customizable templates, bulk sending, and advanced authentication methods. These features streamline your document workflows and enhance security, making it easier for businesses to manage their eSigning needs efficiently.

-

How can airSlate SignNow 6251 benefit my business?

By implementing airSlate SignNow 6251, businesses can signNowly reduce the time spent on document signing processes. This solution enhances productivity and improves customer satisfaction by facilitating faster transactions and document handling.

-

Does airSlate SignNow 6251 integrate with other applications?

Yes, airSlate SignNow 6251 seamlessly integrates with various applications like Google Drive, Salesforce, and more. These integrations help centralize your workflows and enhance the overall efficiency of your business operations.

-

Is it easy to use airSlate SignNow 6251 for new users?

Absolutely! airSlate SignNow 6251 is designed with user-friendliness in mind. New users can quickly navigate the platform, thanks to its intuitive interface, ensuring a smooth onboarding experience for eSigning and document management.

-

What security measures are in place with airSlate SignNow 6251?

airSlate SignNow 6251 prioritizes security with industry-leading protocols, including encryption and secure cloud storage. Our platform ensures that your documents stay safe while being signed, giving users peace of mind.

-

Can I access airSlate SignNow 6251 on mobile devices?

Yes, airSlate SignNow 6251 is fully compatible with mobile devices, allowing you to send and eSign documents on-the-go. This flexibility ensures that users can manage their signing tasks anytime, anywhere.

Get more for Form 6251 Instructions

- Are u s t i n s t board from form

- Finding the components of a vector independent practice worksheet answers form

- Welding bid sheet form

- Dhr fia cares 9708 form

- Coventry healthcare of ga form

- Security agreement form e acknowledgement

- Choral performance evaluation form ensemble name togetherinsong wgby

- U s individual income tax return note form

Find out other Form 6251 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors