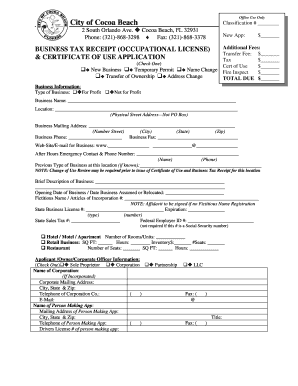

City of Cocoa Beach Business Tax Receipt Form

What is the City of Cocoa Beach Business Tax Receipt

The City of Cocoa Beach Business Tax Receipt is an official document that allows businesses to operate legally within the city limits. It serves as proof that a business has registered with the local government and has met all necessary requirements to conduct business in Cocoa Beach. This receipt is essential for compliance with local regulations and can be requested by customers or clients as verification of a business's legitimacy.

How to Obtain the City of Cocoa Beach Business Tax Receipt

To obtain a City of Cocoa Beach Business Tax Receipt, businesses must complete an application process that includes several steps. First, applicants need to gather the required documents, which typically include proof of identity, business formation documents, and any relevant licenses. Next, they must submit the application along with the applicable fees to the Cocoa Beach City Hall. The processing time may vary, so it is advisable to apply well in advance of starting operations.

Key Elements of the City of Cocoa Beach Business Tax Receipt

The City of Cocoa Beach Business Tax Receipt includes several key elements that are important for both the business owner and the local government. These elements typically consist of:

- Business Name: The registered name of the business.

- Business Address: The physical location where the business operates.

- Tax Receipt Number: A unique identifier assigned to the receipt.

- Expiration Date: The date when the receipt must be renewed.

- Owner's Information: Details about the business owner, including name and contact information.

Steps to Complete the City of Cocoa Beach Business Tax Receipt

Completing the City of Cocoa Beach Business Tax Receipt involves several steps to ensure accuracy and compliance. The process typically includes:

- Gathering necessary documentation, such as identification and business formation papers.

- Filling out the application form accurately, ensuring all information is correct.

- Submitting the application along with any required fees to the appropriate city department.

- Awaiting confirmation of receipt approval, which may involve additional communication with city officials.

Legal Use of the City of Cocoa Beach Business Tax Receipt

The legal use of the City of Cocoa Beach Business Tax Receipt is critical for operating within the law. This receipt not only legitimizes a business's operations but also provides protection against potential legal issues. Businesses are required to display their tax receipt prominently at their place of operation, and it may be requested during inspections or by customers. Failure to possess a valid tax receipt can result in fines or the closure of the business.

Required Documents for the City of Cocoa Beach Business Tax Receipt

When applying for the City of Cocoa Beach Business Tax Receipt, several documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport.

- Business formation documents, like articles of incorporation or partnership agreements.

- Any relevant state or federal licenses specific to the business type.

- Proof of zoning compliance, if applicable.

Quick guide on how to complete city of cocoa beach business tax receipt

Complete City Of Cocoa Beach Business Tax Receipt effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle City Of Cocoa Beach Business Tax Receipt on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to alter and eSign City Of Cocoa Beach Business Tax Receipt seamlessly

- Obtain City Of Cocoa Beach Business Tax Receipt and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign City Of Cocoa Beach Business Tax Receipt to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of cocoa beach business tax receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Florida business tax certificate?

A Florida business tax certificate is a legal document that permits businesses to operate within specific counties in Florida. It serves as proof that the business has registered with the local government and is compliant with tax regulations. Obtaining this certificate is essential for any business looking to establish a legitimate presence in Florida.

-

How do I apply for a Florida business tax certificate?

To apply for a Florida business tax certificate, you need to visit your local county tax collector's office or their official website. The application process typically involves filling out specific forms and providing necessary identification and business details. airSlate SignNow can streamline this process by allowing you to sign and submit required documents electronically.

-

What are the costs associated with obtaining a Florida business tax certificate?

The costs for obtaining a Florida business tax certificate vary by county and can range from $30 to $250 depending on the type of business. Additional fees may apply for renewals or late applications. It's important to check with your local tax collector's office to obtain accurate pricing information.

-

What benefits does a Florida business tax certificate provide?

A Florida business tax certificate allows you to legally operate your business, access certain government contracts, and establish credibility with customers and suppliers. It also ensures you are compliant with local tax regulations, which can help avoid legal issues or fines in the future. With the right documentation, you can also streamline your eSign processes with airSlate SignNow.

-

How often do I need to renew my Florida business tax certificate?

In Florida, business tax certificates generally need to be renewed annually or bi-annually, depending on your county's regulations. It’s crucial to keep track of your renewal date to avoid penalties or disruptions to your business operations. airSlate SignNow can assist with reminders and the renewal process, ensuring your documents are always up-to-date.

-

Can I use airSlate SignNow to manage my Florida business tax certificate?

Yes, airSlate SignNow provides a convenient way to manage documents related to your Florida business tax certificate. You can eSign, share, and store your certificate electronically, making it easily accessible when needed. This simplifies the management of all your important business documents in one secure platform.

-

What integrations does airSlate SignNow offer for business tax management?

airSlate SignNow supports various integrations with popular business applications, enabling seamless document management. You can connect it with accounting software, CRM systems, and other tools to enhance your workflow. This integration capability helps you keep your Florida business tax certificate information synchronized and accessible at all times.

Get more for City Of Cocoa Beach Business Tax Receipt

Find out other City Of Cocoa Beach Business Tax Receipt

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later