Prudential 401k Loan 2010-2026

What is the Prudential 401k Loan

The Prudential 401k loan allows participants to borrow against their retirement savings in their Prudential 401k plan. This option provides individuals with access to funds for various purposes, such as home purchases, education expenses, or debt consolidation. The loan amount typically cannot exceed the lesser of fifty percent of the vested account balance or $50,000. It is important to understand that taking a loan from your 401k reduces the amount available for retirement, and repayments must be made according to the plan's terms.

How to use the Prudential 401k Loan

To utilize the Prudential 401k loan, participants must first determine their eligibility based on their plan's specific rules. Once eligibility is confirmed, individuals can initiate the loan application process. This typically involves completing a loan request form, specifying the desired loan amount, and providing any necessary documentation. After submitting the application, participants will receive instructions on repayment terms, including interest rates and payment schedules.

Steps to complete the Prudential 401k Loan

Completing the Prudential 401k loan process involves several key steps:

- Review your Prudential 401k plan documents to understand loan eligibility and limits.

- Gather necessary information, such as your account balance and personal identification.

- Fill out the Prudential 401k loan request form accurately, specifying the loan amount and purpose.

- Submit the completed form through the designated method, which may include online submission or mailing it to Prudential.

- Await confirmation of your loan approval and review the repayment terms provided by Prudential.

Legal use of the Prudential 401k Loan

The Prudential 401k loan must be used in compliance with IRS regulations. Loans must be repaid within a specified period, typically five years, unless used for purchasing a primary residence, which may extend the repayment term. Failure to repay the loan according to the agreed terms can result in the loan being treated as a taxable distribution, leading to potential penalties. It is essential to maintain accurate records of the loan and repayments to ensure compliance with legal requirements.

Eligibility Criteria

To qualify for a Prudential 401k loan, participants generally need to meet specific criteria set by their employer's plan. Common eligibility requirements include:

- Being an active participant in the Prudential 401k plan.

- Having a vested balance that meets the minimum threshold for borrowing.

- Not having any outstanding loans from the 401k plan at the time of application.

It is advisable to review the plan's summary plan description or consult with a plan administrator for detailed eligibility information.

Required Documents

When applying for a Prudential 401k loan, participants may need to provide specific documentation to support their application. Required documents can include:

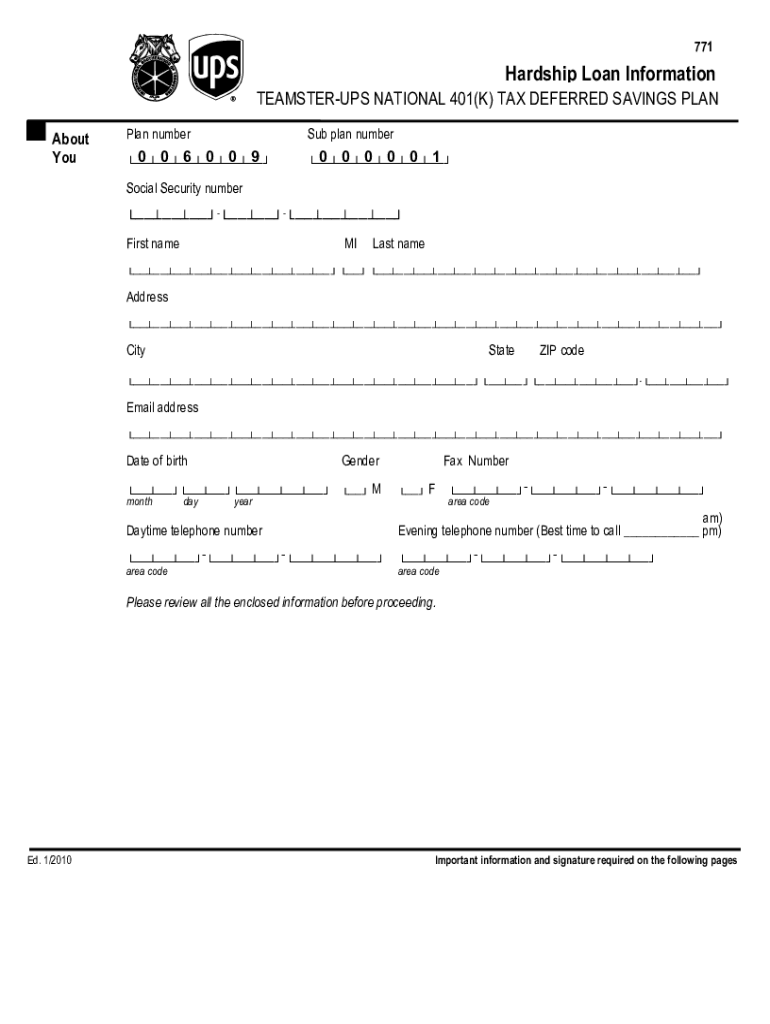

- A completed Prudential 401k loan request form.

- Proof of identity, such as a driver's license or Social Security number.

- Documentation explaining the purpose of the loan, if necessary.

Having these documents ready can help streamline the application process and ensure timely approval.

Quick guide on how to complete prudential 401k loan form

The optimum method to obtain and endorse Prudential 401k Loan

Across the breadth of your organization, ineffective workflows surrounding document authorization can utilize a signNow amount of working hours. Endorsing documents such as Prudential 401k Loan is an inherent aspect of operations in every sector, which is why the efficacy of each agreement’s lifecycle plays a crucial role in the overall performance of the company. With airSlate SignNow, endorsing your Prudential 401k Loan is as straightforward and swift as possible. This platform provides you with the latest version of nearly any form. Even better, you can endorse it right away without needing to install additional software on your device or printing out physical copies.

Steps to obtain and endorse your Prudential 401k Loan

- Explore our collection by category or utilize the search bar to find the form you require.

- Check the form preview by clicking Learn more to ensure it’s the correct one.

- Hit Get form to start editing immediately.

- Finish your form and input any necessary details using the toolbar.

- Once completed, click the Sign tool to endorse your Prudential 401k Loan.

- Choose the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can discover, complete, modify, and even send your Prudential 401k Loan all within a single tab, hassle-free. Optimize your workflows by using one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I take out a loan on my 401k?

So, leaving aside the warnings other answers have stated, the mechanics of taking out a 401K loan are pretty straightforward, assuming your plan allows it.The website of the manager of your plan should have a page “Loans and Withdrawals”. On it is a page which will tell you what the current interest rate is, and what fees, if any, are incurred. (Note: Yes, there is interest, however, you are paying the interest back into your 401K, basically, you’re making a loan to yourself…if you can afford the payments without having to cut your Contribution, this is the scenario where it doesn’t really hurt to take a 401K loan)The nice thing about a 401K loan is that, assuming you are eligible (some plans do not allow loans, other plans put restrictions on them that may make your individual situation ineligible for a loan), approval is automatic, and the application is easy, just fill out the form. Since you’re borrowing the money from yourself, approval is guaranteed. And since it’s your money, the company and the manager don’t have any right to tell you you can’t take out the loan (again, aside from IRS regulations regarding 401K loans, and any conditions they put in regarding maximum numbers of loans outstanding at a time, or amounts that can be borrowed).Once you’ve done that, you can expect a check or funds transfer (which depends upon if your Manager is aware of your bank details, most modern sites allow you to enter the info, I suggest doing that first if possible).

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

Should I cash out 401k to repay student loans?

Hi! I’m not sure of your exact situation. Factors like interest rates, amount of debt, age, and emotions toward debt will influence this decision. But, I wanted to chime in since I’ve been recently thinking about this, too.First off, Martin is correct that you’ll be penalized withdrawing from your 401k. I was considering cashing out my Roth IRA, which you can do anytime without tax, and halting payment on my 401k monthly to put it all toward student debt.The amount of interest I’m paying in student loans versus the amount of interest I’m accruing with my retirement investments is comparable. If my interest rate on my loans was through the roof, I’d pay that all off before retirement. Because they’re the same, it really came down to what made me more comfortable: paying off loans versus saving for retirement with debt. I think that will be your answer, too.I decided to sort of compromise. Because my employer doesn’t match my 401k contribution, I halted that and upped my student loan monthly payments with it. I kept everything in my Roth IRA and now simply have a separate savings account for student loan payoff that I put all extra money toward and hope to payoff my debt this year.I hope this helps! Here’s more of my debt free journey this year :).Best,Leah

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the prudential 401k loan form

How to make an eSignature for the Prudential 401k Loan Form in the online mode

How to generate an electronic signature for the Prudential 401k Loan Form in Google Chrome

How to make an electronic signature for putting it on the Prudential 401k Loan Form in Gmail

How to create an eSignature for the Prudential 401k Loan Form straight from your smart phone

How to make an eSignature for the Prudential 401k Loan Form on iOS devices

How to create an eSignature for the Prudential 401k Loan Form on Android

People also ask

-

What is a Prudential 401k Loan and how does it work?

A Prudential 401k Loan allows you to borrow against your retirement savings in your Prudential 401k plan. This loan is usually limited to the lesser of $50,000 or 50% of your vested balance, and you’re required to pay it back with interest within a specified period. It's a convenient way to access funds while still investing in your retirement.

-

What are the benefits of taking a Prudential 401k Loan?

Taking a Prudential 401k Loan can provide you with immediate access to cash without incurring taxes or penalties, as long as you repay it on time. Additionally, the interest you pay goes back into your own retirement account, making it a more favorable option compared to other loans. This can be particularly beneficial for emergencies or unexpected expenses.

-

Are there any fees associated with a Prudential 401k Loan?

While there are typically no direct fees for taking a Prudential 401k Loan, it’s essential to check with Prudential for any specific charges that may apply. However, be aware that if you fail to repay the loan on time, it may be considered a distribution, potentially leading to taxes and penalties. Always review your plan's loan terms for clarity.

-

How do I apply for a Prudential 401k Loan?

To apply for a Prudential 401k Loan, you will need to contact your plan administrator or log into your Prudential account online. The application process usually involves submitting a loan request form and providing necessary documentation. Once approved, you can receive your funds quickly, making it a streamlined process.

-

What happens if I leave my job while having a Prudential 401k Loan?

If you leave your job with an outstanding Prudential 401k Loan, you may be required to repay the loan in full, or it could be considered a taxable distribution. It’s important to understand your plan’s specific terms regarding loan repayment after employment termination. Consulting with a Prudential representative can provide clarity on your options.

-

Can I use a Prudential 401k Loan for any purpose?

Yes, you can use a Prudential 401k Loan for various purposes, such as home purchases, education expenses, medical bills, or debt consolidation. However, it’s important to evaluate whether borrowing from your retirement savings aligns with your long-term financial goals. Responsible borrowing can provide necessary funds while preserving your retirement savings.

-

What is the interest rate for a Prudential 401k Loan?

The interest rate for a Prudential 401k Loan is typically set at a rate equal to the prime rate plus a margin determined by your plan. This means that the rate can fluctuate based on market conditions. It’s beneficial to compare the interest rate of a Prudential 401k Loan with other financing options to ensure it meets your financial needs.

Get more for Prudential 401k Loan

- Mainstays twin over twin wood bunk bed form

- Berapa gran gas h2 pada karutan asam jika arusbang duberikan 965a selama 5menit form

- Limited warranty on materials comts589 gaf form

- Ciis human research review committee hrrc application ciis form

- Professional opinion letter form

- Backflow test report city of waxahachie form

- Sample letter selective service form

- Employer quarterly gross earnings report directors guild of dga form

Find out other Prudential 401k Loan

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer