Fresno California What is Transient Occupancy Tax Form

What is the Fresno California What Is Transient Occupancy Tax Form

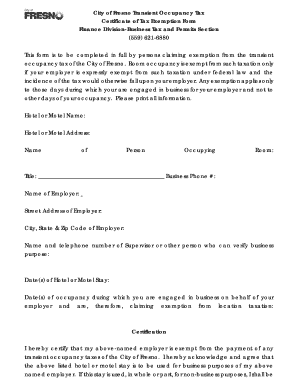

The Fresno California Transient Occupancy Tax Form is a document used by businesses and individuals who provide temporary lodging in the city of Fresno. This form is essential for reporting the transient occupancy tax, which is levied on guests who stay in hotels, motels, or other short-term rental accommodations. The tax is typically calculated based on the rental amount charged to the guest and is a crucial source of revenue for local government services.

How to use the Fresno California What Is Transient Occupancy Tax Form

To use the Fresno California Transient Occupancy Tax Form, individuals or businesses must first gather relevant information regarding their rental transactions. This includes details such as the total rental income, the number of guests, and the duration of their stay. Once this information is compiled, it can be entered into the form. After completing the form, it must be submitted to the appropriate local tax authority, along with any taxes owed.

Steps to complete the Fresno California What Is Transient Occupancy Tax Form

Completing the Fresno California Transient Occupancy Tax Form involves several key steps:

- Gather necessary information, including rental income and guest details.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total transient occupancy tax owed based on the rental income.

- Review the form for accuracy before submission.

- Submit the completed form and payment to the local tax authority by the specified deadline.

Legal use of the Fresno California What Is Transient Occupancy Tax Form

The legal use of the Fresno California Transient Occupancy Tax Form is crucial for compliance with local tax regulations. This form must be filed in accordance with the city’s laws governing transient occupancy taxes. Failure to submit the form accurately and on time may result in penalties or fines. It is important for property owners and operators to understand their obligations under local law to avoid any legal issues.

Key elements of the Fresno California What Is Transient Occupancy Tax Form

Key elements of the Fresno California Transient Occupancy Tax Form include:

- Property owner or operator information.

- Details of the rental transactions, including dates and amounts.

- Calculation of the transient occupancy tax owed.

- Signature of the responsible party certifying the accuracy of the information.

Filing Deadlines / Important Dates

Filing deadlines for the Fresno California Transient Occupancy Tax Form are typically set by the local tax authority. It is important to stay informed about these dates to ensure timely submission. Generally, forms must be filed quarterly, and specific due dates may vary based on the reporting period. Property owners should mark these deadlines on their calendars to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Fresno California Transient Occupancy Tax Form can usually be submitted through various methods, including:

- Online submission through the local tax authority’s website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at the local tax office during business hours.

Quick guide on how to complete fresno california what is transient occupancy tax form

Accomplish Fresno California What Is Transient Occupancy Tax Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Fresno California What Is Transient Occupancy Tax Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and eSign Fresno California What Is Transient Occupancy Tax Form with minimal effort

- Locate Fresno California What Is Transient Occupancy Tax Form and then click Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Finish button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign Fresno California What Is Transient Occupancy Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fresno california what is transient occupancy tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fresno California Transient Occupancy Tax Form?

The Fresno California Transient Occupancy Tax Form is a document that lodging operators must complete to report and remit transient occupancy taxes collected from guests. This tax helps fund local services and tourism-related initiatives. Understanding and filling out this form accurately is crucial for compliance and avoiding penalties.

-

How do I complete the Fresno California Transient Occupancy Tax Form?

To complete the Fresno California Transient Occupancy Tax Form, you will need to gather information on the total number of rental units, occupancy days, and total revenue collected. Ensure that all sections are filled out accurately to reflect the correct tax amount owed. Utilizing software solutions like airSlate SignNow can simplify this process by providing templates and electronic signature capabilities.

-

What are the penalties for not filing the Fresno California Transient Occupancy Tax Form?

Failing to file the Fresno California Transient Occupancy Tax Form can result in severe penalties, including fines and interest on unpaid taxes. Additionally, it may hinder your ability to operate legally in the city. To avoid such issues, it's essential to stay informed and file the form on time, which airSlate SignNow can help streamline.

-

Is there a fee associated with filing the Fresno California Transient Occupancy Tax Form?

Yes, there may be a fee associated with filing the Fresno California Transient Occupancy Tax Form, depending on your lodging business's rental income. Payment is typically made along with the submission of the form. Leveraging airSlate SignNow can provide clarity on these fees and ensure all payments are made promptly.

-

What features does airSlate SignNow offer for managing the Fresno California Transient Occupancy Tax Form?

airSlate SignNow offers features that enhance the management of the Fresno California Transient Occupancy Tax Form, including online templates, eSignature capabilities, and secure document storage. These features streamline the filing process, reduce administrative burdens, and ensure compliance with local regulations.

-

Can airSlate SignNow integrate with my existing accounting software for the Fresno California Transient Occupancy Tax Form?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for accurate tracking of rental income and automatic calculation of taxes owed on the Fresno California Transient Occupancy Tax Form. This integration simplifies the process for lodging operators and enhances financial reporting accuracy.

-

What are the benefits of using airSlate SignNow for the Fresno California Transient Occupancy Tax Form?

Using airSlate SignNow for the Fresno California Transient Occupancy Tax Form offers numerous benefits, including ease of use, cost-effectiveness, and enhanced compliance. The platform's intuitive interface makes it accessible for all users, while its automated features help reduce errors and save time during the filing process.

Get more for Fresno California What Is Transient Occupancy Tax Form

- 9 3 study guide and intervention arcs and chords form

- Application for vehicle to be released from impoundment immobilisation due to hardship form

- Florida blue 1095 a form

- Absence excuse note form

- Publication 5417 sp rev 4 basic security plan considerations for tax professionals spanish version form

- Custody amp visitationsuperior court of california form

- Homesuperior court of californiacounty of santa clara form

- Child care facility search form

Find out other Fresno California What Is Transient Occupancy Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors