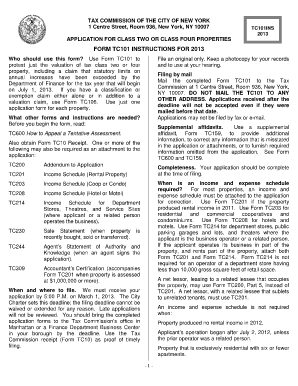

Tc101 Form

What is the TC101 Form

The TC101 form is a document used primarily in the context of tax reporting and compliance within the United States. It serves as a vital tool for individuals and businesses to report specific financial information to the relevant tax authorities. This form is particularly important for ensuring that all parties involved meet their legal obligations regarding income reporting and tax liabilities. Understanding the purpose and requirements of the TC101 form is essential for accurate and timely tax filing.

How to Use the TC101 Form

Using the TC101 form involves several straightforward steps. Initially, it is crucial to gather all necessary financial information required to complete the form accurately. This includes income details, deductions, and any other relevant financial data. Once you have the information, fill out the form carefully, ensuring all sections are completed. After filling it out, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and submit the TC101 form securely.

Steps to Complete the TC101 Form

Completing the TC101 form can be broken down into a series of methodical steps:

- Gather all required financial documents, including income statements and previous tax returns.

- Access the TC101 form through a reliable source or digital platform.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Provide detailed financial information as required, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the TC101 form through the designated method, whether online, by mail, or in person.

Legal Use of the TC101 Form

The TC101 form is legally binding when completed and submitted according to the established guidelines set forth by the IRS and state tax authorities. To ensure its legal standing, it must be filled out accurately and submitted by the appropriate deadlines. Additionally, using a secure platform for electronic submission can enhance the form's legitimacy, as it complies with federal eSignature laws. Understanding the legal implications of the TC101 form is essential for both individuals and businesses to avoid potential penalties.

Key Elements of the TC101 Form

Several key elements are essential to the TC101 form, which include:

- Personal Information: This includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Income Details: Accurate reporting of all income sources is crucial for compliance.

- Deductions and Credits: Properly documenting any deductions or credits can significantly impact tax liability.

- Signature: A signature, whether physical or electronic, is necessary to validate the submission.

Form Submission Methods

The TC101 form can be submitted through various methods, ensuring flexibility for users. These methods include:

- Online Submission: Many tax authorities allow for electronic filing, which is often quicker and more efficient.

- Mail: The form can be printed and mailed to the appropriate tax office, ensuring it is sent with sufficient time to meet deadlines.

- In-Person Submission: Some individuals may choose to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete tc101 form

Complete Tc101 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary format and securely archive it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents rapidly without delays. Manage Tc101 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Tc101 Form with ease

- Obtain Tc101 Form and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or mask sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Tc101 Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tc101 form and how is it used?

The tc101 form is a document type that often requires electronic signatures in various business operations. It serves as a formal request that can be quickly signed and returned using solutions like airSlate SignNow. By utilizing our platform, users can easily manage and process tc101 forms electronically, ensuring a fast and efficient workflow.

-

How does airSlate SignNow support the tc101 form signing process?

airSlate SignNow simplifies the signing process for tc101 forms with its user-friendly interface and robust features. Users can send, receive, and eSign these forms within minutes, reducing paperwork and improving productivity. Our solution also allows tracking and managing multiple tc101 forms seamlessly.

-

What are the pricing options for using airSlate SignNow with tc101 forms?

AirSlate SignNow offers flexible pricing plans that accommodate different business needs when handling tc101 forms. Whether you are a small business or a large enterprise, we have tailored plans to suit various levels of documentation and signing requirements. Detailed pricing information can be found on our website.

-

Can I integrate other applications with airSlate SignNow for tc101 form management?

Yes, airSlate SignNow supports integration with various applications, enhancing the management of tc101 forms. You can connect our platform with tools like Google Drive, Dropbox, and Salesforce for a more streamlined approach to handling documents. This integration helps ensure that your tc101 forms are easily accessible and efficiently managed.

-

What are the key features of airSlate SignNow for handling tc101 forms?

AirSlate SignNow offers several key features for managing tc101 forms, including easy document creation, customizable templates, and real-time tracking. Users can also utilize bulk sending and advanced security measures to protect sensitive information within these forms. Our platform ensures an efficient process from start to finish.

-

How does using airSlate SignNow benefit my business when processing tc101 forms?

Using airSlate SignNow for processing tc101 forms can signNowly reduce the time and costs associated with traditional paperwork. The electronic signing process is not only faster but also enhances accuracy and compliance. Additionally, you gain better visibility into your document workflows, leading to improved overall efficiency.

-

Is it safe to use airSlate SignNow for tc101 forms?

Absolutely! AirSlate SignNow prioritizes security when it comes to processing tc101 forms. Our platform employs advanced encryption methods and complies with industry standards to ensure that all document transactions are secure and confidential.

Get more for Tc101 Form

- Special consideration rmit form

- Print the application arkids first form

- Small employer uniform employee application for group health insurance wisconsin

- Credit reference request form

- Dentist w9 form

- Social history template 404210987 form

- Agreement for direct deposit form uib 1091a

- Business partnership buyout agreement template form

Find out other Tc101 Form

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed