Idaho Form 41es

What is the Idaho Form 41es

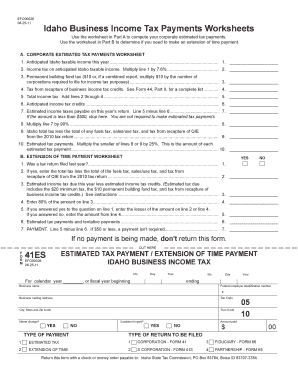

The Idaho Form 41es is a state-specific tax form used by individuals and businesses to report certain income, deductions, and tax liabilities. This form is essential for ensuring compliance with Idaho tax regulations. It is primarily utilized for reporting income earned from various sources, including wages, self-employment, and investments. Understanding the purpose and requirements of the Idaho Form 41es is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Idaho Form 41es

Using the Idaho Form 41es involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and records of any deductions you plan to claim. Next, download the form from the Idaho State Tax Commission website or access it through a digital platform that supports eSigning. After filling out the required fields, ensure that all information is accurate and complete. Finally, submit the form either electronically or by mail, adhering to the deadlines set by the state.

Steps to complete the Idaho Form 41es

Completing the Idaho Form 41es requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income statements and deduction records.

- Download the Idaho Form 41es and open it in a compatible PDF editor or eSignature platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing, ensuring that you keep a copy for your records.

Legal use of the Idaho Form 41es

The Idaho Form 41es is legally binding when completed and submitted according to state regulations. To ensure its validity, the form must be filled out accurately and submitted by the specified deadlines. Additionally, using a reliable eSignature solution, like airSlate SignNow, can enhance the legal standing of the document by providing a digital certificate and ensuring compliance with eSignature laws such as ESIGN and UETA. This is particularly important for maintaining the integrity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Idaho Form 41es are crucial for taxpayers to avoid penalties. Typically, the form is due on April 15 for individual taxpayers, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's essential to stay informed about any changes in deadlines or additional requirements set by the Idaho State Tax Commission to ensure timely filing.

Required Documents

To complete the Idaho Form 41es, several documents are necessary. These include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for reporting income from freelance work or other sources.

- Documentation for any deductions, such as receipts for business expenses or educational costs.

- Previous year’s tax return for reference and consistency.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete idaho form 41es

Effortlessly Prepare Idaho Form 41es on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Idaho Form 41es on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to Modify and eSign Idaho Form 41es Easily

- Obtain Idaho Form 41es and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Idaho Form 41es and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho form 41es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 41ES?

The Idaho Form 41ES is an estimated tax payment form used by individuals and corporations to report and pay estimated income taxes in Idaho. It’s essential for ensuring compliance with state tax regulations and avoiding penalties. Completing the Idaho Form 41ES accurately can help you manage your tax obligations effectively.

-

How can airSlate SignNow help with completing the Idaho Form 41ES?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the Idaho Form 41ES, making the process straightforward and efficient. Our solution eliminates the need for printing and mailing forms, allowing you to finalize your tax documents easily online. You can prepare the Idaho Form 41ES quickly, saving you both time and effort.

-

Is there a cost associated with using airSlate SignNow for the Idaho Form 41ES?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including features specifically designed for handling forms like the Idaho Form 41ES. Depending on the plan you choose, you will gain access to essential functionalities such as unlimited document signing and templates. Investing in airSlate SignNow is a cost-effective way to streamline your document management.

-

What features does airSlate SignNow offer for the Idaho Form 41ES?

airSlate SignNow includes features such as customizable templates, secure eSigning, and remote access, all of which enhance the process of completing the Idaho Form 41ES. Users can collaborate on documents in real-time, track the status of signatures, and ensure secure storage of sensitive information. These features make managing the Idaho Form 41ES seamless and user-friendly.

-

Can I integrate airSlate SignNow with other software when working on the Idaho Form 41ES?

Absolutely! airSlate SignNow offers integrations with popular software tools such as Google Drive, Dropbox, and various CRM systems, facilitating easy access to your documents when completing the Idaho Form 41ES. This integration capability enhances your workflow by allowing you to manage all your essential documents in one place, streamlining the overall process.

-

Is airSlate SignNow suitable for businesses handling multiple Idaho Form 41ES submissions?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it ideal for those handling multiple submissions of the Idaho Form 41ES. With features that accommodate bulk sending and management of various documents, businesses can efficiently organize and track their Idaho Form 41ES submissions without hassle. This scalability ensures that your business can grow while maintaining compliance.

-

How does eSigning improve the process of submitting Idaho Form 41ES?

eSigning with airSlate SignNow signNowly improves the process of submitting the Idaho Form 41ES by enabling quick, legally-binding signatures without the need for physical paperwork. This not only expedites the preparation and submission process but also reduces the chance of errors or lost documents. By using airSlate SignNow, you can ensure a more efficient and reliable filing of the Idaho Form 41ES.

Get more for Idaho Form 41es

- Suspension form

- How to fill out a child service report form

- Form e see rule 41 identity card sl col gujarat gov

- 4187 bah example form

- First differences worksheet form

- North carolina last will and testament templates pdf form

- Islamic will jamaat ibad ar rahman ibadarrahman form

- Report of sale of motor vehicle sp 907m form

Find out other Idaho Form 41es

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement