Ct 1127 Form

What is the Ct 1127 Form

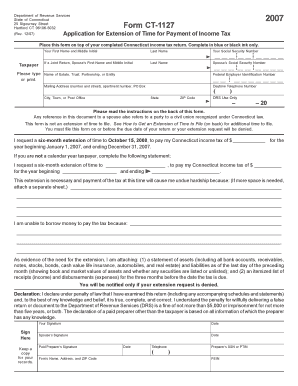

The Ct 1127 Form is a specific document used within the state of Connecticut. It is primarily utilized for tax purposes, specifically for reporting certain types of income or deductions. This form is essential for ensuring compliance with state tax regulations and helps taxpayers accurately report their financial information to the Connecticut Department of Revenue Services.

How to use the Ct 1127 Form

Using the Ct 1127 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the specific requirements set by the state.

Steps to complete the Ct 1127 Form

Completing the Ct 1127 Form requires attention to detail. Follow these steps:

- Gather required documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all figures match your supporting documents.

- Complete the deduction section, if applicable, by providing necessary details and documentation.

- Review the form for accuracy before submission.

Legal use of the Ct 1127 Form

The legal use of the Ct 1127 Form is crucial for maintaining compliance with Connecticut tax laws. When filled out correctly, this form serves as a legally binding document that can be used in case of audits or disputes. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues.

Who Issues the Form

The Ct 1127 Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring that taxpayers comply with their obligations. The form is available through their official website, where taxpayers can also find additional resources and guidance for completing it.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1127 Form are critical to avoid penalties. Generally, the form must be submitted by the due date for your tax return, which is typically April fifteenth for individual taxpayers. However, if you are unable to meet this deadline, it is advisable to check for any extensions or specific dates that may apply to your situation.

Quick guide on how to complete ct 1127 form

Effortlessly Prepare Ct 1127 Form on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Manage Ct 1127 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The Easiest Way to Edit and eSign Ct 1127 Form with Ease

- Locate Ct 1127 Form and select Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislocated files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 1127 Form to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1127 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 1127 Form?

The Ct 1127 Form is a crucial document used in Connecticut for specific tax reporting purposes. It is essential for businesses and individuals to correctly fill out this form to ensure compliance with state tax laws. Understanding the Ct 1127 Form is vital for effective financial planning.

-

How can airSlate SignNow help with the Ct 1127 Form?

airSlate SignNow simplifies the process of completing and eSigning the Ct 1127 Form. Our platform allows you to easily fill out the form electronically, ensuring accuracy and reducing the risk of errors. By using airSlate SignNow, you can streamline your document management and focus on your business.

-

What features does airSlate SignNow offer for the Ct 1127 Form?

AirSlate SignNow features a user-friendly interface that allows for easy document creation and eSigning of the Ct 1127 Form. With advanced options like templates, real-time collaboration, and secure storage, you can efficiently manage your tax forms. Our platform ensures that all your documents are legally binding and compliant.

-

Is airSlate SignNow cost-effective for handling the Ct 1127 Form?

Absolutely, airSlate SignNow is designed to be a cost-effective solution for managing your Ct 1127 Form and other documents. Our pricing plans cater to various business needs, ensuring access to critical eSigning features without breaking the bank. You can save time and money by utilizing our digital solutions for your tax paperwork.

-

Can I integrate airSlate SignNow with other tools for the Ct 1127 Form?

Yes, airSlate SignNow offers seamless integrations with various business applications that can streamline the management of your Ct 1127 Form. You can connect our platform with tools like CRM systems, accounting software, and document storage services for enhanced efficiency. This integration helps simplify your workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for the Ct 1127 Form?

Using airSlate SignNow for the Ct 1127 Form comes with numerous benefits, including increased accuracy and faster turnaround times. Our platform helps eliminate paperwork clutter and enhances collaboration among team members. With secure eSigning options, you can trust that your tax documents are protected and compliant.

-

Is it easy to eSign the Ct 1127 Form using airSlate SignNow?

Yes, eSigning the Ct 1127 Form with airSlate SignNow is incredibly easy. Our intuitive platform allows users to sign documents electronically with just a few clicks. You can invite others to eSign quickly, making the process efficient and hassle-free.

Get more for Ct 1127 Form

- Mw507m 1046371 form

- 11 syncnly application and credit card account agreement credit is extended by synchrony bank married wi residents only if you form

- River spirit w2g copy request form

- How to print pag ibig realtime form

- Conquer the guanlet waiver form

- Soccer referee evaluation form 28895403

- Amoeba sisters video recap genetic drift answer key form

- Counseling conversation record form

Find out other Ct 1127 Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later