Pub 1321 Form

What is the Pub 1321

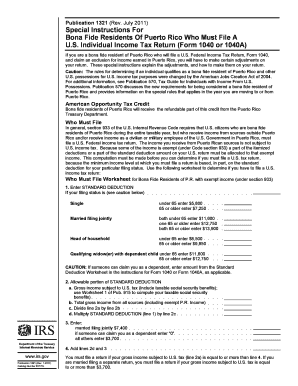

The Pub 1321, or IRS Publication 1321, serves as a crucial resource for taxpayers and professionals navigating the complexities of tax compliance. This document outlines the procedures and guidelines for specific tax-related scenarios, particularly focusing on the requirements for certain forms and filings. Understanding the content of Pub 1321 is essential for ensuring that all necessary documentation is completed accurately and submitted on time, thereby avoiding potential penalties and complications.

How to use the Pub 1321

Using the Pub 1321 effectively involves familiarizing oneself with its structure and the information it provides. Taxpayers should read through the publication to identify relevant sections that pertain to their specific tax situations. It is beneficial to take notes on key points and requirements outlined in the document, as this can streamline the process of filling out necessary forms. Utilizing digital tools, such as signNow, can further enhance the experience by allowing for easy filling and signing of related documents.

Steps to complete the Pub 1321

Completing the requirements outlined in the Pub 1321 involves several key steps:

- Review the publication thoroughly to understand the specific guidelines applicable to your situation.

- Gather all necessary documentation and information required for the forms referenced in the publication.

- Fill out the forms accurately, ensuring that all information is complete and correct.

- Utilize a reliable eSignature solution, such as signNow, to sign the documents digitally.

- Submit the completed forms according to the instructions provided in the publication, whether online, by mail, or in person.

Legal use of the Pub 1321

The legal use of the Pub 1321 is grounded in its compliance with IRS guidelines and federal regulations. When taxpayers follow the procedures outlined in this publication, they ensure that their submissions are valid and recognized by the IRS. This includes adhering to deadlines, providing accurate information, and utilizing appropriate filing methods. By doing so, individuals can avoid legal complications and ensure that their tax obligations are met in a timely manner.

Key elements of the Pub 1321

Key elements of the Pub 1321 include:

- Detailed instructions for completing specific tax forms.

- Clarification of eligibility requirements for various tax situations.

- Important deadlines for submissions and filings.

- Guidance on the legal implications of non-compliance.

- Examples and scenarios to illustrate common taxpayer situations.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical components of the Pub 1321. It is essential for taxpayers to be aware of these dates to avoid penalties. The publication outlines specific timelines for submitting forms, including extensions where applicable. Keeping a calendar with these dates marked can help ensure compliance and timely submissions, which is vital for maintaining good standing with the IRS.

Quick guide on how to complete pub 1321

Complete Pub 1321 seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without holdups. Manage Pub 1321 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Pub 1321 effortlessly

- Obtain Pub 1321 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight crucial sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Pub 1321 and ensure superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pub 1321

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pub 1321 in relation to airSlate SignNow?

Pub 1321 refers to the regulatory guideline that outlines the standards for electronic signatures and document management. Understanding pub 1321 is essential for businesses to ensure compliance when using airSlate SignNow for eSigning and document workflows.

-

How does airSlate SignNow ensure compliance with pub 1321?

AirSlate SignNow incorporates best practices and security measures in line with pub 1321, ensuring that all electronic signatures are legally binding. Our platform supports industry standards and maintains an audit trail for each document to verify authenticity.

-

What pricing options are available for airSlate SignNow under pub 1321?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, while adhering to the principles set forth in pub 1321. Our competitive pricing allows businesses of all sizes to access efficient eSigning solutions without compromising on compliance or quality.

-

What features does airSlate SignNow offer to align with pub 1321 standards?

AirSlate SignNow provides essential features such as secure document storage, robust authentication processes, and an intuitive interface, all of which comply with pub 1321 guidelines. These features help ensure that the signing process is secure, efficient, and user-friendly.

-

How can airSlate SignNow benefit my business regarding pub 1321 compliance?

Using airSlate SignNow can elevate your business's document management processes by ensuring compliance with pub 1321. Our platform streamlines the eSigning process, reduces paper waste, and enhances efficiency, thereby supporting sustainable business practices.

-

Does airSlate SignNow integrate with other software compliant with pub 1321?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms that are also compliant with pub 1321. These integrations enable businesses to enhance their workflows and maintain regulatory compliance across all document processes.

-

Can I customize eSignatures in airSlate SignNow to comply with pub 1321?

Absolutely! AirSlate SignNow allows users to customize eSignatures, ensuring they meet the specifications required by pub 1321. This customization ensures that your documents remain compliant while also reflecting your brand identity.

Get more for Pub 1321

- Mn form ps33203

- Michigan fillable 1040ez form

- Statement of support northwest missouri state university form

- Oklahoma corporation commission forms

- Miq fee waiver form

- Fulton county schools verification of employment form

- Travel baseball sponsorship form

- Form ssa 3820 bk discontinue prior editions omb report

Find out other Pub 1321

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure