Pagibig Loan Term Adjustment Form

What is the Pagibig Loan Term Adjustment

The Pagibig Loan Term Adjustment refers to a modification process for existing housing loans under the Pagibig Fund, which is a government-backed savings program in the Philippines. This adjustment allows borrowers to extend or shorten the repayment period of their loans, accommodating changes in financial circumstances. Understanding this adjustment is crucial for borrowers seeking to manage their loan obligations effectively.

How to use the Pagibig Loan Term Adjustment

To utilize the Pagibig Loan Term Adjustment, borrowers must first assess their current financial situation and determine the desired changes to their loan terms. This process typically involves submitting a formal request to the Pagibig Fund, detailing the reasons for the adjustment and the preferred new terms. It is essential to provide accurate financial information to facilitate the approval process.

Steps to complete the Pagibig Loan Term Adjustment

Completing the Pagibig Loan Term Adjustment involves several key steps:

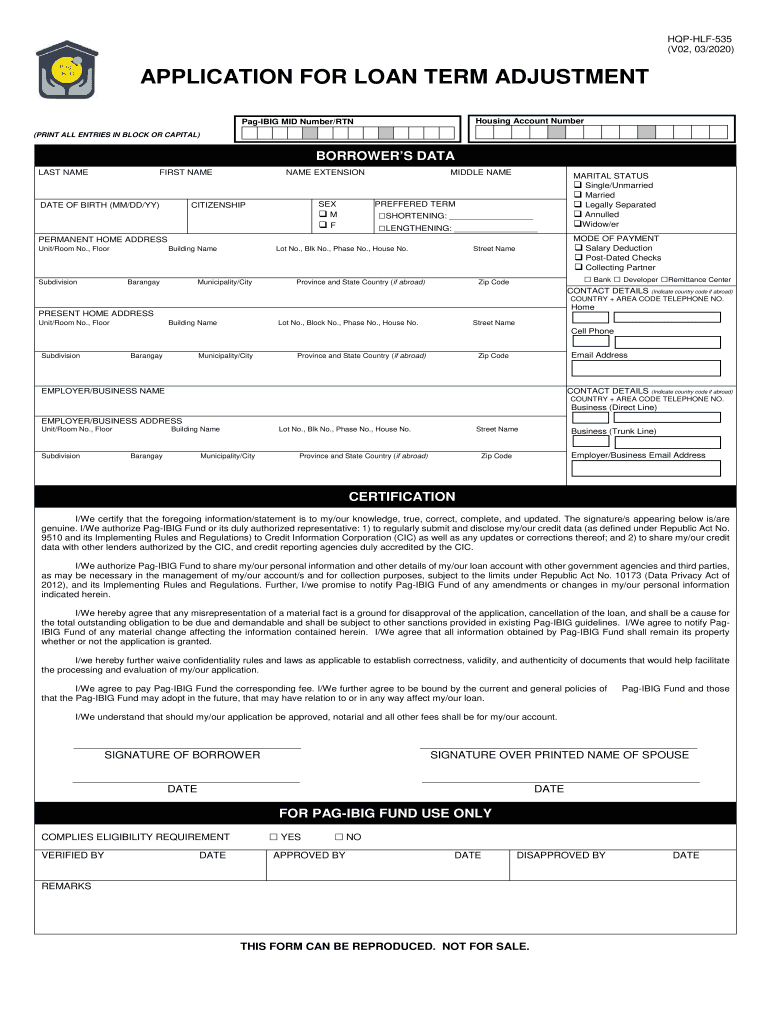

- Gather necessary documents, including identification and loan details.

- Fill out the required application form for the loan term adjustment.

- Submit the application along with supporting documents to the Pagibig office or through their online portal.

- Await confirmation and approval from Pagibig, which may take several weeks.

- Review the new loan terms upon approval and ensure understanding of the revised repayment schedule.

Key elements of the Pagibig Loan Term Adjustment

Several key elements are vital when considering a Pagibig Loan Term Adjustment:

- Eligibility Criteria: Borrowers must meet specific requirements, including being in good standing with their current loan.

- Documentation: Proper documentation is necessary to support the request, including proof of income and identification.

- Impact on Payments: Adjusting the loan term can change monthly payment amounts and the total interest paid over the loan's life.

Legal use of the Pagibig Loan Term Adjustment

The Pagibig Loan Term Adjustment is legally recognized as a formal process under Philippine law. Borrowers must ensure compliance with all regulations set forth by the Pagibig Fund. This includes adhering to the terms outlined in the loan agreement and following the proper procedures for submitting requests. Legal validity is maintained as long as the adjustment is processed through the appropriate channels.

Eligibility Criteria

To qualify for a Pagibig Loan Term Adjustment, borrowers must meet specific eligibility criteria. This typically includes being a member of the Pagibig Fund, having an active housing loan, and demonstrating the ability to repay under the new terms. Additionally, borrowers should not have any outstanding payments or delinquencies on their existing loans to ensure a smooth adjustment process.

Quick guide on how to complete pagibig loan term adjustment

Effortlessly Prepare Pagibig Loan Term Adjustment on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it digitally. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Manage Pagibig Loan Term Adjustment seamlessly on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign Pagibig Loan Term Adjustment with Ease

- Locate Pagibig Loan Term Adjustment and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Pagibig Loan Term Adjustment to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pagibig loan term adjustment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pag ibig housing loan term adjustment?

A pag ibig housing loan term adjustment refers to the process of modifying the duration of your housing loan repayment schedule. This can help borrowers manage their monthly payments effectively by extending or shortening the repayment period. Understanding the implications of a term adjustment is crucial as it can affect your overall interest payments.

-

How can I apply for a pag ibig housing loan term adjustment?

To apply for a pag ibig housing loan term adjustment, borrowers need to submit a request to the Pag-IBIG Fund, along with necessary documentation. It's essential to provide details about your current loan status and the reason for the adjustment. Ensure that your application follows the guidelines set out by Pag-IBIG for a smooth process.

-

What are the benefits of a pag ibig housing loan term adjustment?

The primary benefits of a pag ibig housing loan term adjustment include reduced monthly payments and improved cash flow management. By adjusting the loan term, borrowers can better align their finances according to their current circumstances. Additionally, it can help avoid defaults and maintain a good credit standing.

-

Will my interest rates change with a pag ibig housing loan term adjustment?

Yes, adjusting the term of your pag ibig housing loan may affect your interest rates. Typically, extending the loan term can lead to lower monthly payments but may increase the total interest paid over the life of the loan. It’s advisable to discuss these changes with your loan officer to understand the implications on your interest rates.

-

Can I make multiple pag ibig housing loan term adjustments?

Yes, borrowers can make multiple pag ibig housing loan term adjustments, but each request will be subject to Pag-IBIG’s approval. It’s important to note that frequent adjustments might require additional documentation and could come with processing fees. Planning your adjustments carefully can help minimize costs.

-

Is there a fee for a pag ibig housing loan term adjustment?

There may be a processing fee associated with a pag ibig housing loan term adjustment, which can vary based on your agreement with Pag-IBIG. It’s crucial to check with the local Pag-IBIG branch for specific fee details and any other potential costs involved in the term adjustment process.

-

How does airSlate SignNow facilitate the pag ibig housing loan term adjustment process?

airSlate SignNow provides an efficient platform to handle the documentation needed for a pag ibig housing loan term adjustment. By enabling users to easily eSign and send required forms, the solution saves time and reduces paperwork. This digital approach simplifies the overall application process for borrowers.

Get more for Pagibig Loan Term Adjustment

Find out other Pagibig Loan Term Adjustment

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF