Wv it 140 Form

What is the Wv It 140 Form

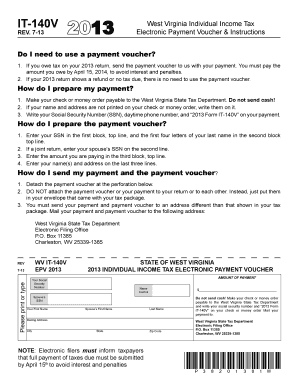

The Wv It 140 form, also known as the West Virginia Personal Income Tax Return, is a crucial document used by residents of West Virginia to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or the potential refund due. It is important for taxpayers to understand the purpose and requirements of this form to ensure accurate filing and compliance with state tax laws.

Steps to complete the Wv It 140 Form

Completing the Wv It 140 form involves several key steps to ensure that all necessary information is accurately reported. Here are the main steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and any other earnings.

- Calculate your total income and any applicable deductions or credits that may reduce your taxable income.

- Determine your tax liability based on the income reported and the current tax rates.

- Review the completed form for accuracy before submission.

Legal use of the Wv It 140 Form

The Wv It 140 form is legally binding and must be completed in accordance with West Virginia tax laws. Submitting this form accurately is essential to avoid penalties or legal issues. Taxpayers are responsible for ensuring that all information provided is truthful and complete. Failure to comply with the requirements of the Wv It 140 can result in audits, fines, or other legal repercussions, underscoring the importance of careful preparation and submission.

How to obtain the Wv It 140 Form

The Wv It 140 form can be obtained through several methods. Taxpayers can download a printable version directly from the West Virginia State Tax Department's website. Alternatively, physical copies of the form may be available at local tax offices or libraries. Additionally, many tax preparation software programs include the Wv It 140 form, allowing users to complete it electronically.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Wv It 140 form. Generally, the deadline for submitting the form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be mindful of any extensions that may apply and ensure that they file on time to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Wv It 140 form. The form can be filed electronically through approved e-filing services, which may expedite processing and refunds. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In-person submissions are also accepted at designated tax offices. Each method has its benefits, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete wv it 140 form

Complete Wv It 140 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the accurate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Wv It 140 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Wv It 140 Form without any hassle

- Locate Wv It 140 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional written signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Wv It 140 Form and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv it 140 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for filling out the WV State IT 140V form?

The airSlate SignNow platform simplifies the process of filling out the WV State IT 140V form by providing an easy-to-use interface. With our solution, you can quickly enter the necessary information and access templates that guide you through the form's requirements for seamless completion.

-

How does airSlate SignNow help in electronically signing the WV State IT 140V?

airSlate SignNow allows you to electronically sign the WV State IT 140V form with just a few clicks. This function ensures that your document is legally binding while providing a secure and efficient way to manage your documents online.

-

Is there a cost associated with using airSlate SignNow to fill out the WV State IT 140V?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our pricing is designed to be cost-effective while providing all the necessary features you need to facilitate how to fill out the WV State IT 140V form efficiently.

-

What features does airSlate SignNow offer for filling out documents?

airSlate SignNow provides robust features such as customizable templates, collaboration tools, and a secure signing process. These features directly support your efforts on how to fill out the WV State IT 140V and enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other software for filling out taxes?

Absolutely! airSlate SignNow easily integrates with various business applications and tax software. This integration will streamline your workflow and assist in how to fill out the WV State IT 140V without needing to switch between multiple platforms.

-

What support does airSlate SignNow provide for users filling out the WV State IT 140V form?

Our customer support team is available to assist you with any queries about how to fill out the WV State IT 140V form. We provide various support resources, including tutorials and online assistance, to ensure you have the help you need while using our platform.

-

Is there a trial period for airSlate SignNow to simplify form filling?

Yes, airSlate SignNow offers a trial period during which you can explore our features and learn how to fill out the WV State IT 140V. This trial allows you to experience the platform's efficiency and effectiveness before committing to a subscription.

Get more for Wv It 140 Form

Find out other Wv It 140 Form

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple