IBA Approved Loan Application Form for MSME

What is the IBA Approved Loan Application Form for MSME

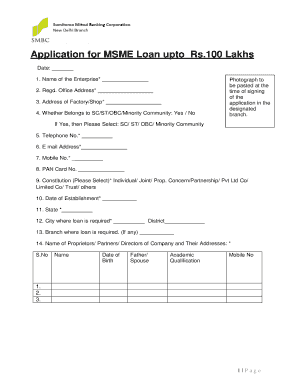

The IBA Approved Loan Application Form for MSME is a standardized document designed for micro, small, and medium enterprises seeking financial assistance from banks and financial institutions. This form serves as a formal request for funding, enabling businesses to outline their financial needs, business plans, and operational details. It is crucial for ensuring that lenders have the necessary information to assess the creditworthiness and viability of the applicant's business.

Key Elements of the IBA Approved Loan Application Form for MSME

The IBA Approved Loan Application Form for MSME includes several essential components that help streamline the loan application process. Key elements typically consist of:

- Business Information: Name, address, and contact details of the business.

- Financial Details: Requested loan amount, purpose of the loan, and existing financial obligations.

- Ownership Structure: Information about the business owners and their respective shares.

- Business Plan: A brief overview of the business model, market analysis, and growth projections.

- Supporting Documents: Required documentation such as tax returns, financial statements, and identification proofs.

Steps to Complete the IBA Approved Loan Application Form for MSME

Completing the IBA Approved Loan Application Form for MSME involves several straightforward steps. To ensure accuracy and completeness, follow these steps:

- Gather Required Documents: Collect all necessary documents, including financial statements and identification.

- Fill Out the Form: Provide accurate information in each section of the application form.

- Review the Application: Check for any errors or missing information before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in-person.

Legal Use of the IBA Approved Loan Application Form for MSME

The IBA Approved Loan Application Form for MSME is legally recognized, provided it is completed accurately and submitted according to the lender's guidelines. The legal validity of the form hinges on compliance with relevant laws governing financial transactions and lending practices. It is essential to ensure that all information disclosed is truthful and that the form is signed by authorized representatives of the business.

How to Obtain the IBA Approved Loan Application Form for MSME

Obtaining the IBA Approved Loan Application Form for MSME can be done through various channels. Businesses can typically access the form by:

- Bank Websites: Many banks provide downloadable versions of the form on their official websites.

- Local Branches: Visiting a local bank branch can also yield a physical copy of the form.

- Financial Institutions: Other lending institutions may offer the form as part of their loan application materials.

Eligibility Criteria for the IBA Approved Loan Application Form for MSME

Eligibility for using the IBA Approved Loan Application Form for MSME generally includes specific criteria that applicants must meet. Common requirements may include:

- Business Size: The enterprise must fall within the micro, small, or medium category as defined by the Small Business Administration.

- Operational History: A minimum operational history may be required to demonstrate business viability.

- Financial Health: Applicants must show a stable financial position and the ability to repay the loan.

Quick guide on how to complete iba approved loan application form for msme

Prepare IBA Approved Loan Application Form For MSME effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage IBA Approved Loan Application Form For MSME on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign IBA Approved Loan Application Form For MSME with ease

- Find IBA Approved Loan Application Form For MSME and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or blackout sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign IBA Approved Loan Application Form For MSME and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iba approved loan application form for msme

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a simple loan application form PDF?

A simple loan application form PDF is a digital document that allows borrowers to provide their information in a structured format. It streamlines the process of applying for loans, making it easier for lenders to review applications. With airSlate SignNow, you can quickly create and send this form for eSigning.

-

How can I create a simple loan application form PDF using airSlate SignNow?

Creating a simple loan application form PDF with airSlate SignNow is straightforward. You can customize templates to include your specific fields and company branding. Once you finalize the form, you can easily share it for eSigning via email or a secure link.

-

Is airSlate SignNow cost-effective for creating loan application forms?

Yes, airSlate SignNow offers a cost-effective solution for creating a simple loan application form PDF. With competitive pricing plans, you can access various features without breaking your budget. This makes it a great option for businesses of all sizes looking to streamline their loan application processes.

-

What features does airSlate SignNow offer for loan applications?

airSlate SignNow provides features such as customizable templates, eSignature blocks, and real-time tracking of document status. These features enhance the efficiency of processing a simple loan application form PDF, ensuring that you can manage applications seamlessly. The platform also supports secure data handling and compliance with legal standards.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various platforms, such as CRM systems and accounting software. This allows you to easily manage the workflow of your simple loan application form PDF alongside your existing processes, enhancing overall productivity and creating a more cohesive environment.

-

What are the benefits of using a digital loan application form?

Using a digital simple loan application form PDF improves the application experience for both lenders and borrowers. It reduces processing time, minimizes paperwork, and enhances accuracy. Additionally, the convenience of eSigning means that documents can be completed from anywhere, streamlining the entire loan approval process.

-

How secure is my data when using airSlate SignNow?

Your data security is a top priority at airSlate SignNow. The platform uses advanced encryption and compliance measures to protect your information while completing a simple loan application form PDF. You can confidently handle sensitive data knowing that it meets industry standards.

Get more for IBA Approved Loan Application Form For MSME

- Health care worker background check form

- Sponsorship t shirt template form

- Child support disclosure form picsweb

- Ct op 424 100064418 form

- Where to send form 8379 for ct

- Tpg 198 request for payoff real estate or uniform ct gov ct

- Westone earmold order form 469006276

- Dcplcabandaff rev 317state of connecticutdepartme form

Find out other IBA Approved Loan Application Form For MSME

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement