Sample Statement in Suport of Registration of U S Civil Aircraft in the Name of an Llc Form

Understanding the Sample Statement in Support of Registration of U.S. Civil Aircraft in the Name of an LLC

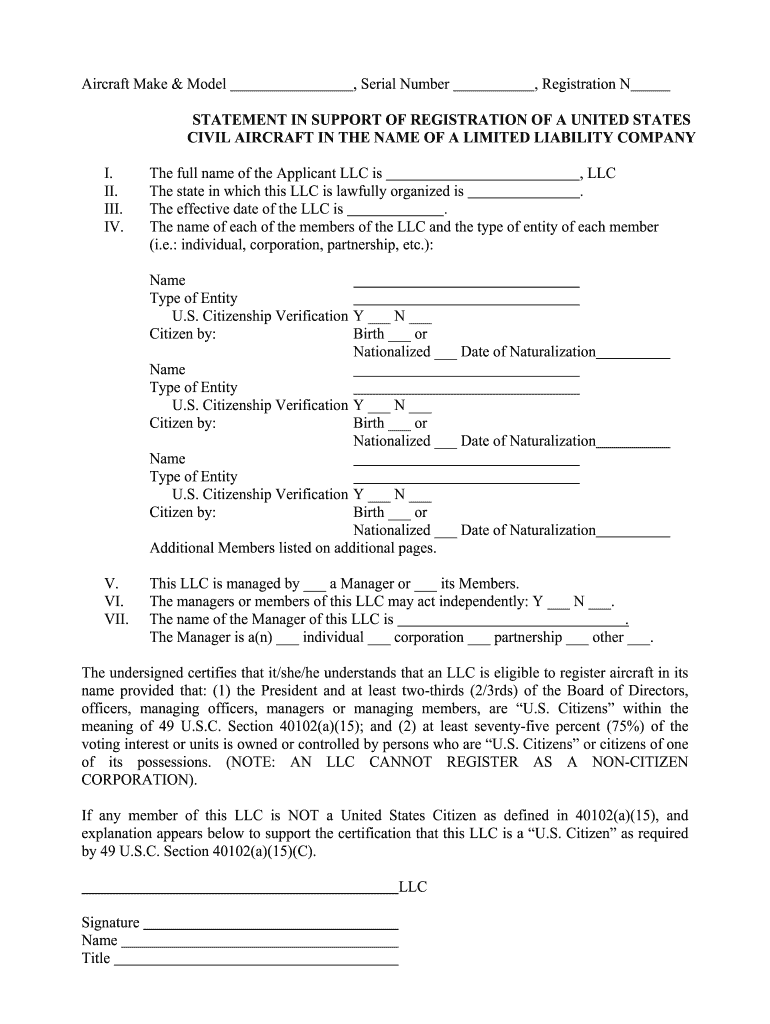

The Sample Statement in Support of Registration is a crucial document for individuals or entities looking to register a civil aircraft under an LLC. This statement serves as a formal declaration affirming the ownership of the aircraft by the LLC. It is essential to ensure that this statement meets specific legal requirements to be valid. The document typically includes details such as the name of the LLC, the aircraft's identification number, and a declaration of intent to use the aircraft for lawful purposes. Understanding this document is vital for compliance with federal regulations and for protecting the interests of the LLC.

Steps to Complete the Sample Statement in Support of Registration

Completing the Sample Statement in Support of Registration involves several key steps. First, gather all necessary information about the LLC and the aircraft. This includes the LLC's legal name, address, and the aircraft's registration details. Next, fill out the statement accurately, ensuring all information is correct and complete. After completing the document, it is advisable to review it for any errors. Once verified, the statement must be signed by an authorized representative of the LLC. Finally, submit the completed statement along with any required documents to the appropriate regulatory body.

Legal Use of the Sample Statement in Support of Registration

The legal use of the Sample Statement in Support of Registration is governed by federal aviation regulations. This document must comply with the Federal Aviation Administration (FAA) guidelines to be considered valid. It is essential that the statement is executed properly, as any discrepancies may lead to delays or rejections during the registration process. Additionally, the statement must be retained as part of the LLC's records, as it may be required for audits or legal inquiries in the future.

Key Elements of the Sample Statement in Support of Registration

Several key elements must be included in the Sample Statement in Support of Registration to ensure its validity. These elements typically consist of:

- LLC Information: The full legal name and address of the LLC.

- Aircraft Details: The aircraft's make, model, and registration number.

- Declaration of Ownership: A statement affirming the LLC's ownership of the aircraft.

- Signature: The signature of an authorized individual representing the LLC.

Inclusion of these elements ensures compliance with FAA regulations and supports the legitimacy of the registration process.

Obtaining the Sample Statement in Support of Registration

Obtaining the Sample Statement in Support of Registration can be done through several channels. Many state aviation authorities provide templates and guidelines for this statement. Additionally, legal resources and aviation industry websites may offer downloadable forms. It is advisable to use the most current version of the statement to ensure compliance with any recent regulatory changes. Consulting with a legal professional familiar with aviation law can also provide valuable insights into obtaining and completing the statement correctly.

Quick guide on how to complete faa statement in support of registration llc form nebrig

Learn how to effortlessly navigate the Sample Statement In Support Of Registration Of U S Civil Aircraft In The Name Of An LLC completion with this simple guide

E-filing and signNowing documents online is gaining traction and is the preferred choice for numerous clients. It offers many benefits over outdated paper forms, such as convenience, time savings, improved accuracy, and safety.

With solutions like airSlate SignNow, you can access, modify, sign, enhance, and send your Sample Statement In Suport Of Registration Of U S Civil Aircraft In The Name Of An Llc without the hassle of endless printing and scanning. Follow this brief guide to begin and complete your form.

Follow these instructions to obtain and complete Sample Statement In Suport Of Registration Of U S Civil Aircraft In The Name Of An Llc

- Begin by clicking on the Get Form button to access your document in our editor.

- Pay attention to the green label on the left that indicates mandatory fields to ensure you don't overlook them.

- Utilize our advanced tools to annotate, modify, sign, secure, and enhance your document.

- Secure your document or transform it into a fillable form using the appropriate tab functions.

- Review the document and check for any errors or inconsistencies.

- Click on DONE to conclude your editing.

- Rename your document or keep it as is.

- Select the storage service you wish to use to save your document, send it via USPS, or click the Download Now button to save your document.

If Sample Statement In Suport Of Registration Of U S Civil Aircraft In The Name Of An Llc isn’t what you were looking for, you can explore our vast selection of pre-uploaded templates that you can fill out with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

Can I fill out the CPT form and the registration in ICAI before the examination of 12th class? How?

First of all I would like to say that CPT is now converted into CA Foundation. I have qualified CPT exam in 2012 and many things have changed now. So, despite giving my openion and suggestion, I am sharing here the link of ICAI for your all queries related to CA course The Institute of Chartered Accountants of IndiaI am also attaching relevant pdf uploaded on ICAI for your convenience.https://resource.cdn.icai.org/45...https://resource.cdn.icai.org/45...Hope! it’ll help you :)

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Is it possible to take the entrance exam for Whistling Woods International in the month of April after filling out the online registration form by this December?

Yes. It is possible. Please let us know that when you submit your application…

-

How can I fill out the form of DTE MPonline to take admission in IET DAVV Indore? Provide the site (link).

See their is no seperate form for iet davv, you have to fill this college during the choice filling stage of counselling.The procedure for the DTE counselling is very simple thier are 3 main steps you need to follow.RegistrationChoice fillingReporting to alloted institute.For all this the website you should visit is https://dte.mponline.gov.in/port...Here at the top right corner you will see a menu as select course for counselling, click on it, select bachelor of engineering then full time and then apply online. This is how you will register for counselling.Hope it helps.Feel free to ask any other problem you face regarding counselling or college selection.

-

I want to incorporate an LLC in Delaware but I'm from out of the country. How can I do this and what are the fees associated with the registration?

The good news is there is no residency requirement for forming a Delaware Company! And, due to Delaware's electronic filing system, you can create your Delaware Limited Liability Company quite readily from the comfort of your home office wherever that may be in the world.A Certificate of Formation is filed to create a Delaware Limited Liability Company. A registered agent will need to be appointed at the time of formation. The State fee filing fee is $90.00. Registered Agent Fees vary widely. If you plan to prepare your own certificate, a template of this document can be found on the State's website at www.http://corp.delaware.gov/corpforms.shtml . An attorney can also assist with document preparation and filing if you require more specialized assistance. Yet another option is to have a registered agent/filing service make the filing for you. Ongoing costs to maintain your Delaware Limited Liability Company include registered agent fees and annual franchise tax. The LLC Franchise Tax is currently a flat fee of $300.00, due by June 1, one year in the arrears. There may be other responsibilities for the company to pursue including applying for an EIN, opening a bank account, obtaining business/professional licensing and registering in other jurisdictions where the company is doing business. You can find additional information about steps to take after formation by clicking on the following link to Delaware Intercorp's website-WhatElseWillINeed

Create this form in 5 minutes!

How to create an eSignature for the faa statement in support of registration llc form nebrig

How to generate an eSignature for the Faa Statement In Support Of Registration Llc Form Nebrig online

How to make an eSignature for your Faa Statement In Support Of Registration Llc Form Nebrig in Google Chrome

How to generate an electronic signature for signing the Faa Statement In Support Of Registration Llc Form Nebrig in Gmail

How to make an eSignature for the Faa Statement In Support Of Registration Llc Form Nebrig from your mobile device

How to make an eSignature for the Faa Statement In Support Of Registration Llc Form Nebrig on iOS

How to make an eSignature for the Faa Statement In Support Of Registration Llc Form Nebrig on Android

People also ask

-

What is statement registration aircraft?

Statement registration aircraft refers to the formal process of registering an aircraft to ensure its legal ownership and compliance with aviation regulations. This process is essential for operators and owners who want to secure the necessary certifications and protections while flying.

-

How does airSlate SignNow facilitate statement registration aircraft?

airSlate SignNow streamlines the statement registration aircraft process by providing a platform to easily eSign and send documents securely. Our solution simplifies the necessary paperwork, reducing the time and effort needed to complete the registration process.

-

What features does SignNow offer for document management of statement registration aircraft?

SignNow offers a variety of features, including customizable templates, secure document storage, and real-time collaboration to assist with statement registration aircraft documentation. These tools ensure all parties can seamlessly engage and finalize registration quickly and efficiently.

-

Is airSlate SignNow cost-effective for statement registration aircraft?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing statement registration aircraft. With flexible pricing plans and a focus on reducing administrative costs, it provides excellent value for businesses looking to streamline their document workflows.

-

Can airSlate SignNow integrate with other platforms for statement registration aircraft?

Absolutely! airSlate SignNow offers various integrations with popular business applications, enhancing your ability to manage statement registration aircraft alongside your existing systems. This allows for a seamless workflow across different platforms, improving efficiency and productivity.

-

What are the benefits of using airSlate SignNow for statement registration aircraft?

Using airSlate SignNow for statement registration aircraft brings numerous benefits, including increased accuracy in documentation, reduced turnaround times, and enhanced collaboration among stakeholders. This ensures that you are always compliant while enjoying a hassle-free registration experience.

-

How secure is airSlate SignNow for handling statement registration aircraft documents?

airSlate SignNow prioritizes security, employing advanced encryption and data protection measures for all documents relating to statement registration aircraft. Our platform complies with industry standards to ensure that your sensitive information remains safe and confidential.

Get more for Sample Statement In Suport Of Registration Of U S Civil Aircraft In The Name Of An Llc

- Bishop state community college dosage cal review booklet form

- Wedding ceremony worksheet form

- Handwriting without tears developmental teaching order form

- Jbs pilgrims pride paperless pay stub login form

- Tdsb transcript request form

- Dd form 2275

- Corporate sponsorship form cedar ridge high volleyball

- Parental custody agreement template form

Find out other Sample Statement In Suport Of Registration Of U S Civil Aircraft In The Name Of An Llc

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe