Fkyc Full Form

What is the Fkyc Full Form

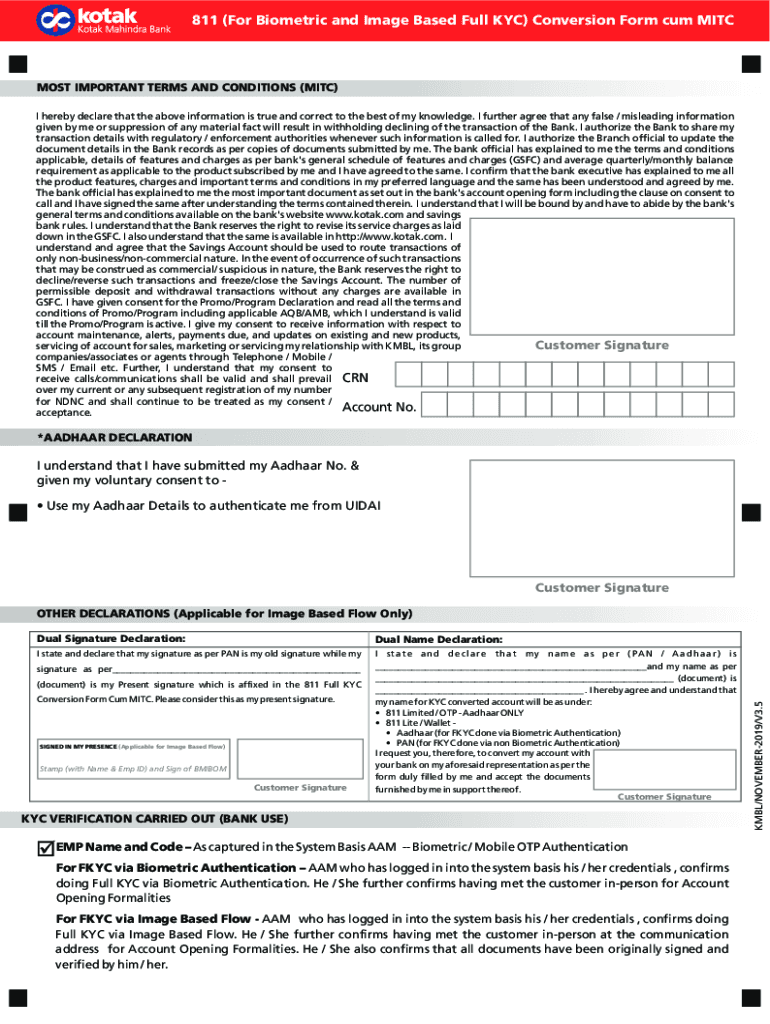

The term "Fkyc" stands for "Full Know Your Customer." It is a process used by financial institutions and other regulated entities to verify the identity of their clients. The Fkyc process helps prevent fraud, money laundering, and other illicit activities by ensuring that businesses know who they are dealing with. This verification typically involves collecting and validating personal information, such as name, address, date of birth, and government-issued identification.

Steps to Complete the Fkyc Full Form

Completing the Fkyc full form involves several key steps to ensure compliance and accuracy:

- Gather necessary documents: Collect identification documents, such as a driver's license or passport, and proof of address, like a utility bill.

- Fill out the form: Provide accurate personal information, ensuring that all details match the documents you are submitting.

- Submit the form: Depending on the institution, you may need to submit the form online, by mail, or in person.

- Verification process: The institution will review your submission and may contact you for additional information or clarification.

Legal Use of the Fkyc Full Form

The Fkyc full form is legally required for various financial transactions, particularly in the banking and investment sectors. Compliance with Fkyc regulations helps institutions mitigate risks associated with identity theft and financial fraud. It is essential for businesses to adhere to these regulations to maintain trust and uphold legal standards. In the United States, the implementation of Fkyc processes aligns with guidelines set forth by regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN).

Key Elements of the Fkyc Full Form

When filling out the Fkyc full form, several key elements must be included to ensure its validity:

- Personal identification: Full name, date of birth, and Social Security number.

- Contact information: Current address, phone number, and email address.

- Identification documents: Type of ID provided (e.g., passport, driver's license) and its number.

- Signature: A signature confirming the accuracy of the information provided.

Examples of Using the Fkyc Full Form

The Fkyc full form is commonly used in various scenarios, including:

- Opening a bank account: Banks require Fkyc verification to comply with anti-money laundering laws.

- Investing in securities: Investment firms use Fkyc to verify the identity of their clients before allowing them to trade.

- Applying for loans: Lenders require Fkyc to assess the creditworthiness of applicants and prevent fraud.

Required Documents

To successfully complete the Fkyc full form, the following documents are typically required:

- Government-issued ID: A valid passport, driver's license, or state ID.

- Proof of address: Recent utility bills, bank statements, or lease agreements.

- Social Security card: For U.S. citizens, this helps verify identity and tax status.

Quick guide on how to complete fkyc full form

Easily Prepare Fkyc Full Form on Any Device

Web-based document management has gained prominence among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can access the correct format and securely store it online. airSlate SignNow equips you with comprehensive tools to create, modify, and eSign your documents quickly without any hold-ups. Manage Fkyc Full Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

Edit and eSign Fkyc Full Form Effortlessly

- Locate Fkyc Full Form and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method to send your document, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Fkyc Full Form and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fkyc full form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KYC full form?

The KYC full form is 'Know Your Customer.' It refers to the process of a business verifying the identity of its clients to prevent fraud and comply with legal regulations. Understanding the KYC full form is essential for financial institutions and businesses that require customer authentication.

-

How does airSlate SignNow help with KYC documentation?

airSlate SignNow provides an efficient solution for managing KYC documentation. Users can easily send and eSign documents required for KYC processes, ensuring a smooth and compliant onboarding experience. This reduces the time and effort usually associated with collecting and verifying KYC information.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. The plans cover essential features, including document sending and eSigning, making it budget-friendly for businesses of all sizes. Each plan provides value in supporting processes such as KYC compliance.

-

What features does airSlate SignNow include for document management?

Key features of airSlate SignNow include secure eSigning, document templates, and customizable workflows. It facilitates efficient KYC processes by allowing businesses to manage documents in a streamlined manner. This ensures that KYC-related tasks are handled quickly and accurately.

-

Can airSlate SignNow integrate with other software for KYC processes?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance the KYC process. Integration with CRM and document management tools enables businesses to automate workflows and ensure compliance more effectively. Utilizing these integrations helps to implement the KYC full form more easily.

-

What benefits does airSlate SignNow provide for KYC compliance?

One of the main benefits of using airSlate SignNow for KYC compliance is the enhanced security it offers through encrypted signatures and document storage. This not only helps in safeguarding sensitive information but also accelerates the verification process. Overall, it aids businesses in successfully adhering to the KYC full form requirements.

-

Is airSlate SignNow suitable for small businesses regarding KYC requirements?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective pricing and user-friendly interface make it an excellent choice for small businesses needing to fulfill KYC requirements without heavy investment. The simplicity of the platform enables better document management and compliance.

Get more for Fkyc Full Form

Find out other Fkyc Full Form

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement