Head Start Income Calculation Worksheet Form

What is the Head Start Income Calculation Worksheet

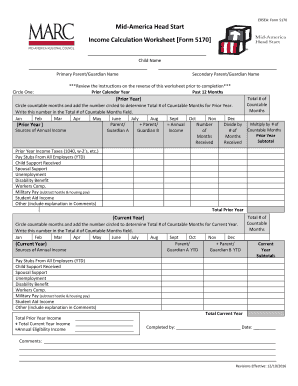

The Head Start Income Calculation Worksheet is a crucial document used to determine the income eligibility of families applying for Head Start programs. This worksheet helps assess whether a family's income meets the federal guidelines for participation in these early childhood education programs. It takes into account various sources of income, including wages, benefits, and other financial resources, ensuring that families receive the support they need for their children's development.

How to use the Head Start Income Calculation Worksheet

Using the Head Start Income Calculation Worksheet involves several steps. First, gather all necessary financial documents, such as pay stubs, tax returns, and benefit statements. Next, fill out the worksheet by entering the total income from all sources for each household member. Be sure to include any deductions or adjustments as specified in the instructions. Once completed, review the calculations to ensure accuracy before submitting the form to the relevant Head Start program.

Steps to complete the Head Start Income Calculation Worksheet

Completing the Head Start Income Calculation Worksheet requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation for each household member.

- Fill in the total income from all sources, including wages, Social Security, and unemployment benefits.

- Account for any deductions, such as child support or alimony, as directed in the worksheet.

- Calculate the total household income by adding all sources together.

- Review the completed worksheet for any errors before submission.

Key elements of the Head Start Income Calculation Worksheet

The Head Start Income Calculation Worksheet includes several key elements that are essential for accurate income assessment. These elements typically consist of:

- Household member information: Names and relationship to the applicant.

- Income sources: Detailed listings of all income types, including wages, benefits, and other financial resources.

- Deductions: Areas to note any applicable deductions that affect total income.

- Signature section: A place for the applicant to certify the accuracy of the information provided.

Legal use of the Head Start Income Calculation Worksheet

The legal use of the Head Start Income Calculation Worksheet is governed by federal guidelines that dictate eligibility for the program. The information provided must be accurate and truthful, as any discrepancies could lead to penalties or denial of services. The worksheet serves as a formal declaration of income, and it is important for applicants to understand their responsibilities in completing it correctly to ensure compliance with the program's requirements.

Eligibility Criteria

Eligibility for the Head Start program is based on several criteria, primarily focused on income levels and family size. Families must demonstrate that their income falls within the federal poverty guidelines, which are updated annually. Additionally, priority may be given to families experiencing homelessness, those receiving public assistance, or children with disabilities. Understanding these criteria is essential for applicants to determine their eligibility before completing the worksheet.

Quick guide on how to complete head start income calculation worksheet

Prepare Head Start Income Calculation Worksheet effortlessly on any device

Digital document management has gained signNow popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Manage Head Start Income Calculation Worksheet on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Head Start Income Calculation Worksheet with ease

- Locate Head Start Income Calculation Worksheet and click Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validation as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Head Start Income Calculation Worksheet and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the head start income calculation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the head start income calculation worksheet?

The head start income calculation worksheet is a crucial tool designed to help families determine their eligibility for Head Start programs. It simplifies the process of calculating income based on household size and income sources, ensuring accurate assessment for program qualification.

-

How can I access the head start income calculation worksheet?

You can easily access the head start income calculation worksheet through our airSlate SignNow platform. By creating an account, you can download, complete, and eSign the worksheet, making the application process for Head Start programs more efficient and streamlined.

-

What features does the head start income calculation worksheet offer?

Our head start income calculation worksheet includes user-friendly fields for entering income data, automatic calculations, and the ability to save and edit your information. Additionally, airSlate SignNow allows you to share this worksheet securely with Head Start program coordinators directly from the platform.

-

Is the head start income calculation worksheet customizable?

Yes, the head start income calculation worksheet is fully customizable to meet your specific needs. You can modify the fields to add unique income sources or additional household members, ensuring you present the most accurate picture of your financial situation when applying for Head Start programs.

-

How does airSlate SignNow ensure the security of my head start income calculation worksheet?

At airSlate SignNow, the security of your documents, including the head start income calculation worksheet, is our top priority. We use state-of-the-art encryption and comply with industry standards for data protection, ensuring your information remains confidential and secure during the entire eSigning process.

-

What are the pricing options for using the head start income calculation worksheet with airSlate SignNow?

airSlate SignNow offers flexible pricing options, allowing you to choose a plan that best fits your needs while using the head start income calculation worksheet. Whether you are an individual or a part of an organization, we have competitive pricing structures that provide value without sacrificing features or security.

-

Can I integrate the head start income calculation worksheet with other tools?

Yes, airSlate SignNow supports various integrations that allow you to connect the head start income calculation worksheet with your favorite productivity tools. This means you can streamline your workflow and manage your sign and document processes seamlessly across multiple applications.

Get more for Head Start Income Calculation Worksheet

Find out other Head Start Income Calculation Worksheet

- How To Add eSign in G Suite

- How Do I Add eSign in G Suite

- Help Me With Install eSign in Oracle

- Help Me With Add eSign in G Suite

- How Can I Add eSign in G Suite

- How Can I Install eSign in Oracle

- Can I Add eSign in G Suite

- How Can I Add eSign in Egnyte

- How To Set Up eSign in Grooper

- Help Me With Set Up eSign in Grooper

- Can I Add eSign in Egnyte

- How To Set Up eSign in Android

- How To Add eSign in Oracle

- How Do I Add eSign in Oracle

- Help Me With Add eSign in Oracle

- How To Save eSign in CMS

- How Can I Add eSign in Oracle

- Can I Add eSign in Oracle

- How To Save eSign in ERP

- Help Me With Save eSign in CMS