Webster Parish Sales Tax 2005

What is the Webster Parish Sales Tax

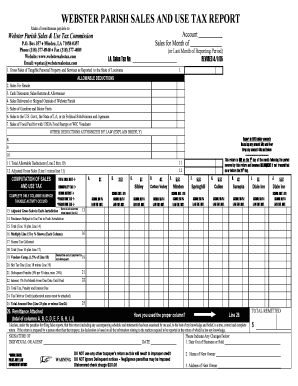

The Webster Parish sales tax is a tax imposed on the sale of goods and services within Webster Parish, Louisiana. This tax is collected by local businesses at the point of sale and is an essential source of revenue for the parish government. The sales tax rate can vary based on the type of goods or services sold, and it is crucial for businesses to understand the applicable rates to ensure compliance. The revenue generated from this tax is typically used to fund local services, infrastructure projects, and community programs.

How to use the Webster Parish Sales Tax

Using the Webster Parish sales tax involves understanding when and how to apply it during transactions. Businesses must charge the sales tax on taxable items sold to customers. This includes most retail sales, leases, and rentals of tangible personal property. It is important for businesses to keep accurate records of sales and the taxes collected to facilitate proper reporting and remittance to the parish authorities.

Steps to complete the Webster Parish Sales Tax

Completing the Webster Parish sales tax process involves several key steps:

- Determine the applicable sales tax rate based on the type of goods or services sold.

- Collect the sales tax from customers at the point of sale.

- Maintain accurate records of all sales and taxes collected.

- Prepare and submit the sales tax return to the Webster Parish tax authority by the designated deadline.

- Remit the collected sales tax to the parish as required.

Legal use of the Webster Parish Sales Tax

The legal use of the Webster Parish sales tax is governed by state and local tax laws. Businesses must comply with these regulations to avoid penalties. This includes correctly collecting the tax, filing returns on time, and remitting the collected taxes to the appropriate authorities. Understanding the legal framework surrounding the sales tax is essential for ensuring compliance and avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Webster Parish sales tax are critical for businesses to adhere to in order to maintain compliance. Typically, sales tax returns are due on a monthly or quarterly basis, depending on the volume of sales. Businesses should be aware of specific due dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely filing and payment.

Required Documents

To complete the Webster Parish sales tax filing process, businesses need to gather specific documents, including:

- Sales records that detail all transactions made during the reporting period.

- Invoices issued to customers, which should reflect the sales tax collected.

- Any previous sales tax returns filed, which can serve as a reference for current filings.

Penalties for Non-Compliance

Failure to comply with the Webster Parish sales tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to stay informed about their tax obligations and ensure timely filing and payment to avoid these consequences. Understanding the risks associated with non-compliance is essential for maintaining a successful business operation.

Quick guide on how to complete webster parish sales tax

Effortlessly Prepare Webster Parish Sales Tax on Any Device

Online document management has become increasingly embraced by businesses and individuals alike. It offers a flawless eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle Webster Parish Sales Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Webster Parish Sales Tax with Ease

- Obtain Webster Parish Sales Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which requires only seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Modify and eSign Webster Parish Sales Tax and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct webster parish sales tax

Create this form in 5 minutes!

How to create an eSignature for the webster parish sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the webster parish sales tax rate?

The current Webster Parish sales tax rate varies depending on the jurisdiction within the parish. It typically includes a combination of state and local taxes that can affect your overall rate. It’s essential to check with local authorities to ensure you are compliant with the latest webster parish sales tax regulations.

-

How can airSlate SignNow help with managing webster parish sales tax?

AirSlate SignNow provides businesses with the tools to seamlessly manage their sales tax documents, including those related to webster parish sales tax. With our eSigning solution, you can easily prepare, send, and securely store your sales tax documents, thus ensuring you stay organized and compliant. This ease of use can help alleviate the stress often associated with tax documentation.

-

Are there additional fees associated with webster parish sales tax forms?

Typically, filing webster parish sales tax forms may come with associated state or local fees, depending on your business structure. Using airSlate SignNow can help streamline the process, but be sure to check with your local tax office for any specific fees related to filing in your jurisdiction. Our software ensures that all documents are easily accessible for review before submission.

-

What features does airSlate SignNow offer for businesses dealing with webster parish sales tax?

AirSlate SignNow offers several essential features, including templates for sales tax documents, customizable workflows, and secure storage solutions. These features simplify the process of preparing and signing webster parish sales tax forms, allowing businesses to focus on growth rather than paperwork. Additionally, our audit trail ensures that all actions taken on documents are tracked for compliance purposes.

-

Can I integrate airSlate SignNow with my accounting software for webster parish sales tax filings?

Yes, airSlate SignNow integrates with various accounting software solutions, allowing seamless management of webster parish sales tax filings. By linking your accounting system with our eSignature platform, you can streamline your financial processes, maintain accurate records, and ensure timely filings. This integration enhances efficiency and ensures you remain compliant with local sales tax regulations.

-

What benefits does using airSlate SignNow provide for webster parish sales tax compliance?

Using airSlate SignNow assists businesses in ensuring compliance with webster parish sales tax regulations through efficient documentation management and secure eSigning capabilities. Our platform reduces the chances of errors in preparation and filing, thereby minimizing the risk of penalties. Furthermore, our user-friendly interface allows team members to collaborate easily, ensuring that all necessary signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for managing webster parish sales tax documents?

Absolutely, airSlate SignNow is designed to be a cost-effective solution for managing various types of documents, including those associated with webster parish sales tax. Our flexible pricing plans cater to businesses of all sizes, allowing you to choose a package that best fits your needs. By reducing time spent on paperwork, our platform ultimately saves you money and improves operational efficiency.

Get more for Webster Parish Sales Tax

Find out other Webster Parish Sales Tax

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract