California Itemized Deductions Worksheet Form

What is the California Itemized Deductions Worksheet

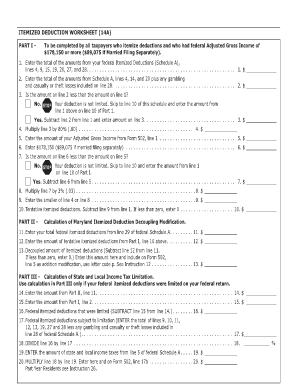

The California Itemized Deductions Worksheet is a crucial tax document used by residents of California to calculate their itemized deductions for state income tax purposes. This worksheet helps taxpayers determine if itemizing their deductions will provide a greater tax benefit compared to the standard deduction. It includes various categories of deductions, such as medical expenses, mortgage interest, and charitable contributions, allowing taxpayers to detail their eligible expenses accurately.

How to use the California Itemized Deductions Worksheet

Using the California Itemized Deductions Worksheet involves several steps. First, gather all relevant financial documents, including receipts and statements for deductible expenses. Next, fill out each section of the worksheet, ensuring that you input accurate figures for each category. It's essential to follow the instructions provided with the worksheet closely to maximize your deductions. Once completed, the worksheet will help you determine the total amount of itemized deductions you can claim on your California tax return.

Steps to complete the California Itemized Deductions Worksheet

Completing the California Itemized Deductions Worksheet requires careful attention to detail. Start by entering your personal information at the top of the form. Then, proceed to list your deductible expenses in the appropriate sections:

- Medical and dental expenses

- Taxes paid

- Interest expenses

- Charitable contributions

- Casualty and theft losses

After entering all relevant expenses, sum the totals for each category. Finally, review the worksheet for accuracy before using it to complete your California tax return.

Legal use of the California Itemized Deductions Worksheet

The California Itemized Deductions Worksheet is legally binding when completed correctly and submitted with your tax return. To ensure its legal standing, it must be filled out with accurate information and signed as required. Electronic signatures can be used if they comply with applicable laws, such as the ESIGN Act and UETA. Maintaining a copy of the completed worksheet is advisable for your records in case of future audits or inquiries.

State-specific rules for the California Itemized Deductions Worksheet

California has specific rules regarding itemized deductions that may differ from federal regulations. For instance, certain deductions that are allowed on the federal level may not be permissible in California. Taxpayers should familiarize themselves with these state-specific rules to ensure compliance and maximize their deductions. It is important to refer to the California Franchise Tax Board's guidelines for the most accurate and up-to-date information.

Examples of using the California Itemized Deductions Worksheet

Examples of using the California Itemized Deductions Worksheet can clarify how to apply the information. For instance, a taxpayer who incurred significant medical expenses during the year may find that itemizing these costs yields a larger deduction than the standard deduction. Similarly, homeowners who pay mortgage interest can benefit from detailing this expense on the worksheet. Each example illustrates how itemized deductions can significantly impact overall tax liability.

Quick guide on how to complete california itemized deductions worksheet

Effortlessly Prepare California Itemized Deductions Worksheet on Any Device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Manage California Itemized Deductions Worksheet on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related tasks today.

How to Modify and Electronically Sign California Itemized Deductions Worksheet with Ease

- Obtain California Itemized Deductions Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or conceal sensitive information using the features specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign California Itemized Deductions Worksheet to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california itemized deductions worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california itemized deductions worksheet?

The california itemized deductions worksheet is a helpful tool for taxpayers in California to itemize their deductions effectively when filing their state taxes. By utilizing this worksheet, you can maximize your available deductions and ensure you're not overlooking any potential savings.

-

How can the california itemized deductions worksheet help me save money?

By using the california itemized deductions worksheet, you can identify and calculate eligible expenses, potentially lowering your taxable income. This can lead to signNow tax savings, making it an essential resource for those needing to itemize their deductions.

-

Is there a cost associated with using the california itemized deductions worksheet?

The california itemized deductions worksheet itself is typically available for free through various tax resources, including state and federal websites. However, if you choose to use airSlate SignNow to eSign and send tax-related documents, there may be associated costs for the service.

-

Can I integrate the california itemized deductions worksheet with other financial software?

Yes, you can integrate the california itemized deductions worksheet with various financial software solutions to streamline your tax preparation process. By leveraging such integrations, you can efficiently manage your deductions and improve overall accuracy.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including secure eSigning, templates for frequently used forms, and seamless document sharing. These features can enhance your efficiency while working with important documents like the california itemized deductions worksheet.

-

Who can benefit from using the california itemized deductions worksheet?

Both individuals and small business owners in California can benefit from using the california itemized deductions worksheet. It provides clear guidelines for itemizing deductions, ensuring taxpayers maximize their potential savings on state taxes.

-

How do I fill out the california itemized deductions worksheet correctly?

To fill out the california itemized deductions worksheet correctly, gather all necessary documentation related to your deductible expenses. Follow the instructions outlined on the worksheet and ensure all figures are accurate to maximize potential savings and avoid mistakes on your tax return.

Get more for California Itemized Deductions Worksheet

- Name approval form

- Legalisation study project questionnaire page 1 form

- Annexure ii affidavit by parentguardian srm university srmuniversity ac form

- Abstract of judgement form texas

- Expires 02282027 form

- I 765 application for employment authorization counts of form

- Instructions to apply for nys special vehicle identification form

- Catering operation application packet form

Find out other California Itemized Deductions Worksheet

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy