Eastwest Bank Auto Loan Form

What is the Eastwest Bank Auto Loan

The Eastwest Bank Auto Loan is a financial product designed to assist individuals in purchasing vehicles. This loan offers competitive interest rates and flexible repayment terms, making it an attractive option for borrowers. Typically, the loan amount can cover the full price of the vehicle or a portion of it, depending on the applicant's creditworthiness and financial situation. Borrowers can use the loan for new or used vehicles, and the funding can be applied to various types of vehicles, including cars, trucks, and SUVs.

Key elements of the Eastwest Bank Auto Loan

Understanding the key elements of the Eastwest Bank Auto Loan can help applicants make informed decisions. Important factors include:

- Interest Rates: Rates may vary based on credit scores and loan terms.

- Loan Amount: Typically ranges from a few thousand dollars to the full price of the vehicle.

- Repayment Terms: Options usually span from three to seven years, allowing borrowers to choose a plan that fits their budget.

- Fees: Potential fees may include application fees, processing fees, and prepayment penalties.

Steps to complete the Eastwest Bank Auto Loan

Completing the auto loan application process involves several steps to ensure a smooth experience:

- Gather Required Documents: Collect necessary documents such as proof of income, identification, and vehicle information.

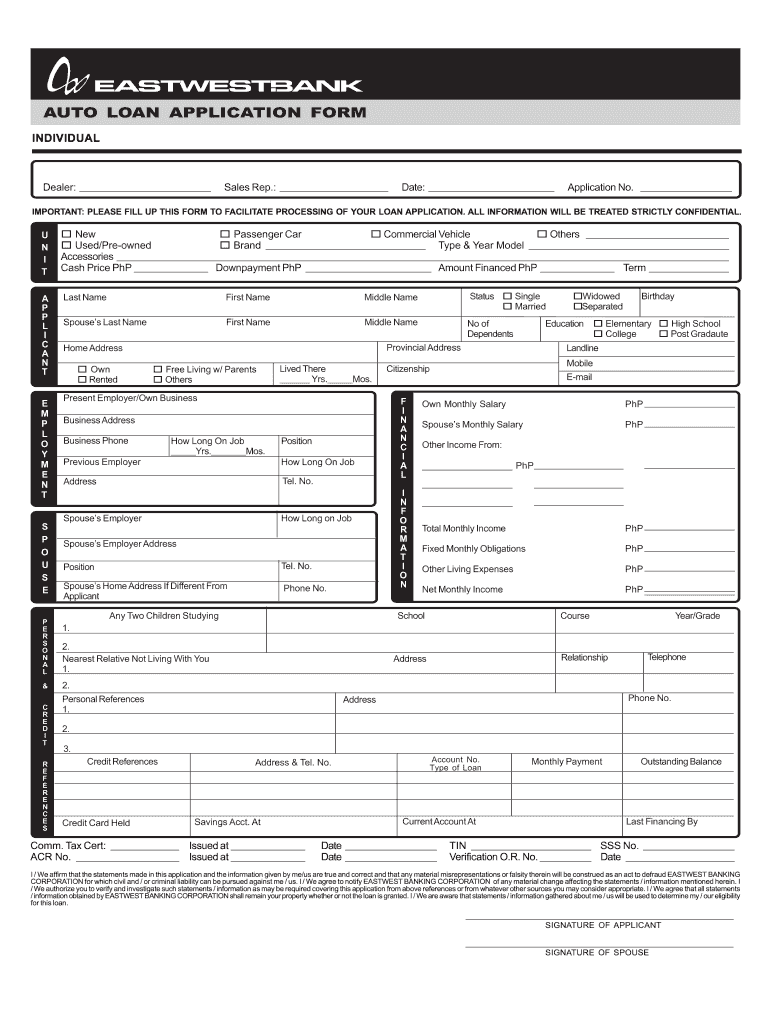

- Fill Out the Application: Complete the auto loan application form accurately, providing all requested information.

- Submit the Application: Submit the completed application online or in person at a local Eastwest Bank branch.

- Await Approval: The bank will review your application and notify you of the decision, typically within a few business days.

- Finalize the Loan: If approved, review the loan agreement, sign the necessary documents, and receive your funds.

Required Documents

When applying for the Eastwest Bank Auto Loan, specific documents are typically required to verify your identity and financial status. Commonly required documents include:

- Government-issued identification (e.g., driver's license or passport)

- Proof of income (e.g., pay stubs, tax returns)

- Credit history report

- Vehicle information (e.g., make, model, VIN)

Eligibility Criteria

To qualify for the Eastwest Bank Auto Loan, applicants generally need to meet certain eligibility criteria. These may include:

- A minimum credit score, which can vary by loan type

- Proof of stable income to demonstrate repayment ability

- Age requirement, typically at least eighteen years old

- Residency status, as applicants must reside in the United States

Application Process & Approval Time

The application process for the Eastwest Bank Auto Loan is designed to be straightforward. After submitting the application, the approval time can vary based on several factors, including:

- The completeness of the application and supporting documents

- The applicant's credit history and financial profile

- Current processing times at Eastwest Bank, which are usually a few business days

Once approved, borrowers can proceed with finalizing the loan terms and securing their funds for vehicle purchase.

Quick guide on how to complete auto loan application form eastwest bank

The simplest method to locate and endorse Eastwest Bank Auto Loan

Across the scope of your whole enterprise, cumbersome procedures regarding paper authorization can consume a signNow amount of work hours. Approving documents like Eastwest Bank Auto Loan is an inherent aspect of operations in any sector, which is the reason the effectiveness of every agreement's lifecycle impacts the organization's overall productivity. With airSlate SignNow, endorsing your Eastwest Bank Auto Loan can be as straightforward and swift as possible. You’ll discover with this platform the most recent version of virtually any document. Even better, you can endorse it right away without needing to install external software on your computer or printing anything out as physical copies.

Steps to obtain and endorse your Eastwest Bank Auto Loan

- Browse our collection by category or use the search feature to find the document you require.

- Check the form preview by clicking Learn more to verify it is the correct one.

- Select Get form to begin editing immediately.

- Complete your document and input any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Eastwest Bank Auto Loan.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and proceed to sharing options as required.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, fill out, edit, and even send your Eastwest Bank Auto Loan in one tab with no complications. Enhance your processes by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the auto loan application form eastwest bank

How to create an eSignature for the Auto Loan Application Form Eastwest Bank online

How to make an electronic signature for your Auto Loan Application Form Eastwest Bank in Chrome

How to create an electronic signature for signing the Auto Loan Application Form Eastwest Bank in Gmail

How to create an eSignature for the Auto Loan Application Form Eastwest Bank straight from your smartphone

How to generate an eSignature for the Auto Loan Application Form Eastwest Bank on iOS

How to create an electronic signature for the Auto Loan Application Form Eastwest Bank on Android OS

People also ask

-

What is the Eastwest Bank Auto Loan and how does it work?

The Eastwest Bank Auto Loan is a financing option designed to help individuals purchase a vehicle. With competitive interest rates and flexible terms, this loan allows you to choose the amount you wish to borrow based on your budget. By applying online, you can receive quick approval and get on the road in no time.

-

What are the interest rates for the Eastwest Bank Auto Loan?

Interest rates for the Eastwest Bank Auto Loan vary based on several factors, including your credit score and the loan term. Typically, Eastwest Bank offers competitive rates that make it an attractive option for auto financing. It's best to check their website or contact their customer service to get the most accurate and up-to-date information.

-

What documents are required to apply for the Eastwest Bank Auto Loan?

To apply for the Eastwest Bank Auto Loan, you will generally need to provide proof of income, identification, and information about the vehicle you wish to purchase. Additional documents may include bank statements and credit history. Having these documents ready can streamline the application process.

-

Can I prepay my Eastwest Bank Auto Loan without penalties?

Yes, one of the benefits of the Eastwest Bank Auto Loan is that you can prepay your loan without incurring any penalties. This feature allows you to pay off your loan early and save on interest costs, giving you the flexibility to manage your finances effectively.

-

What are the benefits of choosing the Eastwest Bank Auto Loan?

The Eastwest Bank Auto Loan offers several benefits, including competitive interest rates, flexible repayment terms, and quick processing times. Additionally, customers appreciate the excellent customer service provided by Eastwest Bank, ensuring a smooth application and approval process.

-

How can I manage my Eastwest Bank Auto Loan payments?

Managing your Eastwest Bank Auto Loan payments is easy through their online banking platform. You can set up automatic payments, view your payment history, and even make extra payments whenever you choose. This convenience helps you stay on top of your loan and avoid missed payments.

-

Is it possible to refinance my Eastwest Bank Auto Loan?

Yes, Eastwest Bank provides options for refinancing your auto loan if you're looking for better rates or terms. Refinancing can help reduce your monthly payments or lower your interest rate, making it a smart financial move for many borrowers.

Get more for Eastwest Bank Auto Loan

- Staff transport agreement format in word

- Aok familienversicherung antrag po polsku form

- Uniform straight bill of lading north park transportation co

- Salford university fee assessment form

- Claiming children in foster care care on your taxes affcny form

- Church rental agreement template 787739905 form

- Church hall rental agreement template form

- Clothing rental agreement template form

Find out other Eastwest Bank Auto Loan

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile