Contract Labor Form

What is the Contract Labor Form

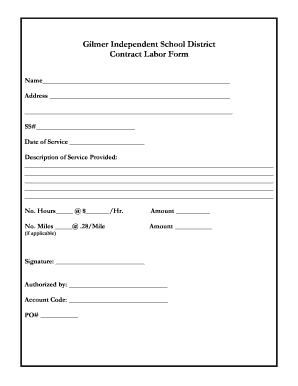

The contract labor form is a crucial document used to outline the terms and conditions between a business and an independent contractor. This form serves as a formal agreement that specifies the scope of work, payment terms, and the rights and responsibilities of both parties involved. It is essential for ensuring clarity and legal protection in the relationship between the contractor and the hiring entity.

How to use the Contract Labor Form

Using the contract labor form involves several key steps to ensure that all necessary information is accurately captured. First, both parties should review the form to understand its requirements. Next, the hiring entity fills in details such as the contractor's name, contact information, and the specific services to be provided. Once completed, both parties should sign the form to make it legally binding. Utilizing digital tools can streamline this process, allowing for easy editing, signing, and storage of the document.

Steps to complete the Contract Labor Form

Completing the contract labor form involves a systematic approach to ensure all relevant details are included. Here are the steps to follow:

- Begin by entering the date of the agreement.

- Fill in the names and addresses of both the contractor and the hiring entity.

- Clearly outline the scope of work, including specific tasks and deliverables.

- Specify payment terms, including rates, payment schedule, and any additional expenses.

- Include clauses related to confidentiality, termination, and dispute resolution.

- Review the completed form for accuracy before obtaining signatures from both parties.

Legal use of the Contract Labor Form

The legal use of the contract labor form is essential for protecting the rights of both the contractor and the hiring entity. To ensure validity, the form must comply with relevant laws and regulations, including those related to independent contractors. Proper execution, including signatures from both parties, is necessary for the document to be enforceable in a court of law. Additionally, keeping a copy of the signed form is important for record-keeping and potential future disputes.

Key elements of the Contract Labor Form

Several key elements must be included in the contract labor form to ensure it is comprehensive and legally binding. These elements include:

- Identification of the parties involved, including contact information.

- A detailed description of the services to be performed.

- Payment terms, including rates and schedule.

- Confidentiality provisions to protect sensitive information.

- Termination clauses outlining the conditions under which the agreement can be ended.

- Dispute resolution mechanisms to address potential conflicts.

IRS Guidelines

Understanding IRS guidelines is critical when using the contract labor form, particularly for tax purposes. The IRS requires that businesses properly classify workers as independent contractors or employees. Misclassification can lead to penalties. It is important to report payments made to contractors on the appropriate tax forms, such as the 1099-MISC. Keeping accurate records of payments and services rendered will help ensure compliance with IRS regulations.

Quick guide on how to complete contract labor form

Effortlessly Prepare Contract Labor Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Contract Labor Form across any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The Easiest Way to Modify and eSign Contract Labor Form Seamlessly

- Obtain Contract Labor Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Contract Labor Form and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the contract labor form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a contract labor form and why is it important?

A contract labor form is a legal document that outlines the terms of employment between a business and a contract worker. It’s important because it helps clarify the responsibilities, payment terms, and project scope, protecting both parties involved. Using a contract labor form ensures compliance with labor laws and can prevent future disputes.

-

How does airSlate SignNow simplify the signing of a contract labor form?

airSlate SignNow simplifies the signing process of a contract labor form by providing a user-friendly platform where documents can be sent, signed, and stored electronically. With features like customizable templates and real-time notifications, users can streamline the entire signing process without the need for paper. This reduces delays and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for contract labor form management?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the creation, sending, and signing of contract labor forms. Businesses can select a plan based on their size and document volume, ensuring cost-effectiveness and value.

-

What features does airSlate SignNow offer for creating a contract labor form?

airSlate SignNow provides several features for creating a contract labor form, including customizable templates, drag-and-drop fields, and advanced editing tools. Users can easily add clauses, adjust formatting, and ensure all necessary fields are included. These features make it simple to produce a professional and legally sound contract labor form.

-

Can I integrate airSlate SignNow with other applications for contract labor form management?

Yes, airSlate SignNow offers integrations with various applications, enhancing the management of contract labor forms. You can integrate it with platforms like Google Drive, Salesforce, and Microsoft Office. This allows for seamless document sharing and collaboration across different tools your business may already be using.

-

How does airSlate SignNow ensure the security of my contract labor form?

airSlate SignNow ensures the security of your contract labor form through robust encryption and secure data storage protocols. All documents are protected during transmission and while stored, giving users peace of mind that sensitive information is safe. Additionally, compliance with industry standards helps safeguard against unauthorized access.

-

What benefits can my business gain from using a contract labor form with airSlate SignNow?

Using a contract labor form with airSlate SignNow can provide numerous benefits, including faster processing times, improved accuracy, and enhanced organization. The electronic signing process reduces paper waste and lowers operational costs, while digital tracking helps manage contract lifecycles effectively. Overall, it leads to a more efficient workflow.

Get more for Contract Labor Form

Find out other Contract Labor Form

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe