Us Tax Court Form 5

What is the Us Tax Court Form 5

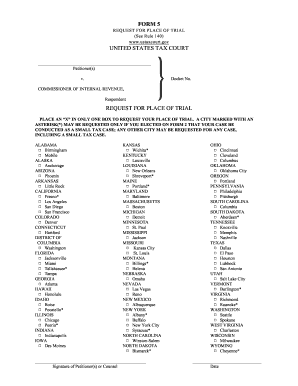

The Us Tax Court Form 5 is a specific document used in U.S. tax proceedings. This form is primarily utilized by taxpayers who wish to appeal a decision made by the Internal Revenue Service (IRS) regarding their tax liabilities. It serves as a formal request for the Tax Court to review and potentially reverse the IRS's decision. Understanding this form is crucial for anyone navigating disputes with the IRS, as it outlines the taxpayer's position and the grounds for appeal.

How to use the Us Tax Court Form 5

Using the Us Tax Court Form 5 involves several key steps. First, ensure that you have a clear understanding of the IRS decision you are contesting. Next, complete the form by providing accurate information regarding your case, including your personal details and the specific issues you are appealing. It is important to follow the instructions carefully to avoid delays. Once completed, the form must be filed with the Tax Court, along with any required documentation that supports your appeal.

Steps to complete the Us Tax Court Form 5

Completing the Us Tax Court Form 5 requires careful attention to detail. Here are the essential steps:

- Begin by gathering all relevant information, including your IRS notice and any supporting documents.

- Fill out the form with your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reasons for your appeal, referencing specific tax laws or IRS regulations as applicable.

- Review the form for accuracy and completeness before submitting it.

- File the form with the Tax Court, ensuring you meet any deadlines associated with your appeal.

Legal use of the Us Tax Court Form 5

The Us Tax Court Form 5 has legal significance as it initiates the formal appeal process against IRS decisions. To be legally binding, the form must be completed accurately and submitted within the stipulated time frames. Compliance with all procedural rules is essential for the court to consider your appeal. Additionally, it is advisable to keep copies of all documents submitted and received for your records.

Filing Deadlines / Important Dates

Timeliness is critical when filing the Us Tax Court Form 5. Generally, taxpayers have a limited window to file their appeal after receiving a notice from the IRS. This period is typically ninety days from the date of the notice. Missing this deadline can result in the loss of the right to contest the IRS's decision. Therefore, it is essential to be aware of all relevant dates and ensure that the form is filed promptly.

Required Documents

When filing the Us Tax Court Form 5, certain documents are necessary to support your appeal. These may include:

- A copy of the IRS notice you are appealing.

- Any relevant tax returns or financial statements.

- Supporting evidence that substantiates your claims or arguments.

Having these documents ready can streamline the filing process and strengthen your case before the Tax Court.

Quick guide on how to complete us tax court form 5

Prepare Us Tax Court Form 5 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Us Tax Court Form 5 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Us Tax Court Form 5 effortlessly

- Locate Us Tax Court Form 5 and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your edits.

- Choose your preferred method of submitting your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign Us Tax Court Form 5 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the us tax court form 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Us Tax Court Form 5, and how can airSlate SignNow help?

The Us Tax Court Form 5 is required for certain tax-related cases. Using airSlate SignNow, you can easily prepare, send, and eSign this form, ensuring accuracy and compliance while saving time and reducing errors in the processing.

-

Are there any costs associated with using airSlate SignNow for the Us Tax Court Form 5?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can efficiently manage the Us Tax Court Form 5 without incurring high costs, making it a cost-effective solution for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other applications for processing the Us Tax Court Form 5?

Yes, airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and more. This allows you to streamline your workflow and easily access the Us Tax Court Form 5 alongside your other documents.

-

What features does airSlate SignNow offer for the Us Tax Court Form 5?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for the Us Tax Court Form 5. These features enhance the document management process and ensure all your documents are organized and easily accessible.

-

Is it easy to eSign the Us Tax Court Form 5 with airSlate SignNow?

Absolutely! With airSlate SignNow, eSigning the Us Tax Court Form 5 is straightforward and user-friendly. You just upload the document, add digital signatures, and send it out, ensuring a smooth and efficient experience.

-

What benefits does airSlate SignNow provide for submitting the Us Tax Court Form 5?

Using airSlate SignNow to submit the Us Tax Court Form 5 ensures timely submissions, reduced paperwork, and improved compliance tracking. These benefits contribute to a more efficient handling of tax-related documents.

-

How does airSlate SignNow ensure the security of the Us Tax Court Form 5?

AirSlate SignNow prioritizes your security by using industry-standard encryption for all documents, including the Us Tax Court Form 5. This ensures that your sensitive tax information is kept safe and secure throughout the eSigning process.

Get more for Us Tax Court Form 5

- Bescheinigung f r arbeitnehmerinnen pdf dokument elterngeld form

- Nf3 form

- Michigan security deposit demand letter form

- Lc 95 form

- Colorado auto bill of sale jefferson county form

- Patient positioning chart form

- Light switch template form

- Julie walpert nyc department of housing preservation ampamp form

Find out other Us Tax Court Form 5

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile