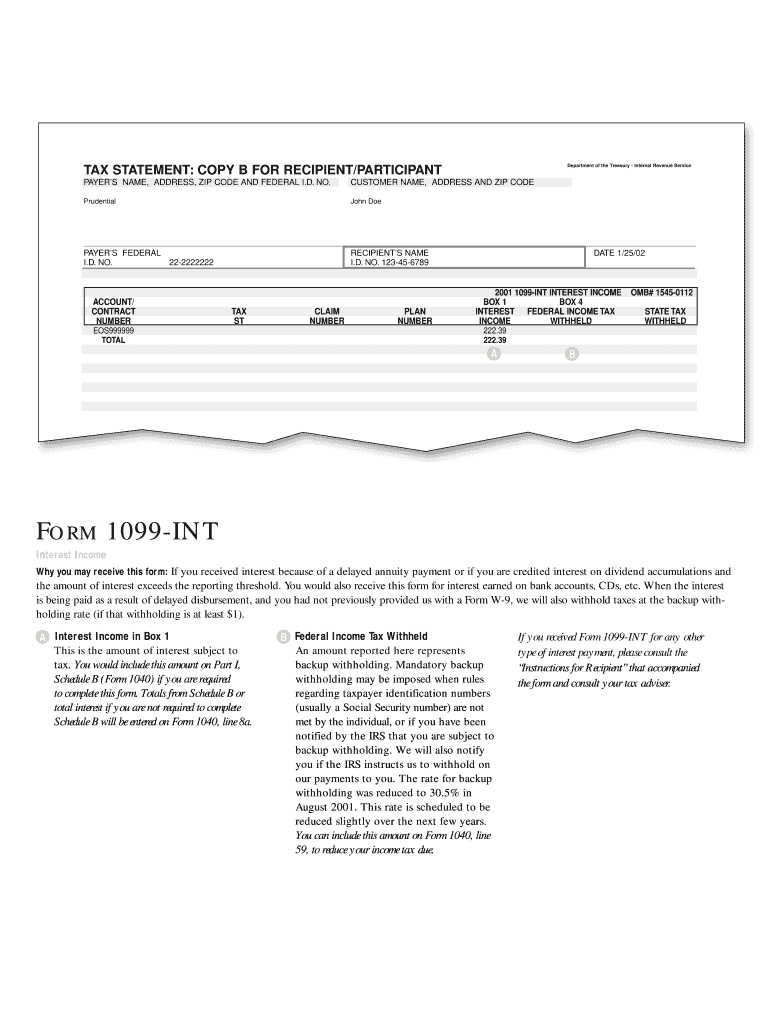

Prudential 1099 Int Form

Understanding the Prudential 1099 R

The Prudential 1099 R form is a crucial tax document used to report distributions from retirement accounts. It is essential for individuals who have received retirement income, such as pensions or annuities, to ensure accurate tax reporting. The form includes important information such as the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding the details on this form can help taxpayers correctly report their income and avoid potential penalties.

How to Obtain the Prudential 1099 R

Obtaining your Prudential 1099 R form is a straightforward process. You can access it through Prudential’s online portal or request a physical copy. To obtain it online, log into your Prudential account, navigate to the tax documents section, and download the form directly. If you prefer a mailed version, contact Prudential customer service to request a copy. Ensure you have your account information handy to expedite the process.

Key Elements of the Prudential 1099 R

The Prudential 1099 R contains several key elements that are vital for tax reporting. These include:

- Recipient Information: Your name, address, and taxpayer identification number.

- Distribution Amount: The total amount distributed during the tax year.

- Taxable Amount: The portion of the distribution that is subject to federal income tax.

- Federal Income Tax Withheld: Any taxes that have been withheld from your distribution.

- Distribution Codes: Codes that indicate the type of distribution and any applicable penalties.

Steps to Complete the Prudential 1099 R

Completing the Prudential 1099 R involves several steps to ensure accuracy. First, gather all relevant financial documents related to your retirement account. Next, fill in the recipient information accurately. Then, report the total distribution and taxable amounts as indicated on your Prudential statements. Finally, review the form for any errors before submitting it to the IRS. Keeping a copy for your records is also advisable.

IRS Guidelines for Prudential 1099 R

The IRS provides specific guidelines regarding the use of the Prudential 1099 R form. Taxpayers must report the income shown on the form on their federal tax returns. It is important to follow IRS instructions to avoid discrepancies. The IRS also outlines deadlines for filing, which typically coincide with the tax return due dates. Familiarizing yourself with these guidelines can help ensure compliance and minimize the risk of audits.

Filing Deadlines for the Prudential 1099 R

Filing deadlines for the Prudential 1099 R are crucial to avoid penalties. Generally, the form must be sent to the IRS by the end of February if filed by mail, or by the end of March if filed electronically. Recipients should also receive their copies by January 31. Being aware of these dates helps ensure timely reporting and compliance with tax regulations.

Quick guide on how to complete prudential 1099 int form

The simplest method to obtain and sign Prudential 1099 Int

On a scale that encompasses your entire organization, ineffective procedures related to document approval can consume a signNow amount of work time. Signing documents such as Prudential 1099 Int is a standard component of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall productivity of the company. With airSlate SignNow, signing your Prudential 1099 Int can be as straightforward and quick as possible. This platform offers the most recent version of virtually any document. Even better, you can sign it right away without the necessity of installing external applications on your computer or printing hard copies.

Steps to obtain and sign your Prudential 1099 Int

- Browse our collection by category or use the search box to locate the document you require.

- View the document preview by selecting Learn more to confirm it’s the correct one.

- Press Get form to start editing immediately.

- Fill out your document and input any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Prudential 1099 Int.

- Select the signature option that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if required.

With airSlate SignNow, you possess everything you need to manage your documents effectively. You can search for, complete, modify, and even send your Prudential 1099 Int all within a single tab effortlessly. Enhance your procedures with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Do you need to fill I-9 form for 1099 contract?

There's no such thing as a “1099 employee.” You are either an employee or you are not. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who is an employee and who is not.While it is illegal to retain a contractor whom you know to be working illegally, you are not required to connect Form I-9 from your independent contractors. You may do so if you wish.Who Needs Form I-9? Explains who must provide Form I-9.

-

I just received a 1099-K form from Coinbase? How do I fill my taxes?

1099-Ks from Coinbase, Gemini, and other exchanges only show your CUMULATIVE transaction value. That’s why the amount may seem HUGE if you swing traded your entire balance multiple times.However you only need to pay taxes on your capital gains/losses, so that amount is likely less than the 1099K’s amount. You need to file a Schedule D 1040 with a 8949.I recommend checking out Crypto tax sites like TokenTax that calculate all of that for you — Here is an article about 1099Ks from them - Coinbase Pro sent me a 1099-K. What do I do now? | TokenTax Blog

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I print out my Form 1099 from SSA?

I fill in the Form 1099 and immediately print it here: http://bit.ly/2Nkf48f

Create this form in 5 minutes!

How to create an eSignature for the prudential 1099 int form

How to create an electronic signature for the Prudential 1099 Int Form online

How to create an electronic signature for the Prudential 1099 Int Form in Google Chrome

How to create an eSignature for signing the Prudential 1099 Int Form in Gmail

How to generate an eSignature for the Prudential 1099 Int Form right from your smart phone

How to generate an eSignature for the Prudential 1099 Int Form on iOS

How to generate an eSignature for the Prudential 1099 Int Form on Android OS

People also ask

-

What is Prudential 1099 Int. and how does it work?

Prudential 1099 Int. refers to the tax form used by Prudential to report interest income earned on investments. This form is crucial for individuals who need to report this income on their tax returns. By using airSlate SignNow, you can easily sign and send any documents related to your Prudential 1099 Int. electronically, simplifying your tax preparation process.

-

How can airSlate SignNow help me manage my Prudential 1099 Int. documents?

With airSlate SignNow, you can create, sign, and send your Prudential 1099 Int. documents quickly and securely. The platform streamlines the document management process, allowing you to track changes and access important tax documents anytime, anywhere. This efficiency can signNowly reduce the stress associated with tax season.

-

What are the pricing options for using airSlate SignNow with Prudential 1099 Int.?

airSlate SignNow offers competitive pricing plans that cater to different business needs when managing Prudential 1099 Int. documents. You can choose from monthly or annual subscriptions, which provide various features tailored to enhance your document signing experience. Evaluate the plans to find the one that best suits your document management requirements.

-

Can I integrate airSlate SignNow with other tools for my Prudential 1099 Int. documents?

Yes, airSlate SignNow integrates seamlessly with various tools and applications to enhance your workflow for managing Prudential 1099 Int. documents. This includes popular CRM systems, cloud storage solutions, and other productivity tools, allowing you to streamline your document processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for Prudential 1099 Int. e-signatures?

Using airSlate SignNow for Prudential 1099 Int. e-signatures offers several benefits, including improved security, reduced turnaround times, and enhanced compliance with legal standards. The platform ensures that your signed documents are securely stored and easily accessible, making tax preparation much simpler and more efficient.

-

Is it easy to learn how to use airSlate SignNow for Prudential 1099 Int. documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple to learn how to manage your Prudential 1099 Int. documents. The platform provides helpful tutorials and customer support, ensuring that you can quickly become proficient in sending and signing your documents electronically.

-

Are there any security features protecting my Prudential 1099 Int. documents on airSlate SignNow?

Yes, airSlate SignNow employs advanced security measures to protect your Prudential 1099 Int. documents. Features include encryption, secure access controls, and audit trails that track document activity. These security protocols help safeguard sensitive information, giving you peace of mind when handling your tax-related documents.

Get more for Prudential 1099 Int

- English language reference form general medical council gmc uk

- Bob and wheel handout edsitement form

- Form v2013 christchurch china consulate

- Cancellation telkom form

- Utility release subgrade rev1106 city of frisco friscotexas form

- Sa1235 2015 2019 form

- Meter bagging request meter bagging request city of west palm wpb form

- Mv2917 green bay packer license plates information and application

Find out other Prudential 1099 Int

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document