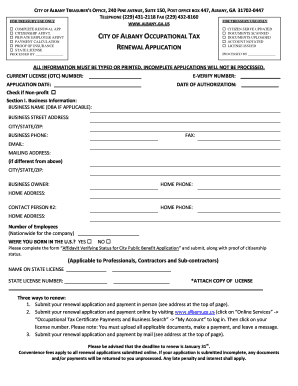

City of Albany Ga Occupational Tax Renewal Form

What is the City Of Albany Ga Occupational Tax Renewal

The City of Albany, Georgia, requires businesses operating within its jurisdiction to obtain an occupational tax license, which must be renewed periodically. The Albany GA business license renewal process ensures that businesses comply with local regulations and continue to operate legally. This renewal is essential for maintaining good standing with the city and avoiding penalties. The occupational tax renewal application typically involves confirming business details, updating any necessary information, and paying the required fees.

Steps to complete the City Of Albany Ga Occupational Tax Renewal

Completing the Albany GA business license renewal involves several key steps. First, businesses should gather all necessary documentation, including proof of business ownership and any previous tax records. Next, they can access the renewal form, which is available through the city’s official website. After filling out the form with accurate information, businesses must submit it along with the renewal fee. It is advisable to keep a copy of the submitted form for record-keeping purposes. Finally, businesses should confirm receipt of their renewal application to ensure it is processed in a timely manner.

Required Documents

When renewing an occupational tax license in Albany, specific documents are typically required to ensure compliance. These may include:

- Proof of business ownership, such as articles of incorporation or a business license.

- Tax identification number (TIN) or employer identification number (EIN).

- Previous year’s occupational tax return, if applicable.

- Proof of any changes in business structure or ownership since the last renewal.

Having these documents ready can facilitate a smoother renewal process.

Form Submission Methods

Businesses in Albany have multiple options for submitting their occupational tax renewal applications. The most convenient method is online submission, which allows for quick processing and confirmation. Alternatively, businesses can choose to submit their applications by mail, ensuring they allow sufficient time for delivery. In-person submissions are also accepted at designated city offices, where staff can assist with any questions. Regardless of the method chosen, it is important to keep a copy of the submission for future reference.

Penalties for Non-Compliance

Failure to renew the Albany GA business license on time can lead to significant penalties. Businesses may face fines, late fees, or even suspension of their occupational tax license, which can disrupt operations. It is crucial for business owners to stay informed about renewal deadlines and ensure that all requirements are met to avoid these consequences. Regular communication with the city’s business licensing office can provide guidance on compliance and renewal timelines.

Legal use of the City Of Albany Ga Occupational Tax Renewal

The legal validity of the Albany GA business license renewal hinges on compliance with local laws and regulations. The renewal application must be completed accurately and submitted within the designated timeframe. Utilizing digital tools for submission can enhance the process, provided that the e-signatures and documents meet the legal standards set forth by the ESIGN Act and UETA. Ensuring that all information is truthful and complete is essential for maintaining the legal standing of the business within the city.

Quick guide on how to complete city of albany ga occupational tax renewal

Effortlessly Prepare city of albany ga occupational tax renewal on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdup. Manage albany ga business license renewal on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign city of albany ga occupational tax renewal without any hassle

- Find city of albany occupational tax renewal application and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign albany ga business license renewal and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to city of albany occupational tax renewal application

Create this form in 5 minutes!

How to create an eSignature for the albany ga business license renewal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask city of albany occupational tax renewal application

-

What is the process for Albany GA business license renewal?

The process for Albany GA business license renewal typically involves submitting a renewal application to the local government office along with required documentation and fees. It's essential to ensure all business information is up-to-date before submitting your application for Albany GA business license renewal.

-

How much does it cost to renew a business license in Albany GA?

The cost of renewing a business license in Albany GA varies based on your business type and size. Generally, renewal fees are relatively modest, but it's advisable to check with the Albany city clerk's office or their website for the precise fee structure related to Albany GA business license renewal.

-

What documents are needed for Albany GA business license renewal?

To successfully renew your Albany GA business license, you typically need a completed renewal application, proof of insurance, and any applicable tax clearance documents. Ensure that all documents are accurate to avoid any delays in the Albany GA business license renewal process.

-

Can I renew my Albany GA business license online?

Yes, many businesses in Albany GA can renew their licenses online through the city’s official website. This convenient option streamlines the Albany GA business license renewal process, making it faster and easier for business owners to manage their licenses.

-

How far in advance should I start my Albany GA business license renewal?

It is recommended to begin your Albany GA business license renewal process at least 30 days before the expiration date. Starting early helps to address any potential issues or required documentation that may arise during the Albany GA business license renewal process.

-

What happens if I miss the deadline for Albany GA business license renewal?

If you miss the deadline for Albany GA business license renewal, you may incur late fees or penalties, and your business's legal status may be affected. It’s crucial to stay aware of renewal timelines to avoid complications with your Albany GA business license.

-

Are there any benefits to using airSlate SignNow for my Albany GA business license renewal?

Using airSlate SignNow can simplify the Albany GA business license renewal process by allowing you to electronically sign and send documents easily. This cost-effective solution enhances efficiency and can help ensure that your renewal paperwork is promptly completed and submitted.

Get more for albany ga business license renewal

Find out other city of albany ga occupational tax renewal

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online