P Tax Code Form

What is the P Tax Code Form

The P Tax Code Form is a specific tax document used to report certain income types and deductions to the Internal Revenue Service (IRS). This form is essential for taxpayers who need to provide detailed information regarding their financial activities during the tax year. It plays a crucial role in ensuring compliance with federal tax regulations and helps determine the correct tax liability for individuals and businesses alike.

How to use the P Tax Code Form

Using the P Tax Code Form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, receipts, and any relevant tax forms. Next, carefully fill out the form, ensuring that all information is complete and accurate. It is important to follow the instructions provided by the IRS for the specific tax year. After completing the form, review it for any errors before submission to avoid delays or penalties.

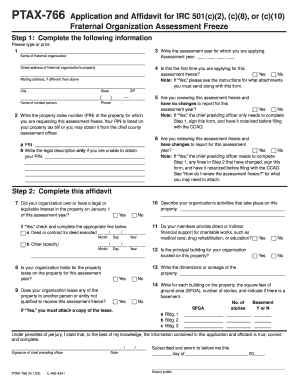

Steps to complete the P Tax Code Form

Completing the P Tax Code Form requires a systematic approach. Begin by obtaining the latest version of the form from the IRS website or a trusted source. Then, follow these steps:

- Identify the income sources that need to be reported.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring to include all relevant deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the P Tax Code Form

The P Tax Code Form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting income and deductions, as well as adhering to submission deadlines. Failure to comply with these regulations can result in penalties or audits. It is advisable to keep copies of submitted forms and any supporting documentation for your records.

Filing Deadlines / Important Dates

Filing deadlines for the P Tax Code Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific state deadlines that may apply. Keeping track of these dates is essential for timely compliance.

Required Documents

To complete the P Tax Code Form, several documents are required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents readily available can streamline the completion process and ensure accuracy.

Quick guide on how to complete p tax code form

Effortlessly Prepare P Tax Code Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage P Tax Code Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign P Tax Code Form hassle-free

- Find P Tax Code Form and select Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign P Tax Code Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p tax code form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the P Tax Code Form and why is it important?

The P Tax Code Form is an essential document used for reporting income and tax information. Understanding this form is crucial for businesses to ensure compliance with tax regulations. Using airSlate SignNow, you can efficiently manage your P Tax Code Form and streamline your tax filing process.

-

How can airSlate SignNow simplify the process of signing the P Tax Code Form?

airSlate SignNow offers a user-friendly platform that allows you to electronically sign the P Tax Code Form with ease. Our solution eliminates the hassle of printing and scanning documents, thus accelerating the signing process. This way, you can focus on your business instead of paperwork.

-

What features does airSlate SignNow offer for handling P Tax Code Forms?

airSlate SignNow provides several features tailored for P Tax Code Forms, including customizable templates, secure cloud storage, and automated reminders. These features ensure that you never miss a deadline and that all documents are organized. Our platform is designed to enhance accessibility and efficiency.

-

Is airSlate SignNow cost-effective for managing P Tax Code Forms?

Yes, airSlate SignNow is a cost-effective solution for managing your P Tax Code Form needs. We offer flexible pricing plans that cater to businesses of all sizes. This accessibility allows you to benefit from a high-quality eSignature solution without breaking the bank.

-

What are the benefits of using airSlate SignNow for P Tax Code Forms?

Using airSlate SignNow for your P Tax Code Form offers numerous benefits, including fast turnaround times, enhanced security, and compliance with legal standards. Electronic signatures are legally binding, so you can trust that your documents are valid and secure. This efficiency helps save time and reduce administrative burdens on your team.

-

Can airSlate SignNow integrate with other software for managing P Tax Code Forms?

Absolutely! airSlate SignNow offers seamless integrations with numerous software platforms, including CRM and accounting tools. This interoperability allows you to synchronize your P Tax Code Form management with other business processes, enhancing productivity and ensuring smooth operations.

-

How secure is my information when using airSlate SignNow for P Tax Code Forms?

Your data security is our top priority at airSlate SignNow. We implement robust security measures, including data encryption and secure access controls, to protect your P Tax Code Form and sensitive information. You can confidently manage your documents without worrying about data bsignNowes.

Get more for P Tax Code Form

- Name approval form

- Legalisation study project questionnaire page 1 form

- Annexure ii affidavit by parentguardian srm university srmuniversity ac form

- Abstract of judgement form texas

- Expires 02282027 form

- I 765 application for employment authorization counts of form

- Instructions to apply for nys special vehicle identification form

- Catering operation application packet form

Find out other P Tax Code Form

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document