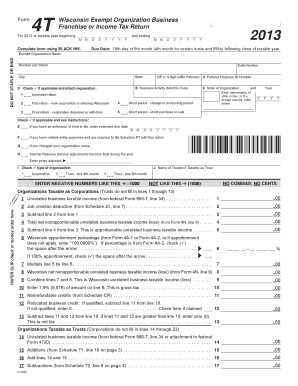

IC 002 Form 4T Wisconsin Exempt Organization Business

What is the IC 002 Form 4T Wisconsin Exempt Organization Business

The IC 002 Form 4T is a specific document used by exempt organizations in Wisconsin to report their business activities and maintain their tax-exempt status. This form is essential for organizations that qualify under IRS regulations as tax-exempt entities. It helps ensure compliance with state and federal laws, allowing organizations to operate without the burden of certain taxes. The form collects information about the organization's structure, activities, and financial status, which is crucial for transparency and accountability.

How to use the IC 002 Form 4T Wisconsin Exempt Organization Business

Using the IC 002 Form 4T involves several steps to ensure accurate completion and submission. Organizations must first gather all necessary information, including financial records and details about their operations. After filling out the form, it is important to review it for accuracy. Once confirmed, the form can be submitted either electronically or by mail, depending on the organization's preference and compliance requirements. Utilizing digital solutions can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the IC 002 Form 4T Wisconsin Exempt Organization Business

Completing the IC 002 Form 4T requires careful attention to detail. Here are the essential steps:

- Gather relevant documents, including financial statements and organizational bylaws.

- Fill out the form with accurate information about the organization's activities and finances.

- Review the completed form for any errors or omissions.

- Choose a submission method: online or by mail.

- Submit the form by the designated deadline to ensure compliance.

Legal use of the IC 002 Form 4T Wisconsin Exempt Organization Business

The legal use of the IC 002 Form 4T is governed by both state and federal regulations. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status. The form serves as a declaration of the organization's compliance with applicable laws, making it a critical document for maintaining legitimacy and operational integrity.

Key elements of the IC 002 Form 4T Wisconsin Exempt Organization Business

Key elements of the IC 002 Form 4T include sections that require detailed information about the organization's mission, activities, and financial performance. These elements typically encompass:

- Organization name and contact information.

- Description of activities conducted during the reporting period.

- Financial data, including income and expenditures.

- Details on governance and management structure.

Filing Deadlines / Important Dates

Filing deadlines for the IC 002 Form 4T are crucial for maintaining compliance. Organizations must submit the form by the specified date to avoid penalties. Typically, the deadline aligns with the end of the organization's fiscal year. It is advisable to keep track of these dates to ensure timely submissions and to avoid any disruptions in tax-exempt status.

Quick guide on how to complete ic 002 form 4t wisconsin exempt organization business

Complete IC 002 Form 4T Wisconsin Exempt Organization Business effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle IC 002 Form 4T Wisconsin Exempt Organization Business on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign IC 002 Form 4T Wisconsin Exempt Organization Business with ease

- Locate IC 002 Form 4T Wisconsin Exempt Organization Business and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign IC 002 Form 4T Wisconsin Exempt Organization Business and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ic 002 form 4t wisconsin exempt organization business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC 002 Form 4T Wisconsin Exempt Organization Business?

The IC 002 Form 4T is specifically designed for exempt organizations in Wisconsin to report financial details to the Department of Revenue. Understanding its requirements is crucial for compliance and ensuring your organization maintains its exempt status. airSlate SignNow simplifies the completion and management of the IC 002 Form 4T Wisconsin Exempt Organization Business, making it easier for your organization to focus on its mission.

-

How can airSlate SignNow help with the IC 002 Form 4T Wisconsin Exempt Organization Business?

airSlate SignNow provides a streamlined process for eSigning and managing the IC 002 Form 4T Wisconsin Exempt Organization Business. Our user-friendly platform ensures that your documents are easily accessible, editable, and ready for signature in just a few clicks. This helps ensure that your organization can comply with Wisconsin regulations efficiently.

-

Is there a cost associated with using airSlate SignNow for the IC 002 Form 4T Wisconsin Exempt Organization Business?

Yes, airSlate SignNow offers a range of pricing plans tailored for businesses of all sizes. You can choose from various subscription options that fit your budget while ensuring you have the tools needed for managing the IC 002 Form 4T Wisconsin Exempt Organization Business effectively. We provide a cost-effective solution that adds value to your organization.

-

What features does airSlate SignNow offer for the IC 002 Form 4T Wisconsin Exempt Organization Business?

With airSlate SignNow, you gain access to features like customizable templates, secure eSigning, document tracking, and automatic reminders. These tools are specifically designed to enhance the efficiency and security of handling the IC 002 Form 4T Wisconsin Exempt Organization Business. Our platform makes it simple to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for managing the IC 002 Form 4T Wisconsin Exempt Organization Business?

Absolutely! airSlate SignNow integrates seamlessly with various CRM, accounting, and project management software. This ensures you can easily manage the IC 002 Form 4T Wisconsin Exempt Organization Business alongside your existing digital tools, streamlining your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for the IC 002 Form 4T Wisconsin Exempt Organization Business?

Using airSlate SignNow offers the benefit of reducing the time and effort spent on paperwork. It enhances collaboration among team members, allowing them to easily review, edit, and sign the IC 002 Form 4T Wisconsin Exempt Organization Business, resulting in faster turnaround times. The automated processes contribute to increased compliance and accuracy in submissions.

-

Is airSlate SignNow secure for handling the IC 002 Form 4T Wisconsin Exempt Organization Business?

Yes, airSlate SignNow prioritizes security and complies with industry standards to safeguard your sensitive information. Our platform uses advanced encryption and secure authentication methods to protect data related to the IC 002 Form 4T Wisconsin Exempt Organization Business. You can trust us to handle your documents safely and securely.

Get more for IC 002 Form 4T Wisconsin Exempt Organization Business

- Mcmaster transcript request form

- Drivers edge rebate form

- Asn medical self declaration form

- Change your childs name child born in victoriabirths form

- Waiver university of lethbridge uleth form

- Verified by synergy gateway informationdurham college

- Kindness gram form

- Red cross training partner application form

Find out other IC 002 Form 4T Wisconsin Exempt Organization Business

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter