Rc7066 Sch E Form

What is the Rc7066 Sch E

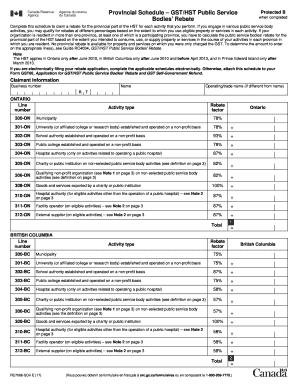

The Rc7066 Sch E is a specific form used in the context of tax filings, particularly for provincial schedules related to the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) for public service bodies. This form is essential for organizations that qualify for rebates under these tax systems. It allows eligible entities to claim refunds on the GST/HST they have paid on eligible expenses. Understanding the Rc7066 Sch E is crucial for ensuring compliance with tax regulations and optimizing potential rebates.

How to use the Rc7066 Sch E

Using the Rc7066 Sch E involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that detail the GST/HST paid on eligible expenses. Next, fill out the form with the required information, including your organization’s details and the amounts being claimed. It is important to follow the guidelines provided by the tax authority to ensure that all entries are correct. Once completed, the form can be submitted either online or by mail, depending on the preferences of the filing entity.

Steps to complete the Rc7066 Sch E

Completing the Rc7066 Sch E requires careful attention to detail. Here are the essential steps:

- Collect all relevant financial records, including receipts and invoices.

- Fill in your organization’s name, address, and tax identification number.

- Detail the amounts of GST/HST paid on eligible expenses.

- Double-check your entries for accuracy and completeness.

- Submit the form through the preferred method: online or by mail.

Ensuring that each step is followed accurately will help in the successful processing of the form.

Legal use of the Rc7066 Sch E

The Rc7066 Sch E must be used in accordance with applicable tax laws to be considered legally valid. This means that the information provided must be truthful and accurate, reflecting the actual expenses incurred. Misrepresentation or errors can lead to penalties or denial of claims. It is advisable to consult with a tax professional if there are uncertainties regarding the legal requirements associated with this form.

Required Documents

When preparing to file the Rc7066 Sch E, certain documents are necessary to support your claims. These include:

- Invoices that show the GST/HST paid on purchases.

- Receipts for eligible expenses.

- Any previous correspondence with tax authorities regarding your GST/HST status.

- Proof of your organization’s eligibility as a public service body.

Having these documents ready will facilitate a smoother filing process and help substantiate your claims.

Filing Deadlines / Important Dates

Filing deadlines for the Rc7066 Sch E can vary based on the fiscal year of the organization. Generally, it is important to file the form by the end of the fiscal period to ensure eligibility for rebates. Organizations should keep track of their specific deadlines and any changes in tax regulations that might affect their filing schedule. Staying informed about these dates is crucial to avoid late submissions and potential penalties.

Quick guide on how to complete rc7066 sch e

Complete Rc7066 Sch E effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents promptly without delays. Manage Rc7066 Sch E on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Rc7066 Sch E effortlessly

- Locate Rc7066 Sch E and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Modify and eSign Rc7066 Sch E and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rc7066 sch e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rc7066 sch e and how does it relate to airSlate SignNow?

The rc7066 sch e refers to a specific tax form that can be completed and signed electronically using airSlate SignNow. By utilizing our platform, users can easily fill out, share, and eSign the rc7066 sch e document securely. This streamlines the process, ensuring timely submissions.

-

How can airSlate SignNow help me with rc7066 sch e documentation?

airSlate SignNow simplifies the management of rc7066 sch e documentation by providing a user-friendly interface for filling out and signing forms online. The platform allows for easy tracking of document status and ensures that all participants can collaborate efficiently. This enhances compliance and reduces administrative burdens.

-

Is airSlate SignNow affordable for small businesses looking to manage rc7066 sch e forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses, making it a cost-effective solution for managing rc7066 sch e forms. With various subscription options, you can choose a plan that fits your business needs. Our platform provides great value through its features and simplicity.

-

What features does airSlate SignNow provide for handling rc7066 sch e?

airSlate SignNow includes key features like customizable templates, in-app eSigning, and document management tools specifically tailored for handling rc7066 sch e forms. You can create and modify forms to suit your requirements, ensuring they meet legal standards effortlessly. Additionally, automated reminders help keep your tasks on track.

-

Can I integrate airSlate SignNow with other tools for rc7066 sch e management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when managing rc7066 sch e documents. Popular integrations include CRM systems, cloud storage solutions, and productivity software. This ensures your documents are accessible and manageable across your existing tools.

-

What are the benefits of using airSlate SignNow for rc7066 sch e?

Using airSlate SignNow for rc7066 sch e provides numerous benefits, including reducing the time spent on paperwork and increasing accuracy. The ease of electronically signing documents enhances security and improves turnaround times. Additionally, it helps maintain organization and compliance, minimizing the risk of errors.

-

How secure is the airSlate SignNow platform for rc7066 sch e documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the rc7066 sch e. Our platform employs industry-standard encryption, secure cloud storage, and robust authentication methods to protect your data. You can manage and sign your documents with confidence, knowing that they are safe.

Get more for Rc7066 Sch E

- Iowa racing and gaming commission license application form

- Employee performance evaluation police department

- Transport friendly society form

- Shipley capture plan template form

- Mvt 5 5 alabama form

- Application must be accompanied by transcript of school record form

- Parking rental agreement template form

- Parental visitation agreement template form

Find out other Rc7066 Sch E

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form