What is a 592 B Form

What is the 592 B Form?

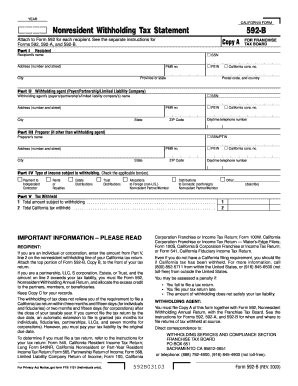

The 592 B Form is a tax document used in the United States, specifically for reporting California source income paid to non-residents. This form is essential for businesses that make payments to individuals or entities outside of California. It helps ensure compliance with state tax regulations by detailing the income that must be reported to the Franchise Tax Board (FTB). The 592 B Form is part of the broader 592 series, which includes other forms related to withholding and reporting for non-residents.

How to use the 592 B Form

To use the 592 B Form effectively, businesses must first determine if they have made payments to non-residents that require reporting. This includes payments for services rendered, rents, royalties, or other forms of income. Once it is established that the form is necessary, the payer must complete the form with accurate details about the recipient, the amount paid, and any applicable withholding. After filling out the form, it should be submitted to the FTB along with any required payments or additional documentation.

Steps to complete the 592 B Form

Completing the 592 B Form involves several key steps:

- Gather necessary information about the non-resident recipient, including their name, address, and taxpayer identification number.

- Calculate the total amount of California source income paid to the non-resident.

- Complete the form by entering the required information in the designated fields, ensuring accuracy to avoid penalties.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the FTB by the specified deadline, along with any required payments.

Legal use of the 592 B Form

The legal use of the 592 B Form is governed by California tax laws. It is crucial for businesses to comply with these regulations to avoid penalties. The form serves as an official record of income paid to non-residents and is necessary for proper tax withholding. Failure to file the form correctly or on time can result in fines and interest charges. Therefore, understanding the legal implications of this form is essential for any business operating in California.

Key elements of the 592 B Form

The 592 B Form includes several key elements that must be accurately reported:

- Recipient Information: This includes the name, address, and taxpayer identification number of the non-resident.

- Income Amount: The total California source income paid to the recipient must be clearly stated.

- Withholding Amount: If applicable, the amount of state tax withheld from the payment should be included.

- Signature: The form must be signed by the payer or an authorized representative to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 592 B Form are critical for compliance. Generally, the form must be submitted to the FTB by January thirty-first of the year following the payment. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying aware of these dates is essential to avoid penalties and ensure timely reporting of non-resident income.

Quick guide on how to complete what is a 592 b form

Prepare What Is A 592 B Form effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle What Is A 592 B Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign What Is A 592 B Form with ease

- Find What Is A 592 B Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign What Is A 592 B Form while ensuring seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is a 592 b form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Is A 592 B Form?

The 592 B Form is a tax form used by California to report withholding for certain payments made to non-residents. It helps businesses comply with state tax regulations regarding income paid to individuals not residing in California. Understanding what a 592 B Form entails ensures you stay compliant and avoid potential penalties.

-

How can I utilize airSlate SignNow for sending a 592 B Form?

You can easily send a 592 B Form using airSlate SignNow’s user-friendly platform. Simply upload your document, add the necessary signers, and send it out for eSigning. Our solution streamlines the process, making it quick and efficient to manage such important forms.

-

What are the benefits of using airSlate SignNow for managing forms like the 592 B?

Using airSlate SignNow for forms like the 592 B Form provides a host of benefits, including faster processing times and reduced paper usage. The ability to track signatures and automate reminders enhances efficiency, ensuring you remain compliant with tax regulations seamlessly.

-

Is airSlate SignNow compliant with legal regulations for forms like the 592 B Form?

Yes, airSlate SignNow is compliant with all legal regulations pertaining to electronic signatures and document management, including forms like the 592 B Form. Our platform adheres to the e-signature laws to provide a secure and legally-binding signing process, giving you peace of mind with your tax documents.

-

What types of integrations does airSlate SignNow offer?

airSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and Salesforce. These integrations simplify your workflow, allowing you to manage documents like the 592 B Form efficiently within your existing systems without any hassle.

-

Are there any pricing options for airSlate SignNow that accommodate small businesses needing to use the 592 B Form?

airSlate SignNow offers competitive pricing options that cater to the needs of small businesses. Our plans provide full access to all features required for managing important documents, including the 592 B Form, at a cost-effective rate tailored to budget-conscious users.

-

How does airSlate SignNow ensure the security of my 592 B Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols and secure storage methods to protect your documents, including sensitive forms like the 592 B. You can be confident that your information remains safe and secure while being processed electronically.

Get more for What Is A 592 B Form

- Field trip permission field trip form

- Driver safety plan wisconsin form

- Cns 2fls form

- Model eu health certificate form

- Aflac form s00223ca

- Sample brokerage trustspecial account columnar ledger com ohio form

- Guernsey county prevention retention and contingency program prc application form

- Volleyball rotation sheet blank pdf fill online printable form

Find out other What Is A 592 B Form

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney