Daughters of the American Revolution Member 2015-2026

Understanding the Daughters of the American Revolution Member

The Daughters of the American Revolution (DAR) is a lineage-based membership organization for women who are directly descended from individuals involved in the American Revolution. Membership in the DAR provides a unique opportunity to connect with history, engage in community service, and promote patriotism. Members often participate in various activities, including educational programs, historical preservation, and charitable work, all while fostering a sense of camaraderie among fellow members.

Steps to Complete the Daughters of the American Revolution Member Application

To become a member of the Daughters of the American Revolution, you must follow a series of steps to ensure your application is complete and accurate:

- Research your lineage to confirm your descent from a Revolutionary War patriot.

- Gather necessary documentation, such as birth certificates, marriage licenses, and proof of lineage.

- Complete the membership application form, ensuring all information is accurate and thorough.

- Submit your application along with the required documentation to your local DAR chapter.

- Await notification regarding the status of your application, which may include an interview or additional documentation requests.

Legal Use of the Daughters of the American Revolution Member

Membership in the Daughters of the American Revolution is not only a recognition of lineage but also comes with certain legal implications. Members are encouraged to use their affiliation responsibly, particularly when representing the organization in public or private events. It is essential to adhere to the guidelines set forth by the DAR regarding the use of the organization’s name, symbols, and resources to maintain the integrity and reputation of the society.

Key Elements of the Daughters of the American Revolution Member

Several key elements define the experience and responsibilities of a DAR member:

- Patriotism: Members are expected to promote and support patriotic endeavors.

- Community Service: Active participation in community service projects is encouraged.

- Historical Preservation: Members often engage in efforts to preserve historical sites and educate the public about American history.

- Networking: Membership provides opportunities to connect with like-minded individuals who share a passion for history and service.

Eligibility Criteria for Daughters of the American Revolution Membership

To qualify for membership in the Daughters of the American Revolution, applicants must meet specific eligibility criteria:

- Be a woman aged eighteen or older.

- Provide proof of direct descent from a patriot who contributed to the American Revolution.

- Demonstrate a commitment to the principles of the DAR, including patriotism, education, and historic preservation.

Examples of Using the Daughters of the American Revolution Member Benefits

Members of the Daughters of the American Revolution can take advantage of various benefits that enhance their experience:

- Access to exclusive educational resources and historical archives.

- Opportunities to participate in national and local events, including conferences and commemorations.

- Networking with other members for personal and professional growth.

- Participation in scholarship programs for descendants and community members.

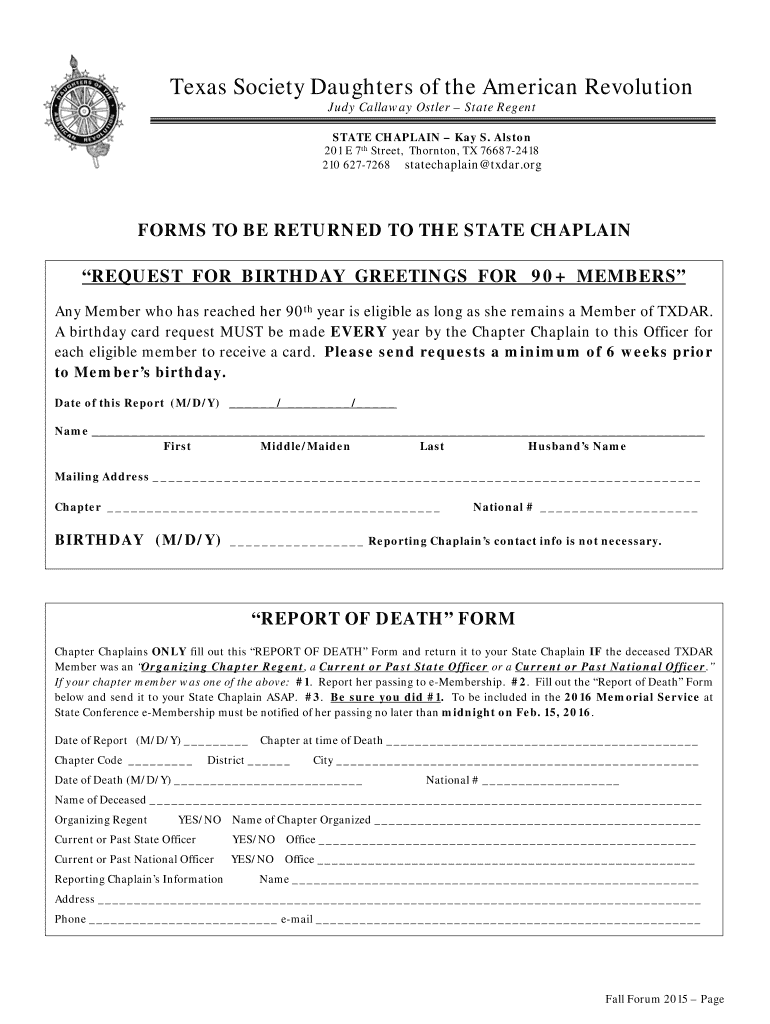

Quick guide on how to complete texas society daughters of the american revolution member txdar

Effortlessly Prepare Daughters Of The American Revolution Member on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Daughters Of The American Revolution Member on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and eSign Daughters Of The American Revolution Member with Ease

- Find Daughters Of The American Revolution Member and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Daughters Of The American Revolution Member to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How has being incarcerated affected you? How has coming out of the prison system been, and how difficult has it been to re-enter into society? Do you feel that mass incarceration of African Americans is a new form of slavery?

While I have never been in prison, I have a background working in addictions and with parolees.First things first - Prison as a new form of slavery. Actually, the 14th Amendment constitutionally banning slavery SPECIFICALLY excludes prisoners when it bans ‘hard labor’ and ‘involuntary servitude’. it’s not a new form of slavery - constitutionally its always been there. To this day, there are states which require inmates to work, but don’t pay them. Other states who give inmates something like 60 cents/day for 8 hours of hard work. This is totally legal and consititional.When you ask specifically about African Americans - you may find books like ‘The Rich Get Richer: The Poor Get Prison’ or ‘The New Jim Crow’ contain enlightening information.As to transitioning back into society. The US has one of the highest recidivism rates for numerous reasons. However, this varies by state. Oregon has a fairly low recidivism rate (40% re-arrest rate) - while some states it’s as high as 90%. It all depends on the transitional and re-integration programs available in the state.For an individual, the transition back into society is all dependent on the support they have when they are released.

Create this form in 5 minutes!

How to create an eSignature for the texas society daughters of the american revolution member txdar

How to create an eSignature for your Texas Society Daughters Of The American Revolution Member Txdar in the online mode

How to create an eSignature for the Texas Society Daughters Of The American Revolution Member Txdar in Chrome

How to create an electronic signature for putting it on the Texas Society Daughters Of The American Revolution Member Txdar in Gmail

How to generate an electronic signature for the Texas Society Daughters Of The American Revolution Member Txdar right from your smart phone

How to generate an electronic signature for the Texas Society Daughters Of The American Revolution Member Txdar on iOS

How to create an electronic signature for the Texas Society Daughters Of The American Revolution Member Txdar on Android OS

People also ask

-

What is the txdar member login for airSlate SignNow?

The txdar member login is your gateway to accessing airSlate SignNow’s features tailored for TXDAR members. By using this login, you can manage your documents, send eSignatures, and track the status of your transactions seamlessly. Ensure that your credentials are secure for a smooth experience.

-

How can I reset my txdar member login password?

To reset your txdar member login password, visit the login page of airSlate SignNow and click on 'Forgot Password?'. You will receive an email with a link to create a new password. Make sure to choose a strong password to enhance your account security.

-

Is there a cost associated with the txdar member login?

The txdar member login provides access to airSlate SignNow’s features, and pricing depends on the specific plan you choose. Plans may vary based on the features you need, from basic eSignature capabilities to advanced workflow automation. Visit the pricing page for detailed information.

-

What features are available through the txdar member login?

With your txdar member login, you'll unlock a variety of features on airSlate SignNow, including document sharing, eSigning, and real-time tracking. Additionally, you can access templates and set up automated workflows to streamline your document management process. Enjoy an easy and efficient experience.

-

Can I integrate other applications with my txdar member login?

Yes, airSlate SignNow supports numerous integrations that can be accessed via your txdar member login. You can connect tools like Google Drive, Salesforce, and many others to enhance functionality and streamline your workflow. Check the integrations page for a complete list of compatible applications.

-

What are the benefits of using airSlate SignNow with a txdar member login?

Using airSlate SignNow with your txdar member login offers a cost-effective solution for managing documents and eSignatures. It simplifies the signing process, reduces turnaround time, and enhances productivity while ensuring compliance and security. Empower your business operations with these robust benefits.

-

Is training available for using the txdar member login effectively?

Yes, airSlate SignNow provides resources and support to help you make the most of your txdar member login. You can access tutorials, webinars, and customer support for any questions you may have. This ensures that you feel confident and equipped to utilize all available features.

Get more for Daughters Of The American Revolution Member

- Software evaluation checklist template 18514807 form

- Liv application form

- Application for review of technical reports and import ladbs org ladbs form

- Nmb kyc form

- Saudi airlines baggage tracking form

- Location and directions judy ampamp arthur zankel hall new york form

- Rental deposit agreement template form

- Rental document agreement template form

Find out other Daughters Of The American Revolution Member

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template