PA 40 Payment Voucher PA V Pennsylvania's Enterprise Form

What is the PA 40 Payment Voucher PA V Pennsylvania's Enterprise

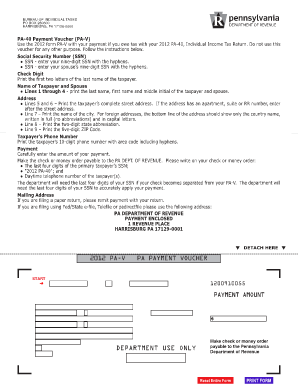

The PA 40 Payment Voucher PA V is a crucial document used by residents of Pennsylvania to submit their personal income tax payments. This form is specifically designed for individuals who are required to make estimated tax payments or pay their tax due when filing their annual tax return. It serves as a means for taxpayers to ensure that their payments are processed correctly by the Pennsylvania Department of Revenue.

How to use the PA 40 Payment Voucher PA V Pennsylvania's Enterprise

Using the PA 40 Payment Voucher PA V involves several straightforward steps. Taxpayers must first complete the voucher by providing their personal information, including name, address, and Social Security number. After filling out the necessary details, individuals should indicate the amount they are paying and the tax year associated with the payment. Once completed, the voucher can be submitted along with the payment to the appropriate address specified by the Pennsylvania Department of Revenue.

Steps to complete the PA 40 Payment Voucher PA V Pennsylvania's Enterprise

Completing the PA 40 Payment Voucher PA V is a systematic process. Here are the steps to follow:

- Download the PA 40 Payment Voucher PA V form from the Pennsylvania Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the payment amount and the corresponding tax year.

- Review the information for accuracy to prevent any issues with processing.

- Sign and date the voucher to validate your payment.

- Mail the completed voucher along with your payment to the designated address.

Legal use of the PA 40 Payment Voucher PA V Pennsylvania's Enterprise

The PA 40 Payment Voucher PA V is legally recognized as a valid method for submitting tax payments in Pennsylvania. To ensure its legal standing, taxpayers must complete the form accurately and submit it by the required deadlines. Adhering to the guidelines set forth by the Pennsylvania Department of Revenue is essential for maintaining compliance and avoiding potential penalties.

Key elements of the PA 40 Payment Voucher PA V Pennsylvania's Enterprise

Several key elements are vital when completing the PA 40 Payment Voucher PA V. These include:

- Personal Information: Accurate details such as name, address, and Social Security number.

- Payment Amount: The specific amount being submitted for tax payment.

- Tax Year: The year for which the payment is being made.

- Signature: A signature is required to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the PA 40 Payment Voucher PA V are crucial for taxpayers to note. Generally, payments are due on April 15 for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to stay informed about any changes to deadlines to ensure timely submissions and avoid penalties.

Quick guide on how to complete pa 40 payment voucher pa v pennsylvanias enterprise

Prepare PA 40 Payment Voucher PA V Pennsylvania's Enterprise easily on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage PA 40 Payment Voucher PA V Pennsylvania's Enterprise on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign PA 40 Payment Voucher PA V Pennsylvania's Enterprise effortlessly

- Find PA 40 Payment Voucher PA V Pennsylvania's Enterprise and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize crucial sections of the documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review the details and then hit the Done button to save your modifications.

- Choose how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and eSign PA 40 Payment Voucher PA V Pennsylvania's Enterprise and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 40 payment voucher pa v pennsylvanias enterprise

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 40 Payment Voucher PA V and how is it used?

The PA 40 Payment Voucher PA V is a form used by businesses and individuals in Pennsylvania to make estimated tax payments. This voucher helps ensure timely tax payments and can streamline the filing process, making it easier for Pennsylvania's Enterprise to stay compliant with state tax laws.

-

How can airSlate SignNow help me with the PA 40 Payment Voucher PA V?

airSlate SignNow provides an easy-to-use platform that allows you to electronically sign and send the PA 40 Payment Voucher PA V. With our efficient document management, you can complete and submit your payment voucher quickly, minimizing the risk of delays or errors in your tax payments.

-

What are the benefits of using airSlate SignNow for the PA 40 Payment Voucher PA V?

By using airSlate SignNow for the PA 40 Payment Voucher PA V, you'll benefit from streamlined document processes, secure e-signatures, and quick turnaround times. This solution is particularly advantageous for Pennsylvania's Enterprise, allowing businesses to save time and reduce paperwork.

-

Is airSlate SignNow affordable for small businesses dealing with PA 40 Payment Voucher PA V?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to the needs of small businesses managing the PA 40 Payment Voucher PA V. With different subscription levels, you can find a plan that fits your budget while providing the features necessary to handle your documents efficiently.

-

Are there any integrations available with airSlate SignNow for PA 40 Payment Voucher PA V?

airSlate SignNow offers numerous integrations with popular business applications, making it easier for users to manage the PA 40 Payment Voucher PA V seamlessly. This flexibility allows you to link your document management with tools you already use, enhancing your overall efficiency.

-

How does airSlate SignNow ensure the security of the PA 40 Payment Voucher PA V?

airSlate SignNow prioritizes security with features like document encryption, secure e-signatures, and compliance with industry standards. This ensures that your PA 40 Payment Voucher PA V and sensitive information remain protected during the signing and submission process.

-

Can I track the status of my PA 40 Payment Voucher PA V with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your PA 40 Payment Voucher PA V in real-time. Notifications and updates keep you informed, ensuring that you know when your document has been viewed, signed, or completed.

Get more for PA 40 Payment Voucher PA V Pennsylvania's Enterprise

- Shooting for perfection form

- Denominators for intensive care unit form

- Exotic dancer contract template form

- Vessel registration application georgia dnr wildlife resources form

- Emaar alterations department form

- Certification of health care provider for family members serious health condition fmla form 2678

- Identogo binghamton ny form

- Request for nys fingerprinting services child care form

Find out other PA 40 Payment Voucher PA V Pennsylvania's Enterprise

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF