Form it 209

What is the Form It 209

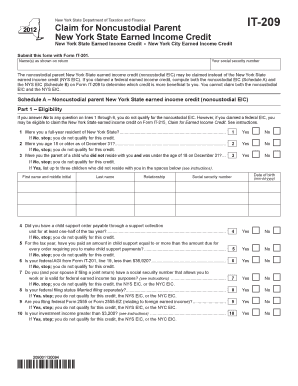

The Form It 209 is an official document used primarily for tax-related purposes in the United States. It serves as a declaration or request that individuals or businesses must submit to comply with specific regulations. Understanding the purpose and requirements of this form is essential for accurate and timely submissions, ensuring that all necessary information is provided to the relevant authorities.

How to use the Form It 209

Using the Form It 209 involves several straightforward steps. First, gather all necessary information that pertains to the form's requirements. This may include personal identification details, financial information, or other relevant documentation. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Once completed, you can submit the form via the designated method, whether online, by mail, or in person, depending on the specific instructions associated with the form.

Steps to complete the Form It 209

Completing the Form It 209 requires careful attention to detail. Follow these steps for effective completion:

- Review the form's instructions thoroughly to understand what information is required.

- Gather all relevant documents and data needed for completion.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check your entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form through the appropriate channels.

Legal use of the Form It 209

The legal use of the Form It 209 is governed by specific regulations that ensure its validity. For the form to be legally binding, it must be completed in accordance with the guidelines set by relevant authorities. This includes proper signatures, dates, and adherence to submission deadlines. Utilizing a reliable electronic signature platform can enhance the legal standing of the form, ensuring compliance with eSignature laws such as ESIGN and UETA.

Key elements of the Form It 209

Key elements of the Form It 209 include essential information that must be accurately provided. This typically encompasses:

- Identification details of the individual or business submitting the form.

- Specific financial information or declarations as required by the form.

- Signature and date fields to validate the submission.

- Any additional documentation that may be necessary to support the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Form It 209 can be submitted through various methods, offering flexibility based on user preference. Common submission methods include:

- Online: Many forms can be filled out and submitted electronically through designated platforms, ensuring quick processing.

- Mail: Completed forms can be printed and sent via postal service to the appropriate address.

- In-Person: Some individuals may prefer to deliver the form directly to a designated office for immediate confirmation of receipt.

Quick guide on how to complete form it 209

Complete Form It 209 effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form It 209 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form It 209 with ease

- Find Form It 209 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to send your form: through email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form It 209 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 209

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form It 209 and how can airSlate SignNow help?

Form It 209 is a specific document type that airSlate SignNow can efficiently manage. With airSlate SignNow, you can easily create, edit, and eSign Form It 209, streamlining your document workflow. Our platform enhances collaboration and ensures compliance, making it a powerful solution for your business.

-

How does the pricing for airSlate SignNow vary for Form It 209 users?

Pricing for airSlate SignNow is competitive and varies based on the features you need for managing Form It 209. We offer different subscription tiers, ensuring you find a plan that best fits your business needs and budget. Each plan provides full accessibility to eSigning and document management features.

-

What are the key features of airSlate SignNow for Form It 209?

airSlate SignNow includes robust features tailored for handling Form It 209, such as customizable templates, secure cloud storage, and real-time tracking. Additionally, the platform supports multi-party signing, making it easy to gather signatures from multiple stakeholders. These features optimize your document process and enhance efficiency.

-

Can I integrate airSlate SignNow with other software while working on Form It 209?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your capabilities for managing Form It 209. You can connect it with CRM systems, cloud storage, and project management tools, allowing for a cohesive workflow. This integration eliminates data silos and improves productivity.

-

What are the benefits of using airSlate SignNow for Form It 209?

Utilizing airSlate SignNow for Form It 209 provides numerous benefits, including reduced turnaround times for signatures and improved document accuracy. The intuitive interface ensures that users can quickly navigate the signing process without extensive training. Furthermore, the security features help protect your sensitive information during transactions.

-

Is airSlate SignNow compliant with legal standards for Form It 209?

Yes, airSlate SignNow is fully compliant with legal standards for eSigning, ensuring that your Form It 209 meets all regulatory requirements. Our platform adheres to industry standards such as ESIGN and UETA. This compliance guarantees that your electronically signed documents hold up in court and are legally binding.

-

How can airSlate SignNow improve the workflow for Form It 209?

airSlate SignNow signNowly enhances workflow for Form It 209 by automating and streamlining document processes. Features like automated reminders and status tracking minimize delays and keep all parties informed. This leads to faster document turnaround and increased efficiency within your team.

Get more for Form It 209

Find out other Form It 209

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF