Sc1065 K 1partners Share of Southcarolina Income Etc Form

What is the SC1065 K-1 Partners Share of South Carolina Income Etc Form

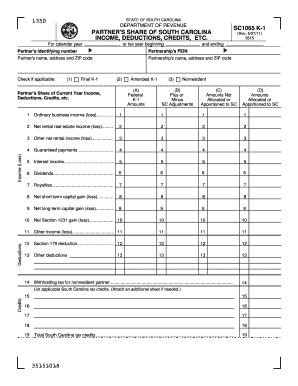

The SC1065 K-1 Partners Share of South Carolina Income Etc Form is a tax document used by partnerships to report the income, deductions, and credits allocated to each partner for state tax purposes. This form is essential for ensuring that partners accurately report their share of the partnership's income on their individual tax returns. It provides detailed information about the partner's share of income, losses, and other tax-related items, which are crucial for compliance with South Carolina tax regulations.

Steps to Complete the SC1065 K-1 Partners Share of South Carolina Income Etc Form

Completing the SC1065 K-1 form involves several key steps:

- Gather necessary information: Collect details about the partnership's income, deductions, and credits, as well as the individual partner's information.

- Fill in partner details: Enter the partner's name, address, and Social Security number or Employer Identification Number (EIN).

- Report income and deductions: Accurately allocate the partner's share of income, losses, and other tax items as per the partnership agreement.

- Review for accuracy: Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

- Distribute copies: Provide each partner with their respective K-1 form for their records and tax filing.

Legal Use of the SC1065 K-1 Partners Share of South Carolina Income Etc Form

The SC1065 K-1 form is legally required for partnerships operating in South Carolina to report income and allocate it among partners. This form must be completed accurately to ensure compliance with state tax laws. Partners use the information provided on the K-1 to report their income on their individual tax returns. Failing to file this form or providing incorrect information can lead to penalties and interest from the South Carolina Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the SC1065 K-1 form align with the partnership's tax return due date. Typically, partnerships must file their returns by the fifteenth day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is important for partnerships to ensure that K-1 forms are distributed to partners in a timely manner, allowing them to meet their individual tax filing deadlines.

Who Issues the Form

The SC1065 K-1 form is issued by partnerships operating in South Carolina. It is the responsibility of the partnership to prepare and distribute the K-1 forms to all partners. Each partner receives their K-1 form, which details their share of the partnership's income, deductions, and credits, enabling them to accurately report this information on their personal tax returns.

Examples of Using the SC1065 K-1 Partners Share of South Carolina Income Etc Form

Consider a partnership with three partners: Alice, Bob, and Carol. The partnership generates a total income of $300,000, with deductions amounting to $100,000. After calculating the net income of $200,000, the partnership allocates this amount equally among the three partners. Each partner would receive a SC1065 K-1 form indicating their share of $66,667 in income. This form allows each partner to report their share accurately when filing their individual tax returns.

Quick guide on how to complete sc1065 k 1partners share of southcarolina income etc form

Complete Sc1065 K 1partners Share Of Southcarolina Income Etc Form effortlessly on any gadget

Virtual document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Sc1065 K 1partners Share Of Southcarolina Income Etc Form on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to modify and eSign Sc1065 K 1partners Share Of Southcarolina Income Etc Form with ease

- Find Sc1065 K 1partners Share Of Southcarolina Income Etc Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to retain your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Modify and eSign Sc1065 K 1partners Share Of Southcarolina Income Etc Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1065 k 1partners share of southcarolina income etc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

The Sc1065 K 1partners Share Of Southcarolina Income Etc Form is a tax document used by partnerships in South Carolina to report income, deductions, and credits. It provides important information for partners to accurately report their share of the partnership income on their individual tax returns. Understanding this form is essential for compliance with South Carolina tax regulations.

-

How can airSlate SignNow help with the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

airSlate SignNow simplifies the process of completing and signing the Sc1065 K 1partners Share Of Southcarolina Income Etc Form. With our eSigning features, users can fill out the form electronically, ensuring accuracy and reducing the time spent on paperwork. Our platform also allows for easy collaboration among partners, making the entire process efficient.

-

Is there a cost associated with using airSlate SignNow for the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

Yes, there is a competitive pricing model for using airSlate SignNow. We offer various plans tailored to different business needs, ensuring cost-effectiveness for managing documents like the Sc1065 K 1partners Share Of Southcarolina Income Etc Form. You can review our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for handling tax forms like the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

airSlate SignNow offers several features that streamline the completion of tax forms such as the Sc1065 K 1partners Share Of Southcarolina Income Etc Form. Key features include customizable templates, secure cloud storage, and seamless eSigning capabilities, which help ensure that all forms are filled out correctly and filed on time.

-

Can I integrate airSlate SignNow with other accounting software for the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

Yes, airSlate SignNow supports various integrations with popular accounting and business management software. This feature allows users to easily transfer information to and from platforms frequently used for tax management, making the handling of the Sc1065 K 1partners Share Of Southcarolina Income Etc Form more efficient.

-

How secure is airSlate SignNow when handling sensitive tax documents like the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and comply with industry standards to ensure that your sensitive documents, including the Sc1065 K 1partners Share Of Southcarolina Income Etc Form, are kept safe. Our platform also offers audit trails for enhanced security and accountability.

-

What benefits does eSigning provide for the Sc1065 K 1partners Share Of Southcarolina Income Etc Form?

ESigning enhances the process of completing the Sc1065 K 1partners Share Of Southcarolina Income Etc Form by allowing partners to sign from anywhere, at any time, using any device. This convenience reduces delays in filing and improves overall collaboration among partners. Additionally, it helps eliminate the inefficiencies of printing and mailing physical documents.

Get more for Sc1065 K 1partners Share Of Southcarolina Income Etc Form

Find out other Sc1065 K 1partners Share Of Southcarolina Income Etc Form

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now