Connecticut Form Reg 7

What is the Connecticut Form Reg 7

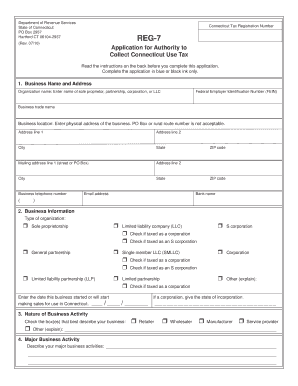

The Connecticut Form Reg 7 is a tax-related document used primarily for reporting and remitting sales and use taxes in the state of Connecticut. This form is essential for businesses that engage in selling tangible personal property or taxable services. It serves to ensure compliance with state tax laws and provides a structured way for businesses to report their tax obligations accurately. Understanding the purpose and requirements of this form is crucial for any business operating within Connecticut.

How to use the Connecticut Form Reg 7

Using the Connecticut Form Reg 7 involves several steps to ensure that the form is filled out correctly and submitted on time. First, gather all necessary financial records, including sales receipts and previous tax filings. Next, complete the form by entering the required information accurately, which includes details about sales, tax collected, and any exemptions. After completing the form, review it for accuracy before submitting it to the Connecticut Department of Revenue Services, either electronically or by mail.

Steps to complete the Connecticut Form Reg 7

Completing the Connecticut Form Reg 7 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant sales data for the reporting period.

- Fill in the business information section, including the name, address, and tax identification number.

- Report total sales and the amount of tax collected during the period.

- Include any applicable exemptions or deductions.

- Calculate the total amount due and ensure all figures are accurate.

- Sign and date the form before submission.

Legal use of the Connecticut Form Reg 7

The legal use of the Connecticut Form Reg 7 is governed by state tax laws. When completed accurately and submitted on time, the form serves as a legal document that fulfills a business's tax obligations. It is important to keep copies of the submitted form and any supporting documents for record-keeping and potential audits. Failure to comply with the legal requirements associated with this form can result in penalties or fines.

Required Documents

To complete the Connecticut Form Reg 7, certain documents are required. These may include:

- Sales records detailing all transactions made during the reporting period.

- Previous tax filings for reference and accuracy.

- Documentation of any exemptions claimed.

- Proof of payment for any taxes previously submitted.

Form Submission Methods

The Connecticut Form Reg 7 can be submitted through various methods to accommodate different preferences. Businesses can choose to file the form electronically through the Connecticut Department of Revenue Services website, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate department. In-person submissions are also accepted at designated state offices, providing flexibility for businesses to meet their filing requirements.

Quick guide on how to complete connecticut form reg 7

Easily create Connecticut Form Reg 7 on any device

The management of online documents has gained traction among both businesses and individuals. It serves as an ideal eco-friendly replacement for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and electronically sign your documents without any delays. Manage Connecticut Form Reg 7 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest way to edit and electronically sign Connecticut Form Reg 7 effortlessly

- Obtain Connecticut Form Reg 7 and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for such purposes.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Put an end to lost or misplaced documents, the hassle of searching through forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Connecticut Form Reg 7 and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut form reg 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Connecticut Form Reg 7?

Connecticut Form Reg 7 is a necessary document used for tax purposes within the state of Connecticut. It is designed for businesses to report and manage their tax liabilities efficiently. Understanding how to complete this form correctly is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with Connecticut Form Reg 7?

airSlate SignNow provides a streamlined platform that allows users to easily eSign and send Connecticut Form Reg 7 documents. With features that simplify the signing process, businesses can enhance their workflow and ensure timely submissions of necessary documents. Our solution is tailored to meet the needs of businesses dealing with various state forms.

-

What are the pricing options for airSlate SignNow when managing Connecticut Form Reg 7?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, making it cost-effective for managing Connecticut Form Reg 7. Subscription plans include essential features for document management, eSigning, and integrations that provide value for your business. You can choose the best plan that fits your needs and budget.

-

Is airSlate SignNow secure for processing Connecticut Form Reg 7?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including Connecticut Form Reg 7, are protected. Our platform employs robust encryption and authentication protocols to safeguard your sensitive information. You can trust us to keep your documents safe while they are processed and stored.

-

Can I integrate airSlate SignNow with other software for Connecticut Form Reg 7?

Absolutely! airSlate SignNow allows seamless integrations with various software systems, which is ideal for managing Connecticut Form Reg 7. You can connect it to your existing workflows, such as CRM or accounting software, enhancing productivity and ensuring data consistency across platforms.

-

How does airSlate SignNow improve the signing process for Connecticut Form Reg 7?

airSlate SignNow enhances the signing process for Connecticut Form Reg 7 by offering an intuitive interface and efficient routing of documents. Your team can create, send, and receive signed documents in a matter of minutes, signNowly reducing turnaround time. This efficiency can lead to improved business operations and faster compliance.

-

What features are included in airSlate SignNow for Connecticut Form Reg 7 management?

AirSlate SignNow includes key features such as templates, bulk sending, and status tracking that simplify the management of Connecticut Form Reg 7. Customize templates for repeat use, send out multiple documents at once, and track the signing process in real-time. These features provide an effective solution for organizations needing to manage their documentation efficiently.

Get more for Connecticut Form Reg 7

Find out other Connecticut Form Reg 7

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple